This afternoon (October 15), VPBank Securities Joint Stock Company (VPBankS) held a meeting to introduce investment opportunities in VPX shares before the initial public offering (IPO). VPBankS belongs to the VPBank ecosystem.

According to the plan, VPBankS will make an initial public offering of 375 million shares at VND33,900/unit, expected to raise more than VND12,712 billion. With this price, VPBankS is valued at about VND63,600 billion, equivalent to nearly USD2.4 billion.

In the past, VPBank sold a securities company, then bought another securities company, developing into VPBankS as it is today. At the conference, an investor asked why VPBank made the above transaction and why it chose to IPO VPBankS at this time.

Mr. Nguyen Duc Vinh - Member of the Board of Directors, General Director of VPBank - admitted that in the period 2010-2015, this bank inherited a securities company and helped this company overcome difficulties. However, at that time, the bank's resources were also very limited.

In its strategic choice, the bank decided to enter the special but risky segment of consumer finance. During the period 2010-2013, VPBank acquired consumer finance companies in the market and poured investment resources.

According to Mr. Vinh, at that time, VPBank needed to concentrate capital so it decided to stop the securities company's operations. The transaction helped the bank earn more than 1,000 billion VND to strengthen the consumer finance sector.

In 2018, the bank's capital scale was larger, its performance was good, and there were 2 strategic foreign bank partners investing in FE Credit. Each partner brought in 1.3-1.5 billion USD, helping to strengthen VPBank's capital source.

At this time, the bank decided to change its strategy from investing in consumer finance companies to a comprehensive multi-functional bank, targeting many segments, including returning to securities companies and investment banks.

VPBankS conducts IPO, expected to raise more than VND 12,712 billion (Photo: VPBankS).

Explaining this issue more clearly, Mr. Vu Huu Dien - General Director of VPBankS - stated that after 3-4 years of building from the foundation, the company has grown strongly in recent times but is limited by safety indicators and regulations of the State.

Mr. Dien gave an example, if there is a limit on capital safety indicators, VPBankS will be restricted in some business areas such as warrants and bonds. At the same time, the investment ratio is also limited to 70% of equity. If equity is small, VPBankS' debt market strategy, underwriting, investment and distribution will be affected. Therefore, VPBankS must increase equity to ensure the development of the warrant and bond market.

Therefore, he affirmed that to ensure growth targets and 5-year plans, the company needs to increase capital at this time, otherwise it will not be able to meet business needs.

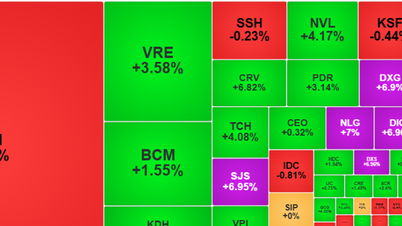

Of course, VPBanks also chose the right time and market conditions. FTSE Russell upgraded Vietnam's stock market from frontier to emerging, expecting large capital inflows from abroad.

This view of Mr. Dien coincides with the comment from Mr. Hoang Nam - Director of Research and Analysis, Vietcap Securities Company.

According to Mr. Nam, the stock market is facing new opportunities, in the context of high macroeconomic growth, stable interest rates, and promoted public investment. The market itself has just been upgraded, with capital expected to flow about 1-2 billion USD from passive funds, 5-6 billion USD from active funds, creating great opportunities for securities companies.

Abundant foreign capital and positive investor confidence have triggered a new wave of IPOs in the market. In the context of Resolution 68 on private economic development just passed, leading enterprises need huge amounts of capital to do business. Vietcap representative estimated that the total value of IPOs from enterprises in many industries could reach 50 billion USD, creating favorable conditions for securities companies to develop the consulting sector.

VPBankS is considered to benefit from the upgraded market context, and at the same time possesses its own advantages such as being supported by the parent bank. However, VPBankS's General Director affirmed that it will not increase its market share at all costs, because it cannot make a profit from the brokerage segment and securities companies are competing heavily on transaction fees, even free of charge.

Instead, the company will focus on businesses with large market shares that generate immediate profits, such as margin lending.

Source: https://dantri.com.vn/kinh-doanh/ceo-vpbank-tiet-lo-ly-do-tien-hanh-thuong-vu-bom-tan-trong-thang-10-20251015214526358.htm

![[Photo] Conference of the Government Party Committee Standing Committee and the National Assembly Party Committee Standing Committee on the 10th Session, 15th National Assembly](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/15/1760543205375_dsc-7128-jpg.webp)

![[Photo] General Secretary To Lam attends the 18th Hanoi Party Congress, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/16/1760581023342_cover-0367-jpg.webp)

![[Photo] Many dykes in Bac Ninh were eroded after the circulation of storm No. 11](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/15/1760537802647_1-7384-jpg.webp)

![[Video] TripAdvisor honors many famous attractions of Ninh Binh](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/16/1760574721908_vinh-danh-ninh-binh-7368-jpg.webp)

Comment (0)