Breakthrough business results

According to the recently released Third Quarter Financial Report, DNSE Securities achieved operating revenue of VND489.5 billion, total revenue of VND491.7 billion, 2.5 times higher than the same period last year. Pre-tax profit of VND171.1 billion, after-tax profit of nearly VND136.8 billion, 3 times higher than the same period last year.

In particular, benefiting from the strong upward trend of the market in this quarter, proprietary trading activities brought outstanding profits to DNSE. Profit from financial assets recorded through profit/loss (FVTPL) reached over VND 71 billion, an increase of more than 7 times compared to the same period.

Interest from loans and receivables reached 171.2 billion VND, nearly 2 times higher than the same period last year. Revenue from securities brokerage reached 156.2 billion VND, nearly 5 times higher than the same period.

Accumulated in the first 9 months of the year, DNSE's operating revenue reached over VND 1,023 billion, total revenue was nearly VND 1,030 billion, pre-tax profit was VND 328.6 billion, after-tax profit was VND 263.3 billion, all increased nearly 2 times compared to the same period last year.

DNSE's outstanding loans also reached a new record of VND5,750 billion, up 48% compared to the beginning of the year.

In terms of asset size, as of September 30, DNSE's total assets reached over VND 14,000 billion, an increase of 32% compared to the beginning of the year.

Maintain leading position in market share

According to Ms. Nguyen Ngoc Linh, General Director of DNSE, the vibrant market context this year creates a good opportunity for DNSE to promote its technology product ecosystem to attract customers and grow business. This is a period with record-breaking business results and market share in DNSE's development history.

Ms. Nguyen Ngoc Linh, General Director of DNSE.

In terms of market share of newly opened accounts, DNSE is maintaining a stable performance, always in the top of the leading companies. In the first 3 quarters of 2025, DNSE opened 361,000 new accounts, accounting for over 20% of the total newly opened accounts in the whole market. Currently, DNSE owns over 1.3 million securities accounts, accounting for 12% of the total number of accounts in the whole market.

According to a report from the Hanoi Stock Exchange (HNX), DNSE is in the top 6 in listed stock brokerage market share with 4.63% market share.

In the derivatives segment, DNSE continued to affirm its top 2 position and narrowed the gap with the top 1 position when reaching nearly 24% market share, an increase of more than 6% compared to the previous quarter, demonstrating the continuous prospect in the business segment considered the company's strength.

According to the company representative, the reason for DNSE's continuous growth in market share comes from a series of unique and superior digital securities product features, with many pioneering trading support tools on the market.

Among them, DNSE's management and lending system for each transaction (Margin Deal) is an exclusive product with outstanding advantages, allowing customers to trade and buy and sell each order with loan packages with different interest rates and ratios, thereby optimizing investment strategies.

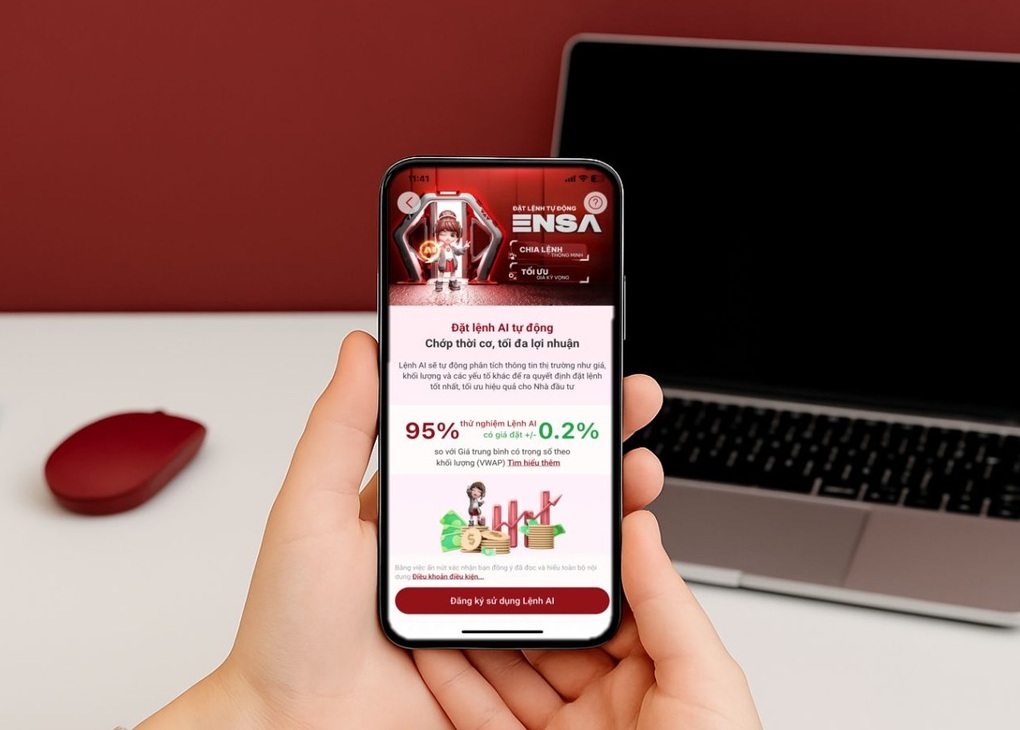

DNSE also focuses on combining human capacity with AI technology to bring investors immediate values, from suggesting ideas, specific action plans, flexible according to market fluctuations, to the AI Order tool that helps split orders to optimize matching prices.

AI command is one of the outstanding artificial intelligence application features of DNSE.

Developing a trading software with a stable and secure technology infrastructure has been identified as the focus of investment in the past 3 years of DNSE, aiming to bring about outstanding speed in price and order processing. This is the key factor that helps DNSE gain more market share from active investors and high-frequency trading in recent times.

By the end of the third quarter, the number of DNSE accounts with NAV (asset value) over VND 1 billion had increased by 50% compared to the end of 2024.

In preparation for business expansion and anticipation of the upcoming market boom, DNSE has carried out many strong capital raising activities. Currently, from October 6 to October 27, DNSE is offering 10 million bonds, expecting to raise VND1,000 billion to supplement capital for pre-sale and margin trading activities.

DSE125018 bonds have an interest rate of 8.3%/year for the first two interest periods, the remaining periods have a floating interest rate, calculated by the sum of 3.5%/year and the average of the reference interest rate. DNSE pays interest every 6 months, ensuring a stable cash flow for investors.

“Careful preparation of capital resources as well as product systems will be the premise for DNSE to seize opportunities and continue to break through, when the Vietnamese market is facing many great prospects in the future, with foreign capital expected to flow in after FTSE Russell officially upgrades the Vietnamese stock market,” Ms. Nguyen Ngoc Linh shared.

Source: https://dantri.com.vn/kinh-doanh/dnse-cong-bo-hoan-thanh-vuot-muc-muc-tieu-loi-nhuan-ca-nam-2025-sau-3-quy-20251015180049071.htm

![[Photo] General Secretary To Lam attends the 18th Hanoi Party Congress, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/16/1760581023342_cover-0367-jpg.webp)

![[Photo] Nhan Dan Newspaper launches “Fatherland in the Heart: The Concert Film”](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/16/1760622132545_thiet-ke-chua-co-ten-36-png.webp)

![[Video] TripAdvisor honors many famous attractions of Ninh Binh](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/16/1760574721908_vinh-danh-ninh-binh-7368-jpg.webp)

![[Photo] Nhan Dan Newspaper launches “Fatherland in the Heart: The Concert Film”](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/16/1760622132545_thiet-ke-chua-co-ten-36-png.webp)

Comment (0)