In her welcoming speech at the program, Ms. Dinh Thi Thuy - Vice Chairwoman of the Board of Directors of MISA emphasized that eliminating lump-sum tax is an important step in the journey of modernizing the Vietnamese tax system, requiring the support of technology enterprises for the policy to truly come into life. With 31 years of pioneering in digital transformation of the finance - accounting sector, MISA is committed to supporting business households to declare and pay taxes more transparently, accurately and conveniently, contributing to building a fair, sustainable and people-centered digital economy .

Roadmap to abolish lump-sum tax – officially paving the way for business households to enter a new era

Opening the program, Mr. Mai Son - Deputy Director of the Tax Department, Ministry of Finance shared the policy and roadmap to accompany business households when eliminating lump-sum tax. Mr. Mai Son said that the transition from lump-sum tax to declaration is an important step to implement the Party and State's policy on fair and transparent tax management and create conditions for private economic development. To date, 98% of declaring business households have paid taxes electronically, more than 18,500 lump-sum households have switched to declaration, and 133,000 households have registered to use electronic invoices from cash registers. These figures show the positive change in policy, the ability to adapt quickly and proactively of business households in the face of major changes.

According to the representative of the Tax Department, the main goal is to help business households fulfill their tax obligations conveniently, safely, transparently and modernly. The Tax sector has synchronously deployed many solutions such as researching and amending policies; promoting propaganda, dialogue, and practical guidance; simplifying accounting regimes and applying easy-to-use technology. Currently, the tax authority is perfecting the legal framework according to three key points: amending the Law on Tax Administration and related documents, developing separate management policies for business households, and developing a simple accounting regime associated with the application of digital technology - towards a modern, transparent and taxpayer-centered tax system. On that policy foundation, technology enterprises play an important role in realizing the policy into life.

Acting early, MISA gives free software to 2 million business households

With a pioneering spirit, MISA announced a program to give away free MISA eShop software to 2 million business households to support the transition to the declaration method. The program is considered a practical and timely solution, helping business households reduce compliance costs, limit errors and get used to a more transparent tax management method. According to the program, MISA gives away 03 months of free use of MISA eShop software, along with 01 year of free use of digital signatures and 5,000 electronic invoices. The "6 in 1" toolkit supports business households from sales management - invoice issuance - digital signature - accounting bookkeeping - tax declaration - direct connection to the Mtax system to help the "Declare - Sign - Submit" process on a single platform. MISA eShop is designed to accompany business households for a long time, from the initial small scale to when they develop into enterprises, contributing to building a transparent, modern and sustainable business environment.

Experts highly appreciate MISA's initiative to support business households with digital technology

Recognizing the efforts of the technology business community, Mr. Nguyen Van Than - Member of the XIV National Assembly, Chairman of VINASME, assessed MISA's program as a timely and highly social action, contributing to concretizing Resolution 68-NQ/TW and supporting business households to adapt to the new management model, improve operational capacity and tax compliance. As a VINASME member, MISA is expected to continue to pioneer technology transfer, promote digital transformation of the business household sector, contributing to the transparent and modern development of Vietnam's private economy.

From a professional perspective, Ms. Nguyen Thi Cuc - President of the Vietnam Tax Consultants Association (VTCA) commented that the shift from lump-sum tax to declaration is an important reform in modernizing tax management, helping to make revenue transparent, tax obligations fair and reduce risks for both tax authorities and taxpayers. The President of VTCA emphasized that the coordination between tax authorities, consulting organizations and technology enterprises such as MISA is a prerequisite to help business households declare conveniently, manage books in an understandable and safe way, and gradually improve management capacity and financial transparency.

When technology reaches every business, it is not just a story of digital transformation, but a journey to create a new generation of businesses - more transparent, more professional and confident in integrating into the digital economy. MISA commits to continue accompanying the Tax industry and the business community on that journey, so that each step of transformation is not only convenient today, but also sustainable for the future.

Source: https://www.misa.vn/154459/le-cong-bo-chuong-trinh-tang-mien-phi-phan-mem-cho-2-trieu-ho-kinh-doanh-thuc-hien-xoa-bo-thue-khoan-theo-nghi-quyet-68-nq-tw/

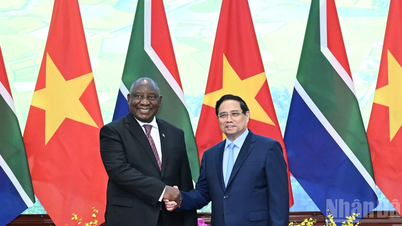

![[Photo] Prime Minister Pham Minh Chinh meets with South African President Matamela Cyril Ramaphosa](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761226081024_dsc-9845-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on railway projects](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761206277171_dsc-9703-jpg.webp)

![[Photo] President Luong Cuong holds talks with South African President Matamela Cyril Ramaphosa](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761221878741_ndo_br_1-8416-jpg.webp)

Comment (0)