On the afternoon of October 23, Lao Dong Newspaper and the Tax Department, the Ministry of Finance co-chaired, together with the Vietnam Confederation of Commerce and Industry (VCCI) to organize the Workshop "Promoting voluntary compliance and full tax contribution - Building a powerful era".

Voluntariness is the central goal of modern tax administration.

Speaking at the opening of the workshop, Mr. Nguyen Duc Thanh, Deputy Editor-in-Chief of Lao Dong Newspaper, commented: In the vision towards a powerful era, national strength is not only measured by GDP but also by institutional quality and the capacity to mobilize and allocate public resources in a transparent, effective, fair and sustainable manner.

From there, Mr. Nguyen Duc Thanh commented on the role of voluntary tax compliance, considering it as "the soft infrastructure of modern governance: creating trust for long-term investment capital to come, creating fairness for businesses to confidently expand production and business, and creating fiscal discipline to prioritize digital transformation, green growth, social welfare - health - education ".

In 2024, Vietnam's tax-to-GDP ratio will be 13.1%, much lower than the IMF's recommended minimum level of 15-16% to support sustainable growth, according to a speech by Mr. Frank Van Brunschot - Senior Economist, Fiscal Affairs Department, International Monetary Fund (IMF).

“A low tax-to-GDP ratio will limit the Government’s ability to achieve sustainable development goals so that it can invest more in infrastructure, education and social security. International experience shows that countries with this ratio exceeding the threshold of 15-16% have stronger and more sustainable growth,” he advised.

Sharing the same view with the IMF expert, citing the experience of countries around the world, Mr. Mai Son - Deputy Director of the Tax Department, Ministry of Finance said that voluntary tax compliance in developed countries is considered the central goal of modern tax management, tax authorities focus on creating favorable conditions for people and businesses to "do the right thing from the start" instead of focusing on prosecuting violations later, because most tax systems operate on a self-declaration and self-payment mechanism.

Perfecting the tax compliance process

Mr. Phan Duc Hieu, Standing Member of the Economic and Financial Committee of the National Assembly, emphasized the need for legal compliance in general, especially in tax law issues. He said that there has been a strong change from policies to institutions, in risk management rules, and in encouraging compliance; clearly demonstrated in Resolution No. 66-NQ/TW of the Politburo on innovation in law making and enforcement, meeting the requirements of national development in the new era.

Recommending some solutions to help increase voluntary tax compliance, Mr. Frank Van Brunschot, International Monetary Fund IMF pointed out that compliance risk management is not just a technical tool. It is a strategic approach that allows tax administrations to allocate resources effectively, target non-compliance intelligently and build trust with taxpayers.

Another suggestion from Mr. Bui Ngoc Tuan, Deputy General Director, Tax and Legal Advisory Services, Deloitte Vietnam, is to promote technology development, digitalization and tax data exploitation.

Currently, the tax authority has comprehensively deployed digital transformation in tax management.

Delegates attending the workshop highly appreciated the strong digital transformation process of the tax authority. However, guests also said that digital transformation and tax data connection still need to be implemented systematically on the business side to proactively control risks and proactively manage businesses in tax compliance. For individual businesses, Ms. Bui Thi Trang, Director of Retail Solutions, MISA Joint Stock Company, data connection and automation of tax declaration and payment operations help business households be more proactive in fulfilling their tax obligations.

Mr. Mai Son shared that, on the tax side, they have been making efforts to comprehensively and strongly innovate in terms of processes, technology systems, people and service methods, taking taxpayer satisfaction as a measure of operational efficiency. And perfecting solutions to improve voluntary compliance. The tax sector will continue to build a favorable tax environment, reduce administrative procedures, and reduce compliance costs for taxpayers. According to calculations, the upcoming goal is to cut about 44% of administrative costs, higher than the general requirement of 30%.

Source: https://nhandan.vn/tu-giac-tuan-thu-thue-chi-so-niem-tin-va-dong-thuan-xa-hoi-post917550.html

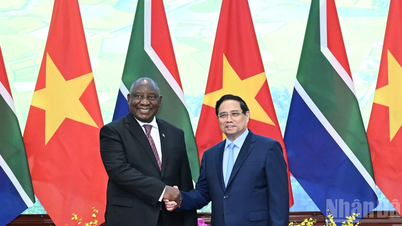

![[Photo] Prime Minister Pham Minh Chinh meets with South African President Matamela Cyril Ramaphosa](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761226081024_dsc-9845-jpg.webp)

![[Photo] President Luong Cuong holds talks with South African President Matamela Cyril Ramaphosa](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761221878741_ndo_br_1-8416-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on railway projects](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761206277171_dsc-9703-jpg.webp)

Comment (0)