In Luxembourg - a small but famously cautious country in Europe, for the first time, a sovereign wealth fund has boldly allocated 1% of its investment portfolio (about 9 million USD) to bitcoin ETFs. This information has attracted the attention of the global financial community.

While the figure is modest, its significance goes beyond monetary value as it marks the entry of cryptocurrencies into the mainstream financial system, and reflects the rise of a new class of super-rich - crypto millionaires who are increasingly reshaping the global wealth map.

The new generation of rich people and their formidable spending power

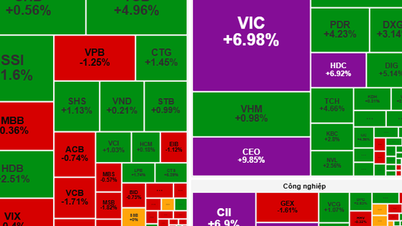

While governments remain cautious, the wealth created by cryptocurrencies has exploded at a breakneck pace. According to the latest report from Henley & Partners, the world now has around 241,700 crypto millionaires (people who own crypto assets worth $1 million or more), a 40% increase in just one year. Of these, 450 own over $100 million and 36 are billionaires.

The rise of bitcoin, which has more than doubled in value over the past year to surpass $125,000, has injected hundreds of billions of dollars into the pockets of a generation of young investors, mostly millennials and Gen Z. But the bigger question is: what are they doing with that wealth?

A groundbreaking study by economics professors at several leading universities analyzed millions of digital wallets to decode the behavior of this class. The results were surprising: for every $1 of profit from cryptocurrency, investors spent about 9.7 cents. This is more than twice as much as when they made profits from stocks or real estate.

The reason is simple: they are younger and more willing to spend. Researchers estimate that in 2024 alone, crypto profits will generate an additional $145 billion in spending for the US economy, equivalent to 0.7% of total consumption. This is a number that cannot be ignored, showing the pervasive influence of digital assets on real life.

However, this is also a double-edged sword. "The strong rise in crypto assets has clearly contributed positively to economic growth. But if there is a major decline, these investors will cut back on spending, putting significant negative pressure on the economy," the report warned.

Crypto assets have exploded, with more than 240,000 people now owning crypto portfolios worth over $1 million - a surge in just one year (Photo: Reuters).

From Lamborghini to Real Estate: Lifestyle Changes

The image of crypto millionaires flaunting Lamborghinis and Rolex watches has become iconic, but it doesn’t tell the whole story. In fact, much of their spending goes toward more mundane areas like restaurants, entertainment, and consumer goods.

When it comes to big investments, however, real estate is the favorite "landing" of the crypto rich. Tad Smith, former CEO of Sotheby's auction house and now a partner at digital asset investment fund 50T Funds, said that during the previous bull cycle, crypto investors were very young. But now, many are married, have children, and spending needs are also shifting to real, more sustainable assets such as real estate.

A study has found a remarkable correlation: as bitcoin prices rise, home prices in areas with a high concentration of cryptocurrency users rise 0.46% faster than elsewhere. The flood of crypto money is quietly pushing up traditional asset prices.

Still, most of the super-rich in the sector are in no rush to cash in. “They want to be fully invested because this is the moment they’ve been waiting for,” said Tad Smith. “For them, this is not the time to sell.” The “hold long term” (HODL) mentality still prevails, especially when they believe the value of these assets will increase further.

The Next Frontier: Crypto-Collateral

One of the biggest barriers preventing more crypto money from flowing into the economy is that traditional banks have yet to accept digital assets as collateral.

“Many people have millions of dollars in crypto but cannot get a home loan because traditional banks refuse to use the collateral in a digital wallet,” said Zac Prince, CEO of GalaxyOne.

But this wall is slowly being breached. Recently, the US Federal Housing Finance Agency (FHFA) instructed the two mortgage giants, Fannie Mae and Freddie Mac, to consider crypto assets in the application process.

This is a potential game changer. Once crypto-collateralized lending products become mainstream, the crypto-rich will be able to unlock their vast wealth without having to sell it. The “buy, borrow, die” strategy, familiar to the traditional ultra-rich, will be applied to digital assets for the first time.

The rise of the crypto millionaires is no longer a side story of the speculative world. From anonymous digital wallets, they have emerged as a real economic force with spending power twice as much as the average person and the ambition to convert digital assets into tangible values such as real estate or art.

As sovereign wealth funds began pouring money into bitcoin, the cryptocurrency craze officially became a new chapter of the global economy.

Source: https://dantri.com.vn/kinh-doanh/gioi-trieu-phu-tien-so-chi-tieu-kieu-moi-khuay-dao-kinh-te-toan-cau-20251011182558241.htm

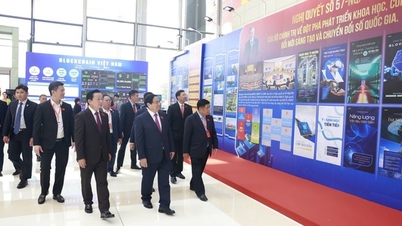

![[Photo] Solemn opening of the 1st Government Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/13/1760337945186_ndo_br_img-0787-jpg.webp)

![[Photo] General Secretary To Lam attends the opening of the 1st Government Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/13/1760321055249_ndo_br_cover-9284-jpg.webp)

Comment (0)