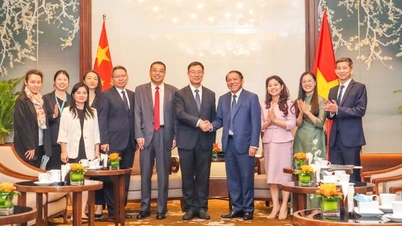

Deputy Governor Nguyen Ngoc Canh - Photo: VGP/HT

Strengthening the legal framework on anti-money laundering

On October 16, the State Bank of Vietnam organized a live and online workshop to disseminate Circular No. 27/2025/TT-NHNN guiding the implementation of a number of articles of the Law on Anti-Money Laundering; introduced Resolution No. 05/2025/NQ-CP on piloting the crypto-asset market; and updated the results of the national risk assessment on money laundering and terrorist financing.

In his opening speech, Deputy Governor of the State Bank of Vietnam Nguyen Ngoc Canh emphasized that in the context of strong fluctuations in international geopolitics and finance, Vietnam's economy is highly open, and risk identification and control are increasingly urgent.

Mr. Nguyen Ngoc Canh said that the completion of legal regulations will not only help Vietnam implement the National Action Plan but also meet its commitments to the Financial Action Task Force (FATF), towards the multilateral assessment of the Asia- Pacific Group (APG) in the 2027-2028 period.

Live and online seminars to disseminate Circular No. 27/2025/TT-NHNN guiding the implementation of a number of articles of the Law on Anti-Money Laundering; introduce Resolution No. 05/2025/NQ-CP on piloting the crypto-asset market; and update the results of the national risk assessment on money laundering and terrorist financing - Photo: VGP/HT

Implementing Circular 27 and Resolution 05 in practice

On September 15, 2025, the Governor of the State Bank issued Circular No. 27/2025/TT-NHNN replacing Circular No. 09/2023/TT-NHNN, effective from November 1, 2025, with a transition period until December 31, 2025. The Circular is considered an important step in implementing Action No. 5 of the National Action Plan on Anti-Money Laundering that Vietnam committed to FATF.

At the workshop, Ms. Nguyen Thi Minh Tho, Deputy Director of the Anti-Money Laundering Department (SBV), presented the main amendments of Circular 27, focusing on removing difficulties for reporting entities during the implementation process.

The changes include: Criteria and methods for assessing money laundering risks; Risk management process and customer classification according to risk level; Internal regulations and reporting regime for large-value, suspicious transactions; Regulations on electronic money transfer transactions, deadline for reporting electronic data; Supplementing forms for reporting risk assessment and suspicious transactions.

Circular 27 emphasizes the principle of risk-based management, requiring financial institutions to periodically update, assess risks, and develop processes for identifying and verifying customers, even when customers do not have accounts or have few transactions. In addition, units must monitor business relationships, ensuring consistency between transactions, sources of funds and customer identification records.

At the same time, the workshop also disseminated the content of anti-money laundering in Resolution No. 05/2025/NQ-CP on piloting the crypto asset market.

Issued on September 9, 2025, the resolution creates a legal corridor for the testing phase and requires strict compliance with anti-money laundering regulations to ensure the safety and sustainable development of the national financial and economic system.

Implementing Article 7 of the Law on Anti-Money Laundering 2022, Vietnam is conducting a national risk assessment for the 2023-2027 period in preparation for the APG multilateral assessment 2027-2028. Representatives of the Ministry of Public Security and the State Bank of Vietnam updated the preliminary results of the 2023-2025 period and outlined the direction of coordination in the coming time.

According to delegates, national risk assessment is an important basis for identifying high-risk sectors, products, services and areas; thereby proposing appropriate control measures, ensuring that Vietnam meets international requirements, especially FATF standards.

Mr. Minh

Source: https://baochinhphu.vn/phai-bao-dam-tinh-phu-hop-giua-giao-dich-nguon-tien-va-ho-so-nhan-dien-khach-hang-102251016120539366.htm

![[Photo] Conference of the Government Party Committee Standing Committee and the National Assembly Party Committee Standing Committee on the 10th Session, 15th National Assembly](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/15/1760543205375_dsc-7128-jpg.webp)

![[Photo] General Secretary To Lam attends the 18th Hanoi Party Congress, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/16/1760581023342_cover-0367-jpg.webp)

![[Video] TripAdvisor honors many famous attractions of Ninh Binh](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/16/1760574721908_vinh-danh-ninh-binh-7368-jpg.webp)

Comment (0)