| Vietnamese coffee and the opportunity to promote and increase exports. Arabica coffee prices skyrocket, benefiting Vietnamese coffee exports. |

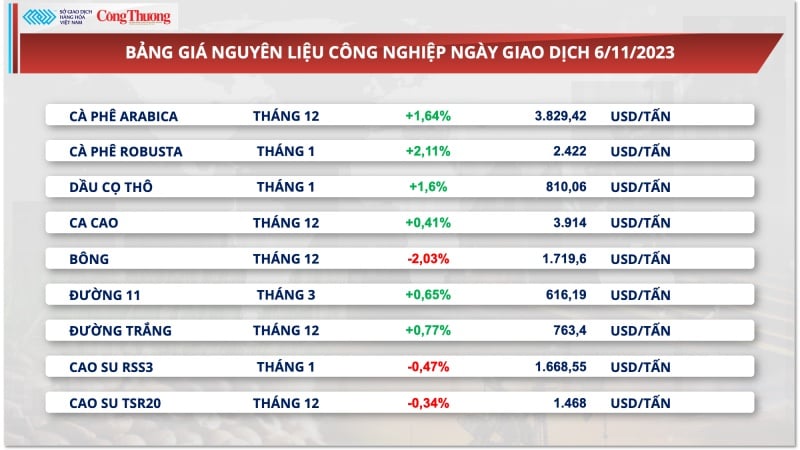

According to the Vietnam Commodity Exchange (MXV), at the end of the first trading day of the week (November 6), the coffee market continued to be a bright spot attracting the attention of investors. Arabica prices extended their upward trend for the third consecutive day, closing 1.64% higher than the reference price. Robusta prices also increased by more than 2% in yesterday's session. Coffee inventories on the Intercontinental Exchange (ICE) decreased sharply, increasing concerns about the ability to ensure sufficient supply in the market, thereby continuing to support the price increase.

|

| Both Arabica and Robusta coffee prices increased. |

In the report ending on November 6, the standard Arabica inventory on ICE-US decreased by 12,454 60kg bags, bringing the total coffee storage to 347,555 bags. This is the lowest inventory level recorded in more than 24 years.

In addition, the domestic Brazilian Real strengthened yesterday, causing the USD/BRL exchange rate to fall by 0.32%. The decrease in the exchange rate has somewhat limited the selling pressure of Brazilian farmers. This also pushed up the price of coffee.

Vietnam currently exports coffee to more than 80 countries. The EU is a major consumer market, accounting for 38.3% of the country's total coffee export volume.

According to the Import-Export Department - Ministry of Industry and Trade , in the third quarter of 2023, Vietnam's coffee exports to all market regions decreased compared to the previous quarter, but the export rate to Asia and Europe decreased at a lower rate. Compared to the third quarter of 2022, Vietnam's coffee exports to most regions decreased, except Asia and Africa.

By market, in the third quarter of 2023, Vietnam's coffee exports to most markets decreased, except for Thailand, which increased slightly compared to the second quarter of 2023. Compared to the third quarter of 2022, coffee exports to many markets decreased, but exports to markets such as Japan, Spain, the Philippines, China, the UK, etc. increased.

Regarding the structure of export products, in the third quarter of 2023, Robusta, Arabica and Excelsa coffee exports decreased by 45.5%, 69.2% and 66.7% respectively, while processed coffee exports increased by 11.4% compared to the second quarter of 2023. Compared to the third quarter of 2022, exports of most coffee varieties decreased, but processed coffee grew by up to 33.9%.

Enterprises are also making efforts to boost coffee processing to increase export value. For example, Cao Nguyen Coffee Service Joint Stock Company (owner of Highlands Coffee chain) started construction of the Cao Nguyen Coffee Roasting Factory project, with an investment capital of up to 500 billion VND, meeting international standards with the ambition of putting Vietnamese roasted coffee on the world map. The factory has a capacity of nearly 10,000 tons of coffee/year in the first phase and can increase to 75,000 tons/year in the next phase.

|

| Production line of Son La Coffee Processing Factory (Photo: Phuong Nguyen) |

The largest coffee processing factory in the Northwest has just been officially put into operation in Son La province by the investor Son La Coffee Processing Joint Stock Company. This is considered a positive signal for the processing stage - which is the weakest point of the agricultural supply chain in general and coffee in particular, not only in the Northwest but also in the whole country.

According to the Vietnam Coffee and Cocoa Association (Vicofa), in September, foreign direct investment (FDI) enterprises accounted for about 70.5% of the total export volume and about 69% of the value of green coffee beans. For roasted and instant coffee, FDI enterprises accounted for about 58.3% of the total coffee export volume and about 64.4% of the value. Currently, the world's largest coffee corporations are present in Vietnam - the world's largest Robusta raw material region.

Source link

![[Photo] Solemn opening of the 1st Government Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/13/1760337945186_ndo_br_img-0787-jpg.webp)

![[Photo] General Secretary To Lam attends the opening of the 1st Government Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/13/1760321055249_ndo_br_cover-9284-jpg.webp)

Comment (0)