Reduce the required reserve ratio for banks

The State Bank has just issued Circular No. 23/2025/TT-NHNN amending and supplementing a number of articles of Circular No. 30/2019/TT-NHNN regulating the implementation of compulsory reserves of credit institutions and foreign bank branches.

Notably, Article 7 stipulates the reduction of the required reserve ratio, stating that the supporting credit institution specified in Clause 39, Article 4 of the Law on Credit Institutions (supporting credit institution) is entitled to a 50% reduction in the required reserve ratio according to the plan to restore the credit institution under special control approved by the competent authority.

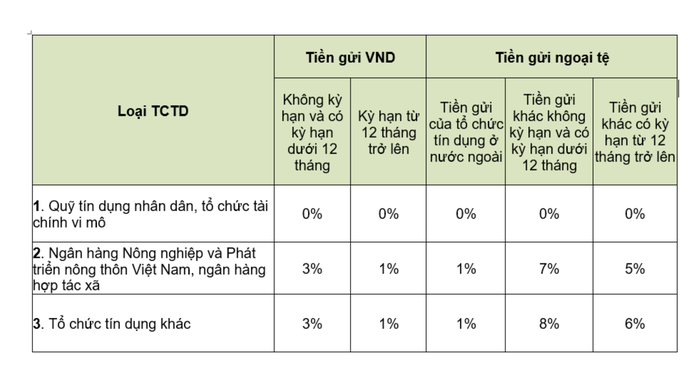

Latest required reserve ratio as announced by the State Bank, applicable from October 2025

The reduction in the required reserve ratio for each credit institution is calculated based on the required reserve ratio for that credit institution, applied to all types of deposits subject to required reserves.

With this regulation, banks that receive compulsory transfers of weak banks will benefit, including: Foreign Trade Bank (Vietcombank), Military Bank (MB), Ho Chi Minh City Development Bank ( HDBank ), Vietnam Prosperity Bank (VPBank). This means that these banks will be able to use tens of thousands of billions of dong from compulsory reserves to lend and maximize profits.

From the end of last year to early 2025, the State Bank completed the transfer of 4 weak banks, including CB transferred to Vietcombank , Oceanbank transferred to MB, DongA Bank transferred to HDBank and GPBank transferred to VPBank.

According to the State Bank, the compulsory transfer of weak credit institutions is one of the solutions to contribute to ensuring macroeconomic stability, national financial and monetary security, political stability and social order and safety, as well as helping these banks overcome accumulated losses and exit special control status.

With this new regulation, banks that are forced to transfer weak banks will benefit.

What do banks benefit from?

Meanwhile, the transferee banks will enjoy many preferential mechanisms in terms of capital sources and credit room to expand their asset scale and outstanding debt to create motivation for these banks to resolutely participate in successfully restructuring weak credit institutions.

In mid-May 2025, the Government issued Decree No. 69/2025/ND-CP amending and supplementing a number of articles of Decree No. 01/2014/ND-CP on foreign investors purchasing shares of Vietnamese credit institutions.

Accordingly, the total shareholding level of foreign investors in commercial banks receiving compulsory transfers (excluding commercial banks in which the State holds more than 50% of charter capital) may exceed 30% but not exceed 49% of charter capital.

Thus, some banks receiving compulsory transfers can increase their foreign room (ownership ratio) to a maximum of 49%.

Source: https://nld.com.vn/thong-tin-quan-trong-cho-nganh-ngan-hang-va-nen-kinh-te-196250814115346004.htm

![[Photo] Discover unique experiences at the first World Cultural Festival](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/11/1760198064937_le-hoi-van-hoa-4199-3623-jpg.webp)

![[Photo] Opening of the World Cultural Festival in Hanoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/10/1760113426728_ndo_br_lehoi-khaimac-jpg.webp)

![[Photo] General Secretary attends the parade to celebrate the 80th anniversary of the founding of the Korean Workers' Party](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/11/1760150039564_vna-potal-tong-bi-thu-du-le-duyet-binh-ky-niem-80-nam-thanh-lap-dang-lao-dong-trieu-tien-8331994-jpg.webp)

![[Photo] Ho Chi Minh City is brilliant with flags and flowers on the eve of the 1st Party Congress, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/10/1760102923219_ndo_br_thiet-ke-chua-co-ten-43-png.webp)

Comment (0)