The Standing Committee of the National Assembly agreed to the provisions in the draft Law, which are to transform from a management model to one that serves taxpayers; promote the application of digital technology and big data on artificial intelligence (AI), reduce administrative burdens; request the drafting agency to review and perfect regulations on taxpayer classification and prohibited acts in tax management; conduct research to appropriately regulate the management of households and individuals with business activities on e-commerce platforms, digital platforms and the use of personal IDs associated with tax management; consider regulating policies to encourage consumers to get invoices when making purchases and reward consumers who report businesses that do not issue and deliver electronic invoices from the state budget with 0.1% of the total domestic value added tax revenue of the previous year.

National Assembly Chairman Tran Thanh Man speaks. (Photo: Nhan Dan)

Commenting on this content, National Assembly Chairman Tran Thanh Man suggested that better management is needed to avoid tax losses and carefully evaluate long-term revenue sources in the current context.

"Many domestic and foreign enterprises are waiting for the National Assembly to pass this Tax Management Law to resolve how to ensure production and business in the context of our country's development but many difficulties. In 2025, although the revenue exceeds, I suggest that the financial sector evaluate all revenue sources so that we know the strengths and weaknesses so that by 2026 we will do better in tax management," National Assembly Chairman Tran Thanh Man requested.

Commenting on the draft Law amending and supplementing a number of articles of the Law on Citizen Reception, the Law on Complaints, and the Law on Denunciations, the National Assembly Standing Committee agreed with the regulations on online citizen reception in parallel with in-person citizen reception to improve the effectiveness of citizen reception and petition handling; facilitate citizens in exercising their right to make complaints and denunciations, and at the same time reduce pressure at citizen reception offices; stating that the person receiving citizens must be the person with the authority to resolve the case, so it is proposed not to stipulate authorization in citizen reception.

Also on October 13, the Standing Committee gave opinions on the Law amending and supplementing a number of articles of the Law on Insurance Business, the draft Law on Personal Income Tax (amended) and the draft Law amending and supplementing a number of articles of the Law on Urban and Rural Planning; the National Assembly Standing Committee also gave opinions on the report on the results of monitoring the settlement and response to voters' petitions sent to the 9th Session.

Source: https://vtv.vn/chuyen-tu-quan-ly-sang-phuc-vu-nguoi-nop-thue-100251013210351246.htm

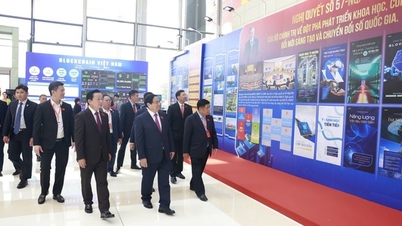

![[Photo] Solemn opening of the 1st Government Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/13/1760337945186_ndo_br_img-0787-jpg.webp)

![[Photo] General Secretary To Lam attends the opening of the 1st Government Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/13/1760321055249_ndo_br_cover-9284-jpg.webp)

Comment (0)