Recently, Vietnam's leading technology company -FPT has just adjusted its business plan for 2025. Instead of setting a target of 20% revenue growth and 21% profit as approved at the Shareholders' Meeting, the Board of Directors has lowered its expectations to about 15% revenue growth and about 18-19% pre-tax profit growth.

This adjustment comes from the slowdown in IT spending in international markets, which is the Group's main growth driver. Experts say that tariff pressure, economic fluctuations and global customer caution have caused many digital transformation projects to be delayed or scaled down, especially in sensitive markets such as APAC. In that context, although the domestic technology sector still maintains growth momentum, the slowdown in the international market segment is inevitable.

The biggest expectation of investors in FPT is the AI Factory business in cooperation with Nvidia. However, this business is facing the first challenges in terms of commercialization. It can be mentioned that the utilization rate at AI factories (Vietnam and Japan) is currently below 10% because the demand for GPU as a Service (GPU as a Service) and AI services from customers has not exploded as expected.

Therefore, FPT decided to temporarily not invest in a new AI Factory in 2025. Instead, the group will focus on increasing capacity and optimizing costs for current facilities.

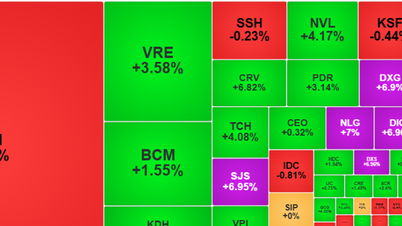

In the above context, FPT shares have been under continuous pressure to adjust and fall back to around VND 90,000/share (closing price on October 15, 2025), significantly losing the achievements achieved in the first period of the year. In addition, pressure also comes from net selling activities of foreign investors, when institutional investors expressed concerns about short-term growth prospects.

Many securities companies have had to adjust their valuation reports for FPT, although they still maintain a positive long-term view. This period is considered by analysts to be the time when FPT is "out of step" compared to the rise of the domestic financial and real estate sectors.

FPT’s plan adjustment is a signal of caution in the context of a volatile global economy. However, this is also an opportunity for the Group to restructure, optimize resources and prepare for a new growth cycle when the AI market recovers, expected in 2026.

FPT plans to develop 3 more AI factories

In the top 500 ranking announced in June 2025, FPT's two AI factories located in Japan and Vietnam ranked 36th and 38th, respectively. This result put FPT in the group of leading supercomputer infrastructures in the world , and established them as the leading commercial AI Cloud service provider in Japan with the Nvidia H200 Tensor Core GPU SXM5 super chip.

According to FPT, the AI factory in Japan has 146,304 processing cores, achieving 49.85 PFlops performance according to the Linpack standard. The factory in Vietnam has 142,240 processing cores, achieving 46.65 PFlops performance. Both use the InfiniBand NDR400 network, supporting expansion from a single GPU to clusters of hundreds of parallel processing servers in each region.

In the next 5 years, the group aims to develop 3 more AI factories globally, aiming to make Vietnam the leading country in the region in AI computing infrastructure.

Source: https://daibieunhandan.vn/sau-giam-muc-tieu-loi-nhuan-tam-thoi-dong-bang-dau-tu-ai-moi-co-phieu-fpt-lui-ve-nguong-90-000-dong-cp-10390585.html

![[Photo] General Secretary To Lam attends the 18th Hanoi Party Congress, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/16/1760581023342_cover-0367-jpg.webp)

![[Photo] Conference of the Government Party Committee Standing Committee and the National Assembly Party Committee Standing Committee on the 10th Session, 15th National Assembly](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/15/1760543205375_dsc-7128-jpg.webp)

![[Photo] Many dykes in Bac Ninh were eroded after the circulation of storm No. 11](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/15/1760537802647_1-7384-jpg.webp)

![[Video] TripAdvisor honors many famous attractions of Ninh Binh](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/16/1760574721908_vinh-danh-ninh-binh-7368-jpg.webp)

Comment (0)