At the end of the session on October 15, VN-Index closed at 1,757 points, down 3 points (equivalent to 0.18%).

The morning trading session on October 15 opened with the VN-Index increasing points. However, immediately after that, this index fluctuated within a range of about 13 points.

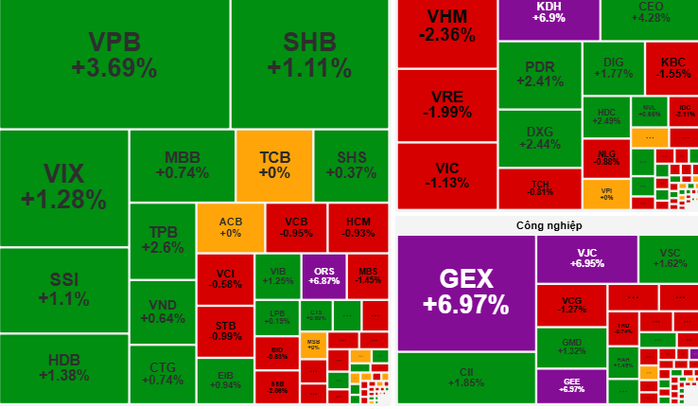

The highlight of the morning session belonged to banking stocks such as VPB, LPB, MBB and stocks in the GEX ecosystem (GEE, GEX), with good gains helping the VN-Index maintain its green color. However, due to increased profit-taking pressure towards the end of the morning session, the VN-Index fell slightly.

In the afternoon session, the market continued to fluctuate around the 1,760 point mark, with a clear tug-of-war. The Vingroup group, after a series of hot sessions, recorded an adjustment, creating pressure on the general index.

On the other hand, blue-chip stocks in the banking group, the GEX ecosystem, and VJC ( Vietjet ) played a supporting role, helping the VN-Index narrow its decline. In particular, the real estate group became the focus of attracting cash flow, with KDH and HDG increasing their ceiling prices, along with some other codes such as DIG and NVL having notable price increases.

At the end of the trading session, VN-Index closed at 1,757 points, down 3 points (equivalent to 0.18%).

According to VCBS Securities Company, VN-Index is in the stage of consolidating momentum around the 1,750-1,780 point range. The differentiation between blue-chip groups shows that the market is adjusting after the previous strong price increase.

VCBS recommends that investors consider taking short-term profits on stocks that have reached their targets or shown signs of reversal, while maintaining the proportion of stocks that are still on an uptrend.

Meanwhile, Dragon Viet Securities Company (VDSC) said that liquidity decreased on October 15, indicating a state of exploration between supply and demand. VDSC assessed this as a normal development, as the market needs time to attract more cash flow.

VDSC forecasts that in the coming sessions, VN-Index will continue to be supported at the 1,750 point zone and have a chance to recover to challenge the supply pressure at the 1,800 point resistance zone.

Both VCBS Securities and VDSC agreed that investors should take advantage of the correction to gradually increase the proportion of stocks, but should avoid chasing high prices. Stock groups that are attracting cash flow such as securities, banks, and real estate could be opportunities for exploratory disbursement.

Source: https://nld.com.vn/chung-khoan-ngay-16-10-co-phieu-ngan-hang-bat-dong-san-dan-dat-dong-tien-196251015170813122.htm

![[Photo] Nhan Dan Newspaper launches “Fatherland in the Heart: The Concert Film”](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/16/1760622132545_thiet-ke-chua-co-ten-36-png.webp)

![[Photo] General Secretary To Lam attends the 18th Hanoi Party Congress, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/16/1760581023342_cover-0367-jpg.webp)

Comment (0)