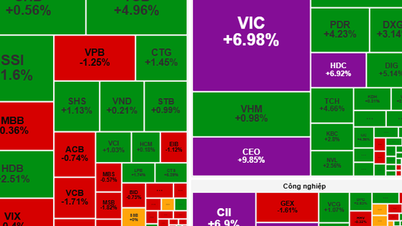

At the end of the session on October 13, VN-Index increased by 17.57 points (1.01%) to 1,765.12 points. HNX-Index increased by 1.73 points (0.63%) to 275.35 points. UPCoM-Index increased by 1.09 points (0.98%) to 112.7 points.

Notably, the VN30-Index increased by 1.6% to 2,012.28 points, surpassing the 2,000-point mark for the first time. Total market liquidity reached nearly VND48,700 billion, of which HoSE accounted for more than VND44,500 billion.

The market continued to increase but there was a “green skin, red heart” phenomenon with 410 stocks decreasing while there were only 288 stocks increasing. Demand was driven by large-cap stocks, while most midcap and penny stocks weakened.

Vin stocks continued to lead the growth momentum, contributing 12 points to the VN-Index when VIC increased by 6.98%, VRE increased by 6.57% and VHM increased by nearly 1%. In addition, TCB increased by 4.96%, VJC increased by 6.98%, HDB increased by 2.51%, and SSI increased by 1.6%.

On the contrary, some stocks put pressure on the market such asFPT down 2.19%, HPG down 2.03%, VPB down 1.25%.

Banking stocks are mixed. Stocks that increased includeSHB , TCB, HDB, CTG... while MBB, ACB, TPB, VIB turned to decrease.

The market continues to increase but there is a phenomenon of "green skin, red heart".

One of the information supporting the market is that FTSE Russell upgraded Vietnam from a frontier market to a secondary emerging market.

The decision is expected to take effect from September 21, 2026, after a mid-term review in March 2026. This is an important milestone, recognizing the achievements of Vietnam's decisive and synchronous reform process, contributing to enhancing the country's position on the global investment map.

Experts from Pinetree Securities Vietnam predict that the market can still pull up pillar stocks before the expiration date, so the uptrend next week is completely feasible, especially with the base index VN30-Index. At the same time, the third quarter reporting season is starting, if positive, it will be a catalyst to push the market to climb to a new peak.

According to experts from Pinetree Vietnam, the trend will continue to explode next week to set a new all-time high. Vingroup and banking stocks will play a leading role, while cash flow can rotate to stocks, real estate, steel and public investment to help the growth be more sustainable.

Source: https://vtcnews.vn/vn-index-tiep-tuc-lap-dinh-moi-ar970950.html

![[Photo] Solemn opening of the 1st Government Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/13/1760337945186_ndo_br_img-0787-jpg.webp)

![[Photo] General Secretary To Lam attends the opening of the 1st Government Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/13/1760321055249_ndo_br_cover-9284-jpg.webp)

Comment (0)