“We have to be better than the Chinese.” General Motors (GM) Chairman Mark Reuss’s terse message in a conversation with InsideEVs illustrates how the American automaker is choosing to confront competitive pressure: not copy, but innovate. The focus is on lowering battery costs to expand the EV portfolio, while maintaining the strength of internal combustion engine models, creating cash flow for research and development.

Innovate rather than copy: direction from GM's top

Since 2019, Mark Reuss and CEO Mary Barra have led GM in a fiercely competitive auto industry, especially in the electric vehicle segment. Reuss has emphasized that the company is not looking to copy Asian technology but to outperform it with a better approach. According to him, simply repeating existing solutions will not be enough to create a sustainable advantage.

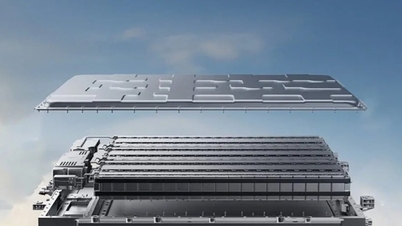

Cheap batteries: a lever to expand electric vehicle portfolio

GM continues to pour money into R&D, with one focus in particular: cheaper batteries. Reuss says this is key to expanding the company’s electric vehicle portfolio amid growing competition. The battery project uses the same technology Ford is also working on. As battery costs fall, electric vehicles could reach more customers and strengthen GM’s position.

Don't abandon ICE: parallel strategies to nurture R&D

Despite its electrification priorities, GM is not abandoning the internal combustion engine. Reuss said the company is “very fortunate” to have a portfolio of both electric and gasoline-powered vehicles. The performance of internal combustion engines continues to be important, helping to generate resources for reinvestment in technology and R&D, serving the goal of achieving parallel success in both areas.

The pressure of “China speed” and product life cycles

What is worth learning from China, according to Reuss, is speed. Manufacturers in this market launch new models, mid-life upgrades and next-generation models significantly faster than the norm in Europe, the US, South Korea and Japan. The new-generation launch cycle in traditional markets is typically 6–8 years, with major updates every 3–4 years; in China, this time is often shortened by half.

The high speed allows Chinese cars to respond to user needs faster and update technology in a timely manner, making it easier for long-standing competitors to become outdated in terms of technology. Reuss also notes that this speed comes in part from companies “carefully evaluating each other and copying each other,” creating a very rapid development cycle, but that is not necessarily good for the market.

| Region/Brand | The development cycle stated in the source |

|---|---|

| Europe/America/Korea/Japan | New generation: 6–8 years; major upgrade: 3–4 years |

| China | About half the time as above |

| Audi (next generation TT) | Target launch within 30 months of project approval |

| BMW (New Class) | Commitment to 40 new and upgraded models in the next 2 years |

The global acceleration wave: competitors have responded

Not only GM, but also big names in Europe have entered the acceleration trajectory. Last month, Audi announced a strategy to bring the next generation TT to market just 30 months after approval. Shortly after, BMW announced that even Chinese manufacturers would have trouble matching the development speed of the Neue Klasse line, and pledged to launch 40 new models and upgrades within two years.

Implications for markets and users

Reuss predicts that electric vehicles will become more popular and affordable as costs fall. If GM’s low-cost battery strategy goes well, consumers could see a rapidly expanding EV portfolio, at more competitive prices. Meanwhile, maintaining internal combustion engine vehicles ensures resources for reinvestment in technology, de-risking the electrification path.

Conclusion: Go at your own pace

Mark Reuss’s message is clear: GM is choosing innovation over copying, betting on low-cost batteries and rapid development models, along with internal combustion engines to fuel R&D. In a race where “China speed” is setting the new standard, GM’s success will depend on translating strategic priorities into real-world execution.

Source: https://baonghean.vn/gm-truoc-toc-do-trung-quoc-mark-reuss-chon-doi-moi-10308757.html

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on railway projects](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761206277171_dsc-9703-jpg.webp)

Comment (0)