This morning, October 23, continuing the 10th Session, the National Assembly discussed in groups the draft Bankruptcy Law (amended) and the draft Deposit Insurance Law (amended). National Assembly Chairman Tran Thanh Man participated in the discussion session in Group 11 including the National Assembly Delegation of Can Tho City and the National Assembly Delegation of Dien Bien Province.

Many new and breakthrough points overcome the limitations of the old law.

At Group 11, delegates agreed on the need to amend the Bankruptcy Law to overcome current shortcomings, improve feasibility, transparency and efficiency in the implementation process. Delegates highly appreciated the Review Report of the Economic and Financial Committee, the efforts of the drafting agency - especially in perfecting the legal framework for procedures for rehabilitating insolvent enterprises and cooperatives.

Regarding the name, National Assembly Chairman Tran Thanh Man agreed with the majority opinion of the Economic and Financial Committee that it is "Bankruptcy Recovery Law", saying that this name is suitable for the content of the draft Law because this time it emphasizes recovery.

The draft law has 8 chapters and 89 articles, of which 22 articles are added, 62 articles are amended and 5 articles are kept unchanged. The National Assembly Chairman assessed that the draft law has strong points, is a breakthrough, and overcomes the limitations of the old law.

Notably, the bill has: established independent recovery procedures; shortened bankruptcy procedures; applied digital technology and improved the roles of related parties such as administrators and asset management enterprises; provided state support mechanisms; and expanded the scope of application, including bankruptcy of individuals and foreign enterprises.

However, the National Assembly Chairman also requested the drafting agency and the Economic and Financial Committee to continue reviewing potential problems that may arise.

First, the risk of abusing the recovery procedure. "The priority of independent recovery can be exploited to prolong the time, avoid real bankruptcy, leading to loss of assets or affecting the interests of creditors. This is an issue that needs attention," the National Assembly Chairman noted.

Second, the impact on the state budget. The National Assembly Chairman said that the regulation of advance payments from the budget could cause waste and not control the source tightly. Therefore, it is necessary to assess the financial impact and stipulate specific funding sources according to the State Budget Law passed by the National Assembly at the 9th Session.

Third, the authority to handle disputes. According to the National Assembly Chairman, assigning the Court to resolve all related disputes is positive but may lead to overlap with other laws such as the Civil Code, Arbitration Law, etc., so it is necessary to continue to review to avoid conflicts.

Fourth, lacks detailed regulations on asset sales. The new bill only stipulates principles and assigns the Government to provide guidance. The National Assembly Chairman said that this could cause delays in asset handling.

Five is, applicable to foreign enterprises. The expansion of scope is good, but specific guidance is needed to avoid complicating procedures, especially issues related to international law.

From the above analysis, National Assembly Chairman Tran Thanh Man suggested that the bill should strengthen the monitoring mechanism to prevent abuse. It should add a regulation on the maximum time for the recovery procedure (for example, not exceeding 6 months or 12 months), along with an independent monitoring mechanism from the state agency or the creditor council. It is possible to learn from the experience of other countries on this issue.

Along with that, focus on perfecting financial and budgetary regulations. It is necessary to clearly define criteria for advance payments from the budget to avoid waste. It should only be applied to businesses that no longer have assets but have the potential to recover, combined with a repayment mechanism after selling assets. At the same time, it is necessary to integrate other support policies such as tax reduction and deferral, ensuring consistency with current tax laws, this is a very important issue.

The National Assembly Chairman also proposed to enhance training and professionalize administrators. Specifically, the Law should require international certificates or periodic training for administrators. At the same time, it is necessary to build an online registration system to increase the quantity and quality of this team, helping to reduce processing time and enhance the confidence of foreign investors.

On the other hand, according to the National Assembly Chairman, deeper integration of technology is needed. In addition to digitization, the use of AI or Blockchain to verify assets and transactions should be regulated, helping to make asset distribution transparent. An online system can be applied to "virtual" creditors' conferences to reduce travel costs. This is a new issue, the National Assembly Chairman suggested that the drafting agency and the verification agency need to study further.

The National Assembly Chairman also noted the issue of harmonization with international law. Accordingly, it is necessary to supplement regulations on cross-border bankruptcy, referencing international conventions; at the same time, avoid overlapping with the 2020 Enterprise Law and the 2015 Civil Code.

Emphasizing that this is a specialized law and is very difficult, the National Assembly Chairman also suggested strengthening the Government's role in supervising its implementation. Accordingly, the Government should establish a committee to supervise the implementation of this law in the first 2-3 years, collecting feedback from businesses and the courts for timely adjustments.

More importantly , "feasibility and effectiveness"

Regarding bankruptcy recovery procedures, the draft Law expands the scope of regulation in the direction of: developing and perfecting bankruptcy recovery procedures as an independent procedure carried out before bankruptcy procedures. The majority of opinions in the Economic and Financial Committee agree with this plan.

