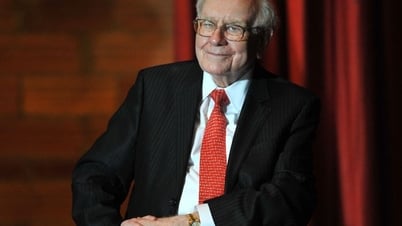

In 2001, when Wall Street was still reeling from the bursting of the dot-com bubble, legendary investor Warren Buffett shared with Fortune magazine a measure he described as “perhaps the best single indicator of where market valuations are at any given time.” The formula for the metric is simple: take the total stock market capitalization and divide it by the country’s gross domestic product (GDP).

He gave a clear guideline: “If the ratio drops to 70-80%, buying stocks is likely to yield very good results. Conversely, if the ratio gets closer to 200%, as it did in 1999 and early 2000, you are playing with fire.”

Two decades later, that warning is back in full force—and even more so. As of late September, the “Buffett Index” had soared to a record 217%, far exceeding the peak of the 2000 tech bubble (about 150%) and far exceeding the peak of the post-pandemic mania of 2021 (190%).

The US stock market is in unprecedented territory: The paper value of companies is twice the size of the entire economy that produces them.

The Buffett Index jumped 217%, far surpassing old peaks, signaling great risk if profits or growth do not keep up with expectations (Photo: Getty).

The big question is: Is Wall Street really “playing with fire” or is this fire different?

Decoding the number 217%: The craze called AI

The 217% figure means that the total value of publicly traded US companies is now 2.17 times the size of the entire economy. To put it in perspective: if GDP were a country’s annual “salary,” then the stock market is trading at more than double that. This reflects investors’ extreme expectations, but also carries with it an ever-greater risk of disappointment.

The main driver behind this meteoric rise is none other than the artificial intelligence (AI) craze. Big Tech has been pouring billions of dollars into AI development, and the market seems willing to pay any price for the promise of a new era of productivity and profits.

The rally of these mega-cap stocks has pulled the entire market up, causing total capitalization to swell at a much faster pace than the actual expansion of the economy. GDP in the first half of 2025 grew only modestly at around 1.75%, a sharp contrast to the boom on the stock market.

Other indexes are sending similar signals. The S&P 500's price-to-earnings ratio recently hit a new record high of 3.33. By comparison, at the peak of the dot-com bubble, it was just 2.27. This suggests that investors are paying more for each dollar of revenue companies generate than at any other time in history.

But this “ever-tall financial scaffolding,” as David Kelly, chief strategist at JPMorgan Asset Management, calls it, is showing cracks. The AI craze isn’t all roses.

The launch of GPT-5 did not create the buzz that was expected, disappointing many investors. Over the summer, a sharp sell-off wiped out $1 trillion in market capitalization. The reality is even more brutal when many high-profile GenAI projects are still struggling to prove their effectiveness in the real world, while AI “unicorns” are valued at up to $2.7 trillion but have extremely modest revenues.

These have led many experts to warn that today's tech giants are even more highly valued than during the internet bubble of the 1990s.

Counterargument: Is the Buffett Index “Outdated”?

However, another school of thought argues that applying the 2001 metrics to the 2025 economy is a mistake. They argue that the Buffett Index may no longer accurately reflect the nature of the modern economy for the following reasons:

Structural economic change: The US economy has shifted dramatically from industries that rely on tangible assets (factories, machinery) to industries that rely on intangible assets (technology, software, intellectual property). GDP, which is designed to measure the output of physical goods and services, may be underestimating the true value of an economy built on data and innovation.

Global Profits: Many large US corporations earn a significant portion of their profits from international markets. This portion of their profits is not fully reflected in US GDP, but contributes directly to their stock market capitalization.

Interest Rate Environment: Years of low interest rates have made risk assets like stocks more attractive, pushing valuations to new highs compared to the past.

By this argument, a higher Buffett Indicator ratio could be the “new normal” for the world's leading and innovative economy.

Buffett's $344 billion cash fortress

While experts argue, Warren Buffett himself has not commented publicly on his namesake index in years. But if you want to know what he thinks, don't listen to what he says, watch what he does.

Buffett’s actions over the past two years, as he prepares to hand over the reins to his successor, Greg Abel, have sent a clear signal of caution. His Berkshire Hathaway conglomerate has been a net seller of stocks for 11 consecutive quarters. Instead of buying, he has built up a huge “cash fortress.” The company’s second-quarter 2025 financial report showed it was holding a record $344.1 billion in cash and Treasury bills.

It’s a classic defensive move. When one of the greatest investors in history decides to sit on the sidelines with such a large amount of cash, it’s a strong message that he doesn’t see many compelling opportunities at current prices. He’s patiently waiting for a “fat pitch,” a time when the market becomes more rational.

Lessons for investors

So what should investors do amid these mixed signals?

A Buffett Indicator above 217% is not a countdown to tomorrow's market crash. The market can remain "expensive" for a long time. However, it is a strong risk warning, emphasizing that future returns are likely to be significantly lower as valuations return to historical averages.

The index's extreme spike, combined with the defensive moves of the "Oracle of Omaha" himself, would certainly give any wise investor pause for thought.

In this context, the “Buffett playbook” is perhaps the most appropriate guide. Instead of chasing hot stocks or trying to predict the market top, focus on the core principles of value investing:

High Quality Businesses: Companies with solid business fundamentals.

Stable Cash Flow: The ability to generate sustainable profits across economic cycles.

Economic moat: An economic moat protects a business from competitors.

Patience: Waiting to buy great properties at a fair price.

History has shown that no matter how bright the market's euphoria may burn, in the end, the real value of the economy is the anchor that pulls everything back. And in this game, those who do not "play with fire" are usually the ultimate winners.

Source: https://dantri.com.vn/kinh-doanh/con-sot-ai-va-loi-sam-truyen-nam-xua-cua-buffett-am-anh-pho-wall-20251001085330824.htm

![[Photo] General Secretary attends the parade to celebrate the 80th anniversary of the founding of the Korean Workers' Party](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/11/1760150039564_vna-potal-tong-bi-thu-du-le-duyet-binh-ky-niem-80-nam-thanh-lap-dang-lao-dong-trieu-tien-8331994-jpg.webp)

![[Photo] Discover unique experiences at the first World Cultural Festival](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/11/1760198064937_le-hoi-van-hoa-4199-3623-jpg.webp)

![[Photo] Opening of the World Cultural Festival in Hanoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/10/1760113426728_ndo_br_lehoi-khaimac-jpg.webp)

![[Photo] Ho Chi Minh City is brilliant with flags and flowers on the eve of the 1st Party Congress, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/10/1760102923219_ndo_br_thiet-ke-chua-co-ten-43-png.webp)

Comment (0)