On May 9, local time, the US Department of Labor announced that the number of unemployment claims in this country increased by 22,000 to 231,000 last week. The number of Americans filing for benefits is higher than expected, reinforcing investors' hopes that the US Federal Reserve (FED) will cut interest rates by the end of 2024.

|

| Expectations of interest rate cuts from the Fed will be the main reason driving gold prices this year. Photo: Bloomberg |

The dollar slipped against other currencies after the announcement, with the dollar index down 0.17% to 105.363. However, the cheaper dollar boosted demand for gold among foreign investors. Spot gold rose 0.2% to $2,350.81 an ounce this morning, its biggest gain in five weeks, according to Reuters. Gold futures also rose 0.7% to $2,356.90 an ounce.

“Gold has regained its form this week thanks to worse-than-expected initial jobless claims figures, suggesting the labor market may be starting to loosen,” said Tim Waterer, chief market analyst at KCM Trade in Australia. Upcoming inflation reports could alter the expected timing of rate cuts, and gold could be a beneficiary, he added.

In fact, investors' expectations about the likelihood and timing of the Fed's rate cuts are having a big impact on the gold market, as lower interest rates reduce the opportunity cost of holding gold. According to CME FedWatch, traders are currently predicting a 67% chance of a US rate cut in September 2024. However, the Fed's representative, San Francisco branch president Mary Daly, said that the US inflation situation in the coming months is extremely unclear, according to Reuters.

According to Mint, expectations for Fed policy will be the most important factor in the five reasons to invest in gold this year. Although the Fed has maintained a relatively tough stance on monetary policy, recent easing from this agency has reinforced expectations of interest rate cuts later this year. Commenting on this, a representative of the financial company Religare Broking (India) said: "The possibility of an interest rate cut in the second half of this year will likely cause the USD to depreciate, thereby acting as a positive catalyst for gold prices."

Another important reason to invest in gold is high inflation, especially in the US. “Given gold’s traditional role as a hedge against inflation, it is expected to remain attractive to investors in the coming months,” commented a representative from Religare Broking. In fact, recent economic data in the US also shows that inflation is falling more slowly than expected. The latest US consumer price index report showed a 3.5% year-on-year increase to 312.33 in March 2024, following a 3.2% increase in February.

The third reason to invest in gold comes from the increasing political tensions around the world. In 2024, the world of gold will be affected by the war in the Middle East, when Israel is increasing tensions with Syria and Hezbollah in the north, and Hamas in the south of the region. Moreover, the prolonged war situation between Russia and Ukraine can also promote gold investment, due to its reputation as a safe investment channel in the context of war.

Slowing global economic growth will also boost investment demand for gold, which is more attractive in times of market uncertainty, according to Religare Brooking. According to the World Bank's latest Global Economic Prospects Report, the global economy could see a pessimistic outcome by the end of 2024, with the slowest GDP growth in half a decade over the past 30 years. Global growth in 2024 is forecast to slow for the third consecutive year, falling to 2.4% from 2.6% in 2023.

The final reason to invest in gold comes from the demand from global central banks for gold, which will drive up the price of gold. These institutions have long considered gold an important part of their financial reserves, especially in a context where supply diversification is increasingly important. Currently, central banks hold about 20% of global gold production. In the first quarter of 2024, central banks bought nearly 290 tons of gold, surpassing the previous year's record, with China leading the way, followed by Türkiye and India.

The World Gold Council's Q1 2024 report highlighted a 3% increase in global gold demand to 1,238 tonnes, the strongest first quarter since 2016. This growth was largely driven by strong over-the-counter (OTC) investment activity and consistent central bank purchases. Bar and coin demand also increased by 3%.

Forecasting the future price of gold, Mr. Rahul Kalantri, Vice President of Mehta Equities Investment Company (India) told Mint: "The lowest price of gold this year will be around 2,278 - 2,294 USD/ounce, and the highest will be around 2,328 - 2,342 USD/ounce".

According to analysts at Religare Broking, although investors are hesitant to buy gold at this stage, if the world gold price slightly decreases to 2,235 - 2,240 USD/ounce, this could be a favorable opportunity to buy gold in the coming time.

|

| World gold price chart at 3:49 p.m. on May 10, 2024 |

The world gold price today, May 10, 2024, continues to increase strongly. Specifically, at 3:49 p.m., the gold price was at 2,368.19 USD/ounce, up 22.49 USD (equivalent to 0.96%) compared to the previous opening session.

|

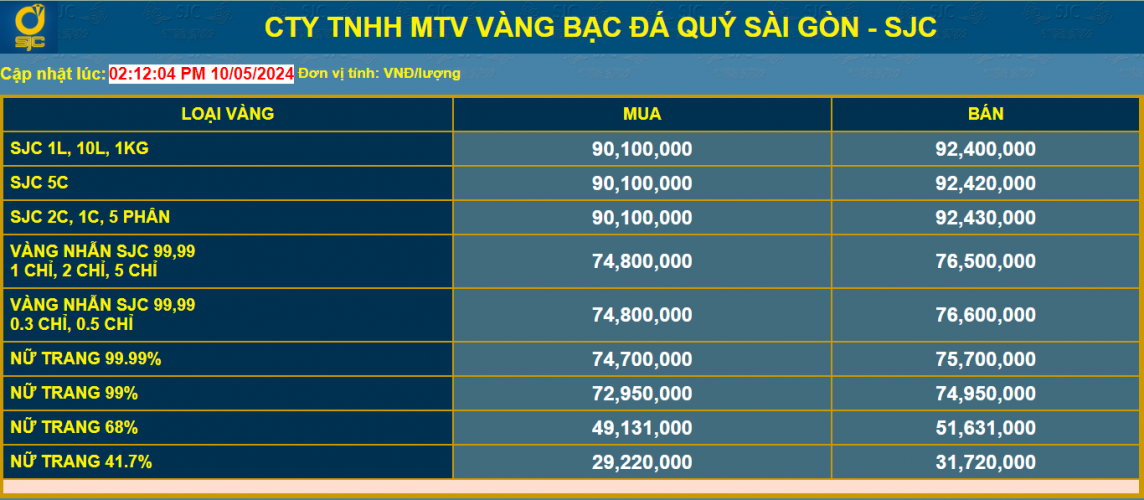

| Gold price list of Saigon Jewelry Company Limited SJC at 2:12 p.m. on May 10, 2024 |

Similarly, the domestic gold price today also continued its record "stormy" increase. At 2:12 p.m., the listed gold price of Saigon Jewelry Company Limited (SJC) was 90.1 million VND for buying and 92.4 million VND for selling. Compared to the same time yesterday, the SJC gold price had a "huge" increase of more than 3.1 million VND for buying and selling.

Giving reasons for the record increase in domestic gold bar prices, experts said that the main reason is the sharp increase in demand for gold bar investment. According to statistics from the World Gold Council, Vietnam's demand for gold investment in the first quarter increased sharply by 12% in the first quarter of 2024, the highest since 2015.

In addition, another reason that contributed to the record-breaking increase in domestic gold bar prices came from the State Bank's unsuccessful gold auctions.

Source: https://congthuong.vn/5-ly-do-nen-dau-tu-khi-vang-van-dat-nhu-tom-tuoi-319358.html

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)