|

A new record has just been set for the amount of money "burned" in the cryptocurrency derivatives market. Photo: CoinGecko . |

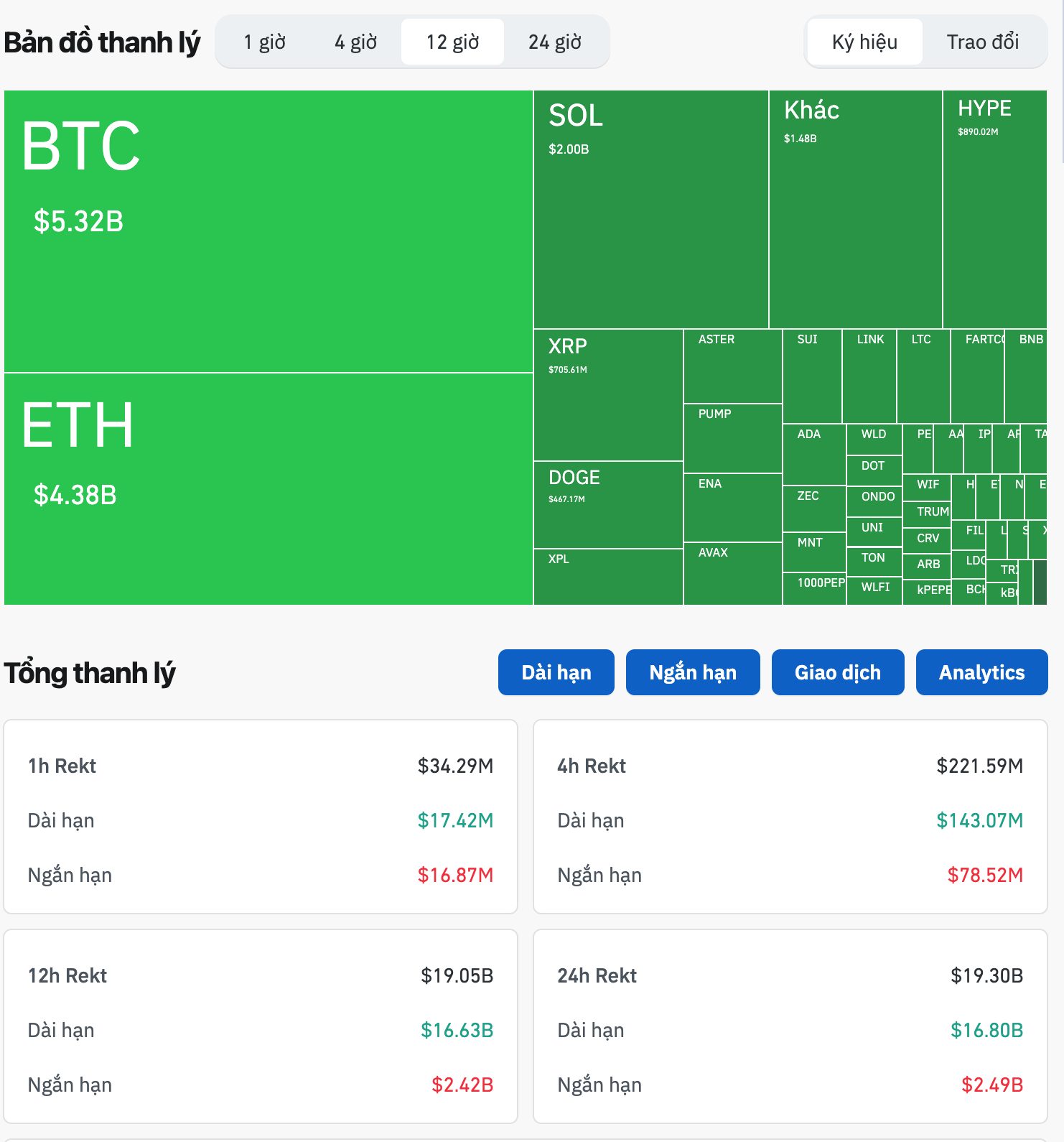

According to data from CoinGlass , about $19.2 billion was liquidated in the cryptocurrency derivatives market in the last 24 hours. This is a record amount of assets evaporated by "future" players ever recorded. Globally, more than 1.6 million accounts were burned. Of which, long positions accounted for $16.7 billion . Short groups suffered losses of $2.5 billion . The largest liquidation order belonged to the ETH-USDT pair on the Hyperliquid platform, worth more than $200 million .

In the groups that suffered losses, Bitcoin led with $5.3 billion , ETH reached $4.4 billion and SOL $2 billion . Coins below include HYPE ( $888 million ) and XRP ( $700 million ). The list also shows the change in the platforms that derivative players choose. Hyperliquid, Bybit surpassed Binance to become the exchange with the highest liquidation volume, proving its popularity.

The sharp fall of Bitcoin, from over 120,000 USD /BTC to around 102,000 USD /BTC in the early morning of October 11 ( Hanoi time), had a strong impact on the derivatives market. ETH was strongly affected with a larger price drop. The digital currency has dropped 12% in the last 24 hours, despite the market's slight recovery.

|

Huge losses in the derivatives market after Mr. Trump's decision. Photo: CoinGlass. |

In the leading group, XRP, SOL, DOGE suffered heavy damage. The total market capitalization evaporated about 400 billion USD in a short time, from the 4,140 billion USD mark.

On the morning of October 11, President Donald Trump announced that the US would impose a new 100% tariff on goods imported from China, the highest of the tariffs they are currently subject to, starting November 1. On the same day, Mr. Trump said the US would control exports of "all important software" from China, according to CNBC.

The statement came just hours after he threatened to impose "massive tariff increases" on Chinese goods in response to Beijing's new controls on rare earth exports.

About 70% of the global supply of rare earths comes from China. These are essential minerals for high-tech industries including autos, defense and semiconductors.

Earlier the same day, Mr. Trump revealed that he might cancel his meeting with Chinese President Xi Jinping at the upcoming Asia- Pacific Economic Cooperation (APEC) summit in South Korea, due to tensions surrounding Beijing's new control measures.

Source: https://znews.vn/19-ty-usd-tien-so-boc-hoi-sau-quyet-dinh-cua-ong-trump-post1592775.html

![[Photo] Opening of the World Cultural Festival in Hanoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/10/1760113426728_ndo_br_lehoi-khaimac-jpg.webp)

![[Photo] General Secretary attends the parade to celebrate the 80th anniversary of the founding of the Korean Workers' Party](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/11/1760150039564_vna-potal-tong-bi-thu-du-le-duyet-binh-ky-niem-80-nam-thanh-lap-dang-lao-dong-trieu-tien-8331994-jpg.webp)

![[Photo] Discover unique experiences at the first World Cultural Festival](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/11/1760198064937_le-hoi-van-hoa-4199-3623-jpg.webp)

![[Photo] Ho Chi Minh City is brilliant with flags and flowers on the eve of the 1st Party Congress, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/10/1760102923219_ndo_br_thiet-ke-chua-co-ten-43-png.webp)

Comment (0)