The US Federal Reserve (Fed) kept its benchmark interest rate unchanged for the second consecutive time at its highest level in 22 years.

On November 1, as expected by the market, the Fed decided not to raise interest rates after a two-day policy meeting. The benchmark interest rate in the US is currently around 5.25-5.5% - the highest in 22 years. In September, the agency also did not raise interest rates.

In a statement after yesterday's meeting, the Fed said that " economic activity grew at a solid pace in the third quarter." Despite the Fed raising interest rates 11 times since March 2022 to curb inflation, the US economy has not yet entered a recession. Not only that, GDP increased by 4.9% in the third quarter, mainly thanks to vibrant consumption.

This is one of the reasons why US government bond yields have increased recently, approaching the 5% mark. In a press conference after the meeting, Fed Chairman Jerome Powell said they will closely monitor this development, as it "could impact future interest rate decisions".

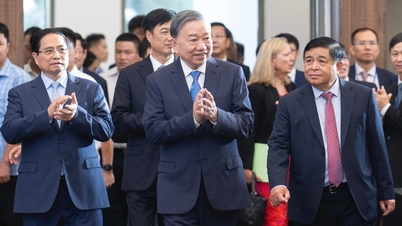

Fed Chairman Jerome Powell at a press conference on November 1. Photo: Reuters

While inflation has eased significantly from a 40-year high last summer, it remains above the Fed’s 2% target. A buoyant economy will make the Fed’s fight against inflation more difficult.

However, some Fed officials predict a slowdown in US growth as the impact of the rate hikes becomes more apparent. The strong growth seen in the third quarter is unlikely to be sustained. In the five years before the pandemic, the US grew an average of just 2.6%, according to the US Department of Commerce.

Powell said they can only “fully restore price stability” if growth slows and the job market weakens. It’s unclear whether inflation can slow without those two numbers cooling. Fed officials still expect a soft landing – one that keeps inflation in check without causing unemployment to rise sharply.

Economists also expect U.S. growth to lose momentum due to pressure from rising yields, student loan repayments, depleting pandemic savings and other hurdles Americans face. "We expect a weaker labor market, as companies freeze hiring and even reduce staff amid slowing wage growth," said Lydia Boussour, an economist at EY-Parthenon.

Major US stock indexes jumped after the Fed's decision not to raise interest rates. At the end of the session on November 1, the S&P 500 increased by 1%, the DJIA increased by 0.67% and the Nasdaq Composite increased by 1.6%.

The market now expects the Fed to finish raising interest rates and start cutting them by the middle of next year. This year, the agency has one more policy meeting in December.

Ha Thu (according to CNN)

Source link

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Megastory] A term of creation: An Giang rises from historical imprints](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/1/2660ab96e53f4270bcc37f8d39c36c78)

Comment (0)