Berkshire Hathaway Energy, a subsidiary of Berkshire Hathaway, reported in its first-quarter earnings report that its investment in Chinese electric vehicle maker BYD was zero as of March 31. A Berkshire spokesman also confirmed that the group had sold all of its shares in BYD.

In 2018, at the suggestion of Charlie Munger - former Vice Chairman of Berkshire Hathaway - billionaire Warren Buffett made a surprising investment decision to invest in BYD, a young Chinese electric vehicle manufacturer.

At that time, they paid $230 million for 225 million shares, equivalent to 10% of the shares. Many people thought this decision was reckless, when the electric car industry was young and full of risks.

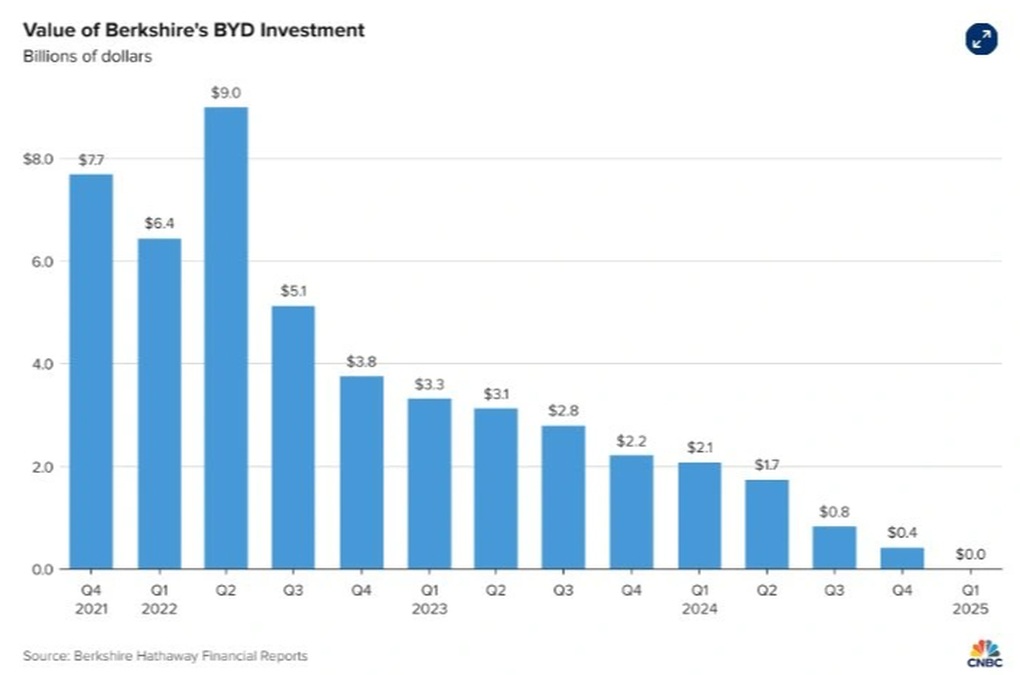

Now, Berkshire Hathaway has completely divested itself of that once hugely profitable investment, a move that has caught the attention of the entire financial world.

Previously, billionaire Warren Buffett had repeatedly praised BYD founder Wang Chanfu and visited the company's factory in China in 2010.

At the 2023 annual general meeting of Daily Journal publishing company, legendary Charlie Munger also commented that he "has not done anything as good as investing in BYD".

Berkshire's total investment value in BYD (Photo: CNBC).

However, from 2022, billionaire Buffett's group began selling after BYD shares increased more than 20 times. By June last year, they had sold nearly 76% of their holdings, leaving Berkshire's stake at less than 5% - the level that does not require transactions with BYD shares to be disclosed according to the regulations of the Hong Kong Stock Exchange (China).

Billionaire Warren Buffett has never explained in detail why his conglomerate sold its BYD shares. In 2023, he said the Chinese electric carmaker was an "incredible company" run by an "incredible man."

However, he said Berkshire “will find a better use for the proceeds.” At the same time, the group also sold almost all of its shares in chipmaker TSMC, worth about $4 billion, just months after buying it.

Berkshire's portfolio is largely in the US. At the 2024 shareholders' meeting, billionaire Buffett said they would continue to pursue this strategy, with BYD being the exception. Currently, their largest investment is Apple, worth about $68 billion. Then there are American Express, Bank of America and Coca-Cola.

Source: https://dantri.com.vn/kinh-doanh/ty-phu-warren-buffett-bat-ngo-ban-sach-co-phieu-byd-an-so-nao-phia-sau-20250922153432403.htm

![[Photo] Joy on the new Phong Chau bridge](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/b00322b29c8043fbb8b6844fdd6c78ea)

![[Photo] The 4th meeting of the Inter-Parliamentary Cooperation Committee between the National Assembly of Vietnam and the State Duma of Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/9f9e84a38675449aa9c08b391e153183)

![[Photo] National Assembly Chairman Tran Thanh Man presided over the welcoming ceremony for Chairman of the State Duma of the Russian Federation Vyacheslav Volodin](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/889b54ac5cd440099ddc618c99663612)

![[Photo] High-ranking delegation of the Russian State Duma visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/c6dfd505d79b460a93752e48882e8f7e)

Comment (0)