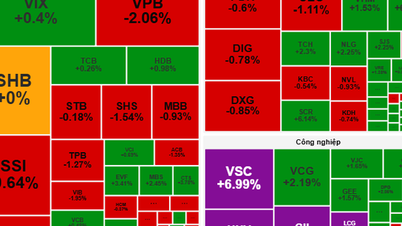

The main market indices promptly maintained green in the last trading session, ending the series of strong increases in the past week. At the end of the trading week, the VN-Index increased by 33.09 points (+2.64%), to 1,285.32 points. The HNX-Index increased by 4.92 points (+2.09%), to 240.07 points.

Liquidity on both exchanges improved significantly compared to the previous week, with matched volume increasing by 20.6% on HOSE and nearly 24% on HNX. In addition, trading volume remained above the 20-day average, showing that investors have begun to actively participate again. Cash flow continued to flow into real estate stocks, helping this group become a bright spot on the electronic board for the second consecutive week.

However, the net selling pressure from foreign investors last week will hinder the index from maintaining its upward momentum in the coming time. Foreign investors net sold more than VND1.2 trillion on both exchanges last week. Of which, foreign investors net sold nearly VND968 billion on HOSE and net sold nearly VND255 billion on HNX.

Also last week, US stocks rose on Friday (August 23), after Federal Reserve Chairman Jerome Powell said that interest rates would soon be cut. However, Mr. Powell did not provide specific information about the timing or the rate cut. However, this is also information that investors are waiting for.

Domestically, statistics on the second quarter 2024 business results of listed enterprises show that after-tax profits increased by 26% compared to the same period in 2023. In addition to reflecting the recovery of the business environment, the profit growth of enterprises helps make stock valuations more attractive.

Experts from Yuanta Vietnam Securities Company assessed that it is highly likely that the VN-Index has created a short-term bottom in the session on August 5, 2024, with the lowest score of 1,184.53 points.

Looking back at the history of the last 2 years, the index often created a V-shaped bottom, then accumulated sideways and then increased; looking at a longer period, the market has created a double bottom or triple bottom pattern many times.

At the present stage, Yuanta experts are leaning towards the scenario that VN-Index has successfully formed a V-shaped bottom and the recovery is heading towards the 1,260 +/- 10 point zone, after which it may enter a sideways phase with an amplitude of 30 - 50 points. If following that scenario, VN-Index may break out of the 1,300 point threshold and head towards a new zone around 1,370 points.

Experts from DSC Securities Company believe that domestic and foreign stock indices are back on the offensive after a necessary break. Experts expect that not only technical cash flow but also the most "indifferent" positions will soon be disbursed again. It is likely that the market will begin to enter an "easy investment" phase after 3-4 months of ups and downs. DSC recommends that investors can expand their capital scale, wait for the downturns in the new week to increase their positions.

Source: https://laodong.vn/kinh-doanh/thi-truong-chung-khoan-duy-tri-da-tang-diem-tot-1384108.ldo

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Infographics] An Giang economic picture in the period 2020 - 2025](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/1/093e29084648496c82a22536f5384c21)

Comment (0)