According to National Assembly Deputy Nguyen Van Quan (Can Tho), this is a new point of the draft Law, an important change compared to the current law to create opportunities for enterprises and cooperatives facing financial difficulties to restructure and maintain production and business activities before having to cease production and business activities. Thereby, it shows that the draft Law targets debtors, mainly giving priority to helping enterprises have the opportunity to restructure and restore production.

However, there are also some other opinions in the Economic and Financial Committee that separating the rehabilitation procedure into an independent procedure to be carried out before the bankruptcy procedure is inappropriate and proposes to stipulate that it is only a step in the process of carrying out bankruptcy procedures.

National Assembly Deputy Le Minh Nam (Can Tho) also said that the rehabilitation procedure is a policy that demonstrates the humanity and flexibility of the Bankruptcy Law to ensure the harmony of interests between enterprises, creditors, employees and the economy. "Therefore, the need for rehabilitation procedures is very necessary and must also be clearly stipulated in the Law for implementation in the coming time."

Regarding the regulation method, delegate Le Minh Nam said, "if it is separated, it will be more convenient and transparent in practical implementation". However, what is more important is "the feasibility and effectiveness of this policy and how it should be regulated in the law to ensure its true feasibility and effectiveness".

Citing the reality in Vietnam, delegate Le Minh Nam said that the feasibility of the recovery procedure is still limited. Because when businesses reach the "threatened bankruptcy" state, they often fall into serious illiquidity and "use all tricks" to cope. In addition, the financial information of these units often does not create trust in transparency anymore.

Therefore, "to effectively implement the recovery procedure requires complete and strict regulations". Emphasizing this, delegate Le Minh Nam suggested that it is necessary to consider and quantify the specific criteria, bases, and foundations to determine whether a cooperative enterprise is eligible for recovery and the responsibilities of the subjects participating in recovery. "Only with clear regulations can we select feasible and effective subjects of application".

Along with that, to be able to control, according to the delegate, there must also be a mechanism to support business restructuring when recovering. "We not only support regulations and resources but also need to pay attention and support specialized financial and legal services to help the unit in the recovery process. We need very good "doctors" to save businesses in a "life and death" situation.

Delegate Le Minh Nam also suggested that there should be regulations on building an early financial warning system to detect businesses at risk, thereby encouraging them to proactively apply for rehabilitation before the situation becomes too serious.

Clarifying regulations on using state budget for bankruptcy costs

Regarding Article 20 on advance payment of bankruptcy recovery costs, delegates expressed their agreement with the view of using the state budget to cover these costs (instead of using other funds). However, delegate Nguyen Van Quan also suggested that it is necessary to assess the impact of using the state budget to pay bankruptcy costs, in order to ensure feasibility, while "avoiding policy abuse causing loss and waste".

Along with that, it is necessary to specifically identify funding sources and develop procedures and processes in accordance with the provisions of the State Budget Law. This is to ensure that policies to support business recovery can be implemented and bring about practical results.

Regarding the plan to allow the state budget to advance bankruptcy costs, delegates also suggested that the Law should specify more clearly the order of priority, ensuring that this money is "immediately returned to the state budget" when selling assets.

Previously, in the report on the draft Bankruptcy Law (amended), the Government stated that bankruptcy costs are not specifically regulated in the expenditures of the State Budget Law; the small and medium enterprise development fund also does not have the function of pre-paying bankruptcy costs. Therefore, the drafting agency and the Government need to continue to review and coordinate closely to reach a consensus, ensuring the feasibility of allocating resources from the state budget.

In addition, delegates also noted that policies to support business recovery (such as tax exemptions and reductions) need to be reviewed to ensure consistency and consistency with other specialized laws such as tax laws.

Source: https://daibieunhandan.vn/chu-tich-quoc-hoi-tran-thanh-man-tang-cuong-co-che-giam-sat-chong-lam-dung-chinh-sach-phuc-hoi-pha-san-10392554.html

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on railway projects](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761206277171_dsc-9703-jpg.webp)

![[Photo] President Luong Cuong holds talks with South African President Matamela Cyril Ramaphosa](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761221878741_ndo_br_1-8416-jpg.webp)

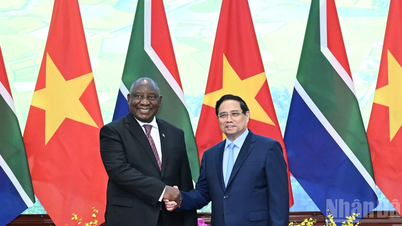

![[Photo] Prime Minister Pham Minh Chinh meets with South African President Matamela Cyril Ramaphosa](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761226081024_dsc-9845-jpg.webp)

Comment (0)