Pinetree Securities experts believe that the stock market's performance this week depends largely on the return of cash flow into pillar stocks and their ability to spread to the entire market.

Stock market perspective 3-7/3: Depends heavily on the return of cash flow into pillar stocks

Pinetree Securities experts believe that the stock market's performance this week depends largely on the return of cash flow into pillar stocks and their ability to spread to the entire market.

The world stock market is in a correction phase, mainly in Asia. With the sharp decline in the past week, Japanese and Korean stocks have lost the MA200 technical level, in addition, the upward trend of the Chinese market has also been blocked. Most notably, the stock market in Southeast Asia with the Thai and Philippine markets has entered a bear market, meaning it has decreased by more than 20% since the recent peak.

In commodities, gold prices snapped an eight-week winning streak after falling more than 3% last week. Its role as a safe haven asset was quickly taken over by the US dollar and US Treasury bonds. Oil prices also hit a two-month low, marking the first monthly decline since November 2024.

US President Donald Trump continued to announce new tariff ideas that made global investors uneasy last week. Geopolitical concerns were further heightened when the negotiations between the US and Ukraine failed right at the White House after a heated dialogue between the two presidents. On March 4, a 25% tariff on Mexico and Canada will take effect after a 1-month delay. In addition, Mr. Trump also announced an additional 10% tariff on China (March 4), after having imposed a 10% tariff on Chinese goods since the beginning of February 2025, thus, the tax rate is 20% for China from March 4.

The domestic market bucked the global stock market trend with its sixth consecutive week of gains, the longest streak since mid-August 2023, and remained above the 1,300-point threshold for all sessions last week. The index closed the week at 1,305.36 points, up +8.61 points, or +0.66% compared to the previous week.

The increase last week was mainly concentrated in the Midcap group (+1.36%), while Smallcap increased +1.05% and VN30 increased slightly +0.2%. Some prominent stock groups such as: Construction and construction materials, mostly steel stocks (+5.01%), securities (3.2%), real estate (+2.58%)... On the opposite side, logistics (-2.69%), aviation (-2.48%), insurance (-2.34%)...

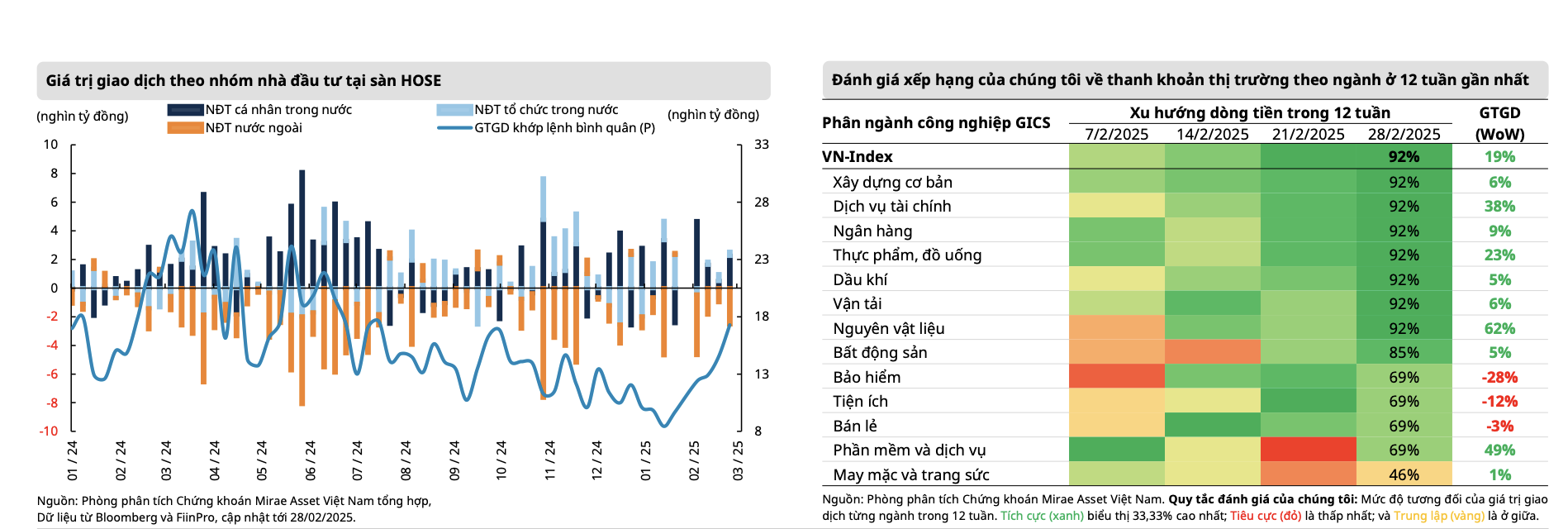

The peak momentum last week caused cash flow to explode rapidly with matched stock volume increasing by more than 13%, while recording improved liquidity for the 6th consecutive week. The average matched transaction value per session increased by 19% compared to the previous week and reached more than 17,300 billion VND, the highest level since July 2024.

Specifically, the total market liquidity last week reached VND21,137 billion, up 13.2% compared to the previous week, of which the matched liquidity also increased by 16.3% to VND19,448 billion. February liquidity increased to VND17,861 billion, up nearly 40% compared to January but still 23.3% lower than the same period. Accumulated from the beginning of the year, the total market liquidity reached VND15,343 billion, down 27.2% compared to the average level in 2024.

