Feelings about money and how to spend it wisely can be challenging for children if they don't have a clear concept of money.

Knowledge about money and how to spend money will help children a lot in the future, so that they can manage their personal finances effectively. Parents should not underestimate the importance of teaching their children about money, how to spend, and how to save from a young age.

This knowledge will help children have a certain amount of understanding when entering adulthood, know how to spend consciously and gradually acquire important knowledge and skills that contribute to personal financial success. In fact, schools do not teach much about money, so parents need to proactively teach their children.

Knowledge and skills with money are what parents need to teach their children (Illustration: iStock).

Use real money to teach your child the early concepts of money.

Children often like to play shop games, parents can take advantage of this game and use real money to play with children. Buying and selling activities during the game will help children learn to get familiar with money in different denominations, how to give and take, exchange, and calculate surplus and deficit more quickly and flexibly.

When children have knowledge of math and numbers, that is the most appropriate time for parents to help them gain more knowledge about money, understand the value of bills and how to make payments in transactions.

When taking your child shopping, if he wants to buy something of small value, let him buy it with his own savings. This will help him form the concept of prices, how to spend money, and how to save money.

Let your children bring some of their savings to go shopping with you, this will help them understand the value of money and the prices of items more quickly. If you are not in a hurry, let your children make transactions at the checkout counter themselves, this will help them develop a stronger sense of responsibility in managing their own money.

Children need to get into the habit of saving money from a young age (Illustration: iStock).

Teaching children to make wise choices

Parents need to teach children how to think logically when acting, including logical thinking when making choices about what they want to buy. For example, when children buy toys, guide them to choose high-quality, durable toys. However, in the end, parents should respect their children's choices and let them buy what they want with their savings.

By spending their own money on things, children will gradually learn to "feel sorry" for spending money on low-quality items. Gradually, children will learn to consider and choose wisely when buying things.

Teach children how to save

For lucky money and pocket money that children receive from relatives, parents should teach their children how to save and manage this money together. This will be the first financial lesson for children. Help your children visualize the amount of money they will have if they save regularly until they are 18 years old.

If the amount of money grows and you feel uneasy about letting your child keep it, you can help your child deposit it in the bank and teach them the concept of interest. Parents should help their children understand the meaning of saving money. Children's enthusiasm for saving money and knowing how to spend wisely when buying things are the first important lessons about money that parents need to teach their children.

Source: https://dantri.com.vn/giao-duc/de-con-khong-danh-mat-khai-niem-ve-dong-tien-cha-me-can-lam-gi-20240916121949929.htm

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

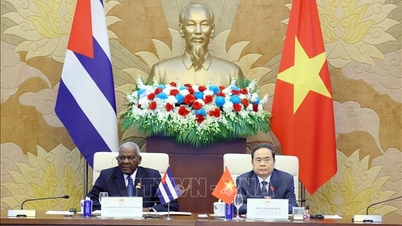

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)