As planned, on September 5, 2025, the DB x-trackers FTSE Vietnam ETF fund will announce the list of stocks that comprise the FTSE Vietnam All-share and FTSE Vietnam Index. Then, on September 12, 2025, the Van Eck Market Vector Vietnam Local Index ETF fund will announce the Marketvector Vietnam Local Index portfolio.

The data will be finalized at the end of this week (August 29, 2025). However, based on data from August 20, Yuanta Vietnam Securities has made an early forecast on the trading movements of two foreign ETFs. In particular, the securities company believes that both funds will add new stocks to their portfolios in the third quarter of 2025.

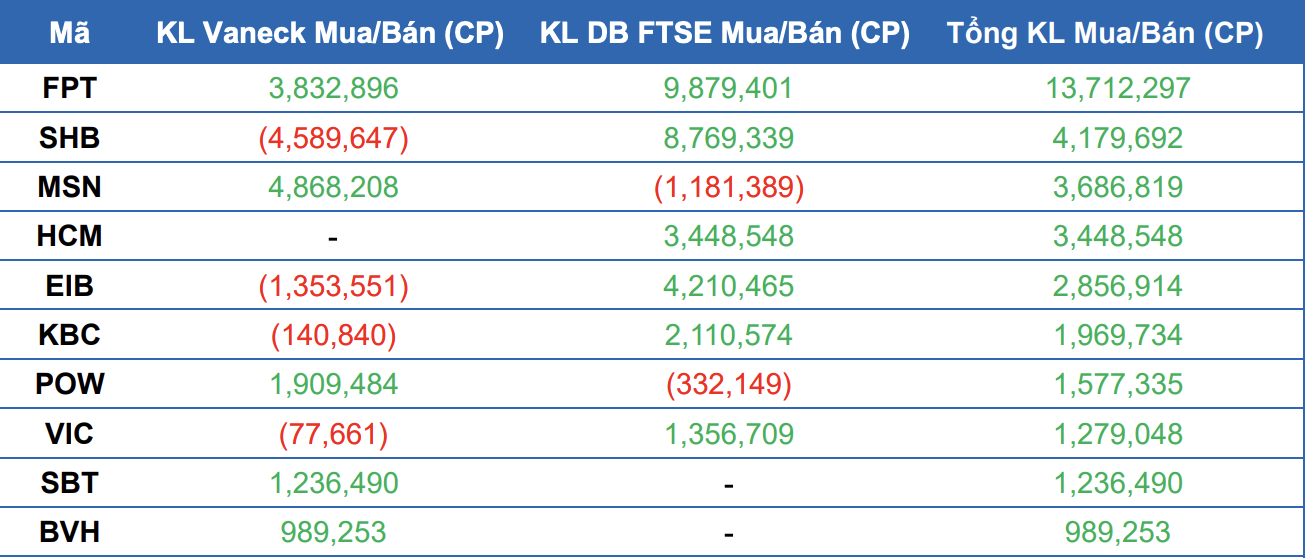

Specifically, analysts from Yuanta Vietnam believe that FTSE will addFPT and Ho Chi Minh City Securities (HCM) shares, while removing Viettel Post's VTP shares. In addition, FPT Securities (FTS) shares are also likely to be removed in this restructuring period, but currently the capitalization conditions of FTS are still quite close to the regulations. As for Van Eck Market Vector Vietnam Local Index ETF, this fund will add new FPT shares with a proportion of 2.44% of the portfolio.

FTSE can buy approximately 9.9 million new FPT shares, equivalent to a proportion of more than 10% and ranking second in terms of proportion in the new portfolio structure. Besides FPT, for the "newbie" HCM, FTSE is forecast to disburse 97 billion VND, equivalent to 3.45 million shares.

In addition, according to Yuanta Vietnam's calculations, FTSE will buy more shares in Vingroup,SHB and Eximbank with a net purchase value of over hundreds of billions of VND.

On the other hand, some stocks will reduce their weight with large net selling values such as FRT (VND 299 billion), HPG (VND 239 billion), VHM (VND 208 billion), VCI (VND 143 billion), SSI (VND 127 billion) or Vietcombank (VND 132 billion). The weight of VTP stocks in FTSE's portfolio is no longer large, with a net selling value of approximately VND 31 billion.

Meanwhile, Van Eck may also see some strong changes in some stocks. Yuanta Vietnam expects the fund to increase its holdings in Masan (MSN) to 7%, which means it will likely disburse more than VND400 billion. Meanwhile, this foreign fund is expected to significantly reduce its investment in securities stocks such as VIX, SSI, VCI and VND.

|

| Top stocks expected to be bought the most by two foreign ETFs in the portfolio rotation period of the third quarter of 2025. |

The new appearance in both portfolios of foreign ETF funds is expected to help FPT welcome large foreign capital flows.

Analysts from Yuanta Vietnam predict that Van Eck Market Vector Vietnam Local Index ETF may buy more than 3.8 million new FPT shares and FTSE may buy approximately 9.9 million new units. Thus, the total number of new purchases by the two funds is up to 13.7 million FPT shares, equivalent to an estimated purchase value of VND1,340 billion.

FPT is the stock that foreign investors have sold the most net since the beginning of the year (VND 14,430 billion) and since the beginning of August (VND 4,600 billion). After the 2024 stock price boom, profit-taking pressure has pulled FPT stock's profitability much lower than the general level. However, in the August 27 session alone, FPT stock price increased by 5% and topped the net buying list of the day (over VND 290 billion).

In terms of trading volume, the most purchased stocks were FPT, SHB, MSN, HCM and EIB. Meanwhile, the stocks facing the greatest selling pressure from the two funds were HPG (8.5 million units), SSI (over 7 million units), VND (6.4 million units) or NVL (6.17 million units)...

According to the plan, the completion date of portfolio restructuring of both foreign funds is September 19, 2025.

Source: https://baodautu.vn/co-cau-danh-muc-quy-iii2025-hai-quy-etf-ngoai-co-the-giai-ngan-manh-vao-fpt-d372455.html

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's online conference with localities](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/264793cfb4404c63a701d235ff43e1bd)

![[Photo] Prime Minister Pham Minh Chinh launched a peak emulation campaign to achieve achievements in celebration of the 14th National Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/8869ec5cdbc740f58fbf2ae73f065076)

![[VIDEO] Summary of Petrovietnam's 50th Anniversary Ceremony](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/4/abe133bdb8114793a16d4fe3e5bd0f12)

![[VIDEO] GENERAL SECRETARY TO LAM AWARDS PETROVIETNAM 8 GOLDEN WORDS: "PIONEER - EXCELLENT - SUSTAINABLE - GLOBAL"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/23/c2fdb48863e846cfa9fb8e6ea9cf44e7)

Comment (0)