Three-month copper on the London Metal Exchange (LME) CMCU3 rose 0.3% to $9,726.50 a tonne, after hitting a two-week peak earlier in the session.

The most-traded December copper contract on the Shanghai Futures Exchange (SHFE) SCFcv1 rose 0.8% to 77,630 yuan ($10,923.96) a tonne.

The dollar edged down to 103.81 as traders balanced positions on the day of the U.S. election, making the metal more attractive to holders of other currencies.

Another survey also supported prices, showing China's services activity expanded at its fastest pace in three months in October, followed by a surprise expansion in manufacturing activity.

"The short-term direction of copper will depend on who wins the election and what details Chinese officials reveal... A Trump presidency could put pressure on prices as it would exacerbate trade tensions with China," said Marex adviser Edward Meir.

This week's meeting of the standing committee of China's National People's Congress is in focus as investors look for more details on stimulus measures.

Elsewhere, the US election is proving to be a tight race between Democrat Kamala Harris and Republican Donald Trump, with the winner likely not being known for days.

The US Federal Reserve (Fed) is expected to cut interest rates by 25 basis points on Thursday.

“We think copper could see a temporary rally to $10,000 in the coming week, driven by China easing, Fed easing and broader equity risk (if Trump wins) or reduced tariff concerns (if Harris wins),” analysts at Citi wrote in a note.

LME aluminum CMAL3 rose 0.6% to $2,634.50 a tonne, nickel CMNI3 rose 1.1% to $16,185, zinc CMZN3 rose 0.8% to $3,060.50, lead CMPB3 rose 0.3% to $2,040 and tin CMSN3 rose 0.1% to $32,185.

SHFE's aluminium SAFcv1 rose 1.2% to 21,010 yuan/tonne and tin SSNcv1 rose 0.3% to 262,150 yuan, while nickel SNIcv1 fell 0.2% to 124,520 yuan, zinc SZNcv1 fell 0.2% to 25,065 yuan and lead SPBcv1 fell 0.3% to 16,755 yuan.

Source: https://kinhtedothi.vn/gia-kim-loai-dong-ngay-6-11-tiep-tuc-tang-gia.html

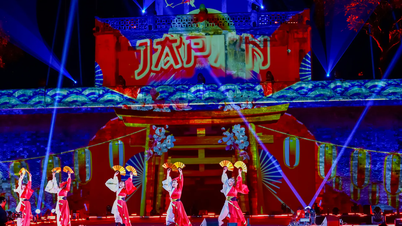

![[Photo] Opening of the World Cultural Festival in Hanoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/10/1760113426728_ndo_br_lehoi-khaimac-jpg.webp)

![[Photo] Discover unique experiences at the first World Cultural Festival](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/11/1760198064937_le-hoi-van-hoa-4199-3623-jpg.webp)

![[Photo] General Secretary attends the parade to celebrate the 80th anniversary of the founding of the Korean Workers' Party](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/11/1760150039564_vna-potal-tong-bi-thu-du-le-duyet-binh-ky-niem-80-nam-thanh-lap-dang-lao-dong-trieu-tien-8331994-jpg.webp)

![[Photo] Ho Chi Minh City is brilliant with flags and flowers on the eve of the 1st Party Congress, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/10/1760102923219_ndo_br_thiet-ke-chua-co-ten-43-png.webp)

Comment (0)