|

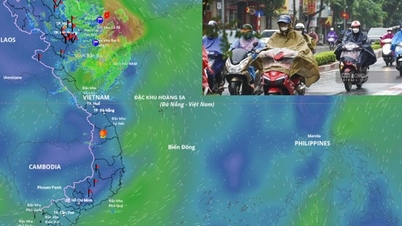

| Oil prices fall despite the Israel-Hamas conflict showing no signs of abating. (Source: AP) |

The Hamas attack and Israel’s subsequent declaration of war raised fears of a wider regional conflict that could impact Middle East oil supplies, but those concerns have largely subsided among traders, who believe there is little risk of the conflict escalating.

Brent crude, the international oil benchmark, is selling for around $80 a barrel, cheaper than when the Israel-Hamas conflict began.

Why are oil prices falling?

Why aren’t prices higher? Analysts say the main reason is that the conflict, however intense, hasn’t caused much disruption to oil supplies. “The conflict is not an immediate threat to the energy market,” analysts say.

“While traders see increased risk, that has not led to a rush of hedging,” said Richard Bronze, head of geopolitics at Energy Aspects, a London-based market research firm.

Pessimism about future oil demand is pervading energy markets.

Per capita gasoline demand in the world's largest economy will fall to a 20-year low next year, with high gas prices and inflation likely to cause Americans to drive less on non-essential trips, according to a recent US government report.

Adding to the pressure on oil prices was a slight recovery in the US dollar from recent lows, making oil more expensive for traders holding other currencies.

Traders are also worried about the outlook for the Chinese economy, the world's largest oil importer.

Crude oil imports by the world's second-largest economy rose sharply in October, but China's overall exports of goods and services fell at a faster-than-expected pace, adding to concerns about weakening global demand. China's exports have fallen for a sixth straight month.

In addition, Saudi Arabia and Russia continue to voluntarily cut oil production until the end of 2024. Forecasters warn that 2024 could be a difficult year in the oil market.

These issues have caused oil prices to fall, despite the Israel-Hamas conflict showing no signs of abating.

Risks remain

Bjarne Schieldrop, commodity analyst at SEB bank (Sweden), said the market is watching for the next move from Saudi Arabia and Russia if Brent oil prices fall below $80/barrel, which could put a strain on the budgets of both countries.

He predicted: “If oil prices fall below $80/barrel, I think the two oil giants mentioned above will intervene to create confidence in the price level.”

Developments in the Middle East do not directly affect oil supplies, but experts have expressed concerns about disruptions to exports from Iran and other countries in the region.

Four years ago, a missile attack on a key Saudi facility temporarily knocked out about half the kingdom’s oil production. In a worst-case scenario, Iran, Hamas’s main backer, could try to block the Strait of Hormuz, through which vast amounts of oil flow to the rest of the world.

The global oil market is facing supply risks if the Hamas-Israel conflict spreads in the Middle East, and oil prices may rise slightly in the short term, said Giovanni Staunovo, an energy analyst at UBS Group AG.

Analysis by Rystad Energy (USA) also shows that if the Israel-Hamas conflict continues to escalate or prolong, it will have a major impact on the regional gas market, despite Israel having a surplus of this commodity.

"The biggest risk to Europe's liquefied natural gas (LNG) supply is the stability of Egyptian gas exports as winter approaches," Rystad Energy warned.

In addition, the disruption of Israel's three largest gas exploitation projects, Tamar, Leviathan and Karish, will also affect the Middle East market.

Israel's Tamar gas field was shut down after Hamas attacks earlier this month, according to Reuters . The gas field project meets more than 70% of Israel's domestic gas needs and is the main source of gas-fired electricity generation. About 5-8% of Tamar's gas production is for export.

The Tamar production shortfall has been partially offset by increased production at the Leviathan field, which accounts for 44% of Israel’s current gas production. But a prolonged Tamar shutdown would reduce supplies to Israel and affect electricity exports to Egypt.

America benefits?

Regarding the US market, according to experts, the increase in oil prices will not have a significant impact on gas prices or consumer spending in this country. However, the Israel-Hamas conflict along with the Russia-Ukraine conflict will make the European Union (EU) more dependent on US gas in the longer term.

US LNG exports are likely to increase further for at least two or three years.

The US is now the world's largest LNG exporter, with October output reaching 7.92 million tonnes, according to data from the London Stock Exchange Group (LSEG). US LNG suppliers are directly benefiting from increased demand as the EU gradually ends its dependence on Russian gas.

As in 2022, the EU and the UK will remain the main destinations for US LNG exports in the first half of 2023, accounting for 67% of total US exports. Five countries – the Netherlands, the UK, France, Spain and Germany – imported more than half of all US LNG exports.

Source

![[Photo] Prime Minister Pham Minh Chinh launched a peak emulation campaign to achieve achievements in celebration of the 14th National Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/8869ec5cdbc740f58fbf2ae73f065076)

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's online conference with localities](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/264793cfb4404c63a701d235ff43e1bd)

![[VIDEO] Summary of Petrovietnam's 50th Anniversary Ceremony](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/4/abe133bdb8114793a16d4fe3e5bd0f12)

![[VIDEO] GENERAL SECRETARY TO LAM AWARDS PETROVIETNAM 8 GOLDEN WORDS: "PIONEER - EXCELLENT - SUSTAINABLE - GLOBAL"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/23/c2fdb48863e846cfa9fb8e6ea9cf44e7)

Comment (0)