Fed Chairman Powell is under great pressure from President Trump to cut interest rates - Photo: AFP

In a meeting room in Washington on September 17, US Federal Reserve (Fed) Chairman Jerome Powell and the Federal Open Market Committee (FOMC) made a remarkable decision: cutting the US benchmark interest rate for the first time since December 2024.

The Fed's move is aimed at dealing with the weakening labor market and the risk of economic recession in the US.

The Paradox of the Poor

After months of intense pressure from President Donald Trump and facing alarming signs of a weakening labor market, the Fed finally acted by cutting interest rates by 0.25 percentage points, bringing interest rates to a range of 4 - 4.25%, according to the Financial Times .

The decision not only reflects ongoing economic challenges but also signals a significant shift in US monetary policy, with the Fed forecasting two more cuts before the end of 2025.

The Fed's decision to cut interest rates comes amid alarming signs about the US labor market. The unemployment rate rose to 4.3% in August, the highest since October 2021, according to CNBC. The number of new jobs in the past three months has increased by an average of only 29,000 per month, down sharply from the previous 96,000 jobs/month, according to the Wall Street Journal (WSJ).

The US Bureau of Labor Statistics revised down its figures, showing that the economy created 911,000 fewer jobs over the past 12 months than initially reported. Chairman Powell commented on CNBC: "It is unusual for labor supply and demand to decline sharply at the same time, given the lack of dynamism and weakness in the labor market."

The Fed's decision to cut interest rates not only has domestic impacts, but also creates strong ripple effects on global financial markets.

In the short term, the rate cut will benefit American consumers immediately. According to the WSJ , the move "will bring immediate relief to people with credit card debt and small businesses with floating-rate loans."

"This initial rate cut will help ease the burden on small businesses that are struggling with macroeconomic challenges and high borrowing costs," Chris Ward, head of US small business banking at TD Bank in Charlotte, North Carolina, told WSJ .

For the real estate market, positive signs appeared even before the Fed's official decision. According to Money magazine, due to falling mortgage rates, homebuyers "added more than $22,000 to their home-buying budgets over the summer."

This interest rate adjustment also creates the so-called "poor man's paradox in monetary policy". The Fed cuts interest rates to stimulate employment, but low-income people will suffer a double impact: high inflation due to tariffs pushing up prices of essential goods (food, clothing) and lower savings interest rates, causing them to lose money, while the middle class and the rich benefit from cheap loans to invest in real estate and stocks.

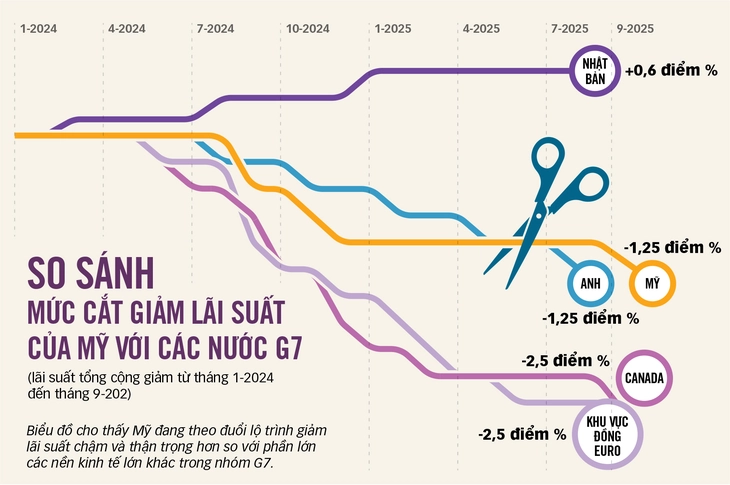

Image source: Visualcapitalist.com - Data: DO QUANG - Graphics: TAN DAT

The Split Expert

Financial experts are divided on the effectiveness of the Fed's rate cuts. Michael Rosen of Angeles Investments in Santa Monica, California, warned Reuters that "Powell has somewhat tempered the initial market enthusiasm for the prospect of more aggressive monetary easing."

Expert Michael also commented that the US economy is going through "a period of mild stagflation, with slowing growth due to the impact of tight trade and immigration policies, and persistent inflation around 3%".

In contrast, Mr. Simon Dangoor, Head of Fixed Income Macro Strategy at Goldman Sachs Asset Management (GSAM) - the asset management division of Goldman Sachs Group, was more optimistic.

"A majority of FOMC members are now looking at two more rate cuts this year, which suggests that the dovish advocates on the committee are in control," said Mr. Simon.

The Fed faces a dilemma: if it cuts rates too quickly, the risk of a resurgence of inflation increases; but if it acts too slowly, the economy could fall into recession. As Donald Kohn, former Fed vice chairman during the 2008 financial crisis, puts it: "Even putting politics aside, this is a difficult and very complicated situation."

Political infighting at the Fed

Political tensions have crept into the Fed at an unprecedented level. Stephen Miran, Trump's economic adviser, who was confirmed by the Senate and sworn in just before the meeting, was the only member to oppose the decision to cut by 0.25 points, instead supporting a more drastic reduction of 0.5 points, according to CNBC.

What is unusual is that Mr. Miran is only taking unpaid leave, not officially leaving his position as Chairman of the White House Council of Economic Advisers. The incident has raised concerns about an unprecedented conflict of interest. According to the WSJ , Mr. Miran "may return when his Fed term expires early next year."

For the first time in history, the Fed had to make an important decision when a member (Mr. Miran) was both a White House adviser and a member of the Fed board. This not only violated the independence principle but also set a dangerous precedent: future presidents could appoint "inside spies" to directly influence monetary policy.

Meanwhile, President Trump sought to fire Governor Lisa Cook over allegations of mortgage fraud involving federally guaranteed loans, but the Court of Appeals blocked the move and allowed her to continue attending meetings.

Does Fed's interest rate cut affect VND/USD exchange rate?

Speaking with Tuoi Tre