However, most of the increase was formed in the session on February 24, while the VN-Index entered a state of re-accumulation after breaking through the psychological resistance of 1,300 points. In particular, cash flow continued to withdraw from groups with high trading performance in the previous period such as banking and technology (FPT ) and gradually shifted to groups of stocks that have not yet entered the price increase phase with prospects of better profit performance such as steel, construction, real estate and securities.

Among them, the stock groups that attracted the most cash flow were steel stocks after the Ministry of Industry and Trade imposed a temporary anti-dumping tax of up to 27.83% on hot-rolled coil (HRC) imported from China and securities stocks thanks to expectations of market upgrade by FTSE Russell as well as the KRX system.

|

| Source: Mirae Asset |

The optimistic sentiment from domestic investors continued to strengthen the market's upward momentum and at the same time balanced the selling pressure from foreign investors. Foreign investors net sold more than VND2,758 billion, bringing the net selling in February to VND9,850 billion and the cumulative net selling since the beginning of the year, foreign investors net sold VND16,606 billion. ETF capital withdrawals from Diamond and Fubon funds were -4.63 million USD and -4.5 million USD respectively last week.

The group of stocks that were net sold last week focused on: FPT (-470 billion VND), STB (-416 billion VND), HPG (-369 billion VND), while net buying returned to MWG (+547 billion VND), VNM (+170 billion VND)... In the past month, stocks that were net sold by foreign investors include: FPT (-1,334 billion VND), VNM (-1,119 billion VND), MSN (-979 billion VND), VCB (-714 billion VND)...

|

| Source: MBS |

Regarding valuation, according to MBS Securities experts, the current P/E index (TTM - sliding 4 most recent quarters) of the market has increased from 13.3 times in early February to 14.18 times but is still 16.5% lower than the 5-year average. This is the second time the P/E index has been lower than the average level of 1 standard deviation since the end of October and early November 2024, when the VN-Index was at 1,250 points .

Mirae Asset Securities experts believe that the trade war has not shown any signs of cooling down with the US's decision to continue imposing an additional 10% import tax on China while the new tax on Mexico and Canada is expected to take effect from March 4 after the end of the previous 30-day suspension. The role of the US on the fronts is gradually becoming unpredictable with the ceasefire agreement in Russia - Ukraine likely to last longer than expected when the press conference between President Zelensky and Mr. Trump last weekend did not go smoothly. Although this is considered one of the negative factors in geopolitics, the impact on the stock market is still not really clear with the US growth prospect still being the most important factor at the present time; especially when consumer activities gradually slow down in this country.

For the Vietnamese market, March will be a preliminary period when global cash flow may become cautious when the US tariff decisions will begin to take effect, along with the corresponding tax rates that will be announced in early April. These are risks that the market needs to carefully monitor. In Mirae Asset's view, cash flow in Vietnam will tend to continue to shift to groups with prospects of bringing higher trading performance, with the shake-out movements from profit-taking in the banking group likely to cause the market to adjust to new equilibrium price zones (1,280 - 1,290 points) before once again testing the resistance zone of 1,300 - 1,330 points.

According to Pinetree Securities experts, the time the market surpassed the 1,300-point mark in the last week of February 2025 marked the first time the market has remained at this psychological threshold for 5 consecutive sessions, in nearly 3 years. VN-Index has experienced a shaky week, but investor sentiment is gradually becoming more positive despite some disturbing news such as the consecutive blows from President Donald Trump's conservative tariff policy or the slow-down of public investment disbursement figures in the first 2 months of the year compared to the plan and slower credit growth across the system.

Pinetree Securities experts believe that this week will be a more difficult trading week, as the VN-Index is still struggling around the important psychological mark of 1,300 points. The clear breakthrough is difficult to confirm without the driving force from the banking stocks group . Especially when the Prime Minister's Directive requires strict handling of credit institutions that compete unfairly on interest rates and directs banks to "be willing to share part of their profits to reduce lending rates to support people and businesses", implying that the net interest margin (NIM) of the banking system may be affected to some extent.

Accordingly, the development next week depends largely on the return of cash flow into pillar stocks and the ability to spread to the entire market. In a slight correction scenario, VN-Index may return to the 1,285 - 1,290 point range to gain momentum, then the next target will be the 1,330 point range, and in the case of stronger fluctuations, the market may return to 1,255 - 1,260 points.

Source: https://baodautu.vn/goc-nhin-ttck-3-73-phu-thuoc-nhieu-vao-su-tro-lai-cua-dong-tien-vao-nhom-co-phieu-tru-d250433.html

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's online conference with localities](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/264793cfb4404c63a701d235ff43e1bd)

![[Photo] Prime Minister Pham Minh Chinh launched a peak emulation campaign to achieve achievements in celebration of the 14th National Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/8869ec5cdbc740f58fbf2ae73f065076)

![[VIDEO] Summary of Petrovietnam's 50th Anniversary Ceremony](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/4/abe133bdb8114793a16d4fe3e5bd0f12)

![[VIDEO] GENERAL SECRETARY TO LAM AWARDS PETROVIETNAM 8 GOLDEN WORDS: "PIONEER - EXCELLENT - SUSTAINABLE - GLOBAL"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/23/c2fdb48863e846cfa9fb8e6ea9cf44e7)

Comment (0)