Three-month copper on the London Metal Exchange (LME) fell 0.1% to $8,994.50 a tonne, having fallen 11% since hitting a four-month high on September 30.

"The initial reaction to the election has now subsided. The dollar has stopped rising further, so that is bringing some stability back to the market. The market is looking ahead to January and trying to assess the impact of tariffs and trade wars on demand, so for now that will keep the market trading very cautiously," said Ole Hansen, head of commodity strategy at Saxo Bank in Copenhagen.

The dollar index edged down on Monday, after hitting a one-year high on Friday. A weaker dollar makes commodities cheaper for buyers using other currencies.

Some industrial consumers have taken advantage of the lower prices to buy, but Sandeep Daga, director of the Metals Intelligence Center, does not expect that to last. He expects LME copper to fall as low as $7,000 a tonne by the second quarter of 2025.

LME aluminium fell 1.8% to $2,602.50 a tonne after jumping 5.3% on Friday after China said it would scrap a 13% rebate on aluminium product exports.

While the move is likely to reduce semi-fabricated aluminum exports, Citi said in a note that it kept its three-month price target at $2,600, saying optimism could fade.

Lead gave up gains and fell 0.3% to $1,951 a tonne after LME inventories rose 49,500 tonnes, or 27%, to 234,725.

The inflow could be a side trade against short positions or bearish ahead of the November contract expiring on Wednesday, said Alastair Munro at broker Marex.

A large amount of zinc flowing into LME warehouses - 11,050 tonnes - could also be a trade by a party holding a short position, he added.

LME zinc fell 0.6% to $2,930.50, nickel fell 0.5% to $15,470 and tin rose 0.2% to $28,795.

Source: https://kinhtedothi.vn/gia-kim-loai-dong-ngay-19-11-tiep-tuc-giam.html

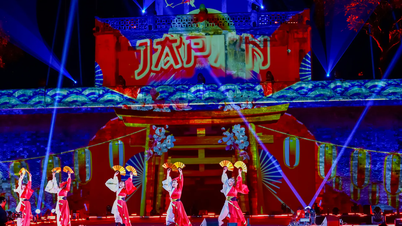

![[Photo] Discover unique experiences at the first World Cultural Festival](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/11/1760198064937_le-hoi-van-hoa-4199-3623-jpg.webp)

![[Photo] General Secretary attends the parade to celebrate the 80th anniversary of the founding of the Korean Workers' Party](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/11/1760150039564_vna-potal-tong-bi-thu-du-le-duyet-binh-ky-niem-80-nam-thanh-lap-dang-lao-dong-trieu-tien-8331994-jpg.webp)

![[Photo] Opening of the World Cultural Festival in Hanoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/10/1760113426728_ndo_br_lehoi-khaimac-jpg.webp)

![[Photo] Ho Chi Minh City is brilliant with flags and flowers on the eve of the 1st Party Congress, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/10/1760102923219_ndo_br_thiet-ke-chua-co-ten-43-png.webp)

Comment (0)