On the afternoon of October 13, the National Assembly Standing Committee gave opinions on the Draft Law on Tax Administration (amended).

According to the draft Law, the amendment is implemented in accordance with the policy of eliminating lump-sum tax in Resolution 68. Accordingly, business households and individuals will base on actual annual revenue to determine whether they are subject to no tax, do not have to pay tax or have to pay tax.

For business households and business individuals who are subject to tax payment, they must declare and calculate taxes for each type of tax according to the tax period. The Government shall provide detailed regulations on this, including the method of calculating value added tax; documents and procedures for declaring revenue, declaring taxes and paying taxes. The Ministry of Finance shall provide regulations on the accounting regime applicable to business households and business individuals.

The Law takes effect from July 1, 2026, except for the provisions on tax declaration of business households and individuals in Article 13 which takes effect from January 1, 2026, according to the Government 's proposal.

The summary report of the preliminary examination of the draft Law on Tax Administration (amended) by the National Assembly's Economic and Financial Committee said that for business households and business individuals, the mechanism of transferring from contract to declaration will basically increase the revenue declared according to invoices compared to the contract level that households are applying.

Accordingly, the tax burden (value added tax and personal income tax) of business households will change significantly.

“Therefore, the standing body of the review agency recommends that the drafting agency carefully calculate and evaluate the impact of changes in tax obligations on business households and individual businesses. If necessary (if the change in declared revenue compared to the current fixed rates is too large), it is recommended to consider adjusting tax rates (in policy laws) to reduce the tax burden on related subjects.

Regarding electronic invoices, the draft law stipulates that 0.1% of the total domestic value added tax of the previous year will be deducted to implement measures (as prescribed by the Ministry of Finance) to encourage consumers to get invoices when making purchases and to reward consumers who report businesses that do not issue and deliver invoices.

The Standing Committee of the Economic and Financial Committee believes that a policy to encourage and reward consumers is necessary, however, the effectiveness of this policy is not yet clear.

In the context of increasing pressure on the budget, the Standing Committee of the Economic and Financial Committee proposed to continue implementing this policy from the budget for propaganda and support for taxpayers as has been done in the past. At the same time, it is recommended that the Ministry of Finance pay attention to arranging appropriate funding sources to ensure transparent and effective implementation.

Source: https://vietnamnet.vn/bo-thue-khoan-tu-2026-de-nghi-danh-gia-ky-tac-dong-den-ho-kinh-doanh-2452295.html

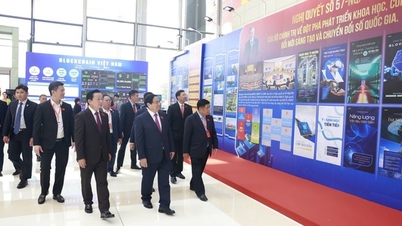

![[Photo] Solemn opening of the 1st Government Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/13/1760337945186_ndo_br_img-0787-jpg.webp)

![[Photo] General Secretary To Lam attends the opening of the 1st Government Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/13/1760321055249_ndo_br_cover-9284-jpg.webp)

Comment (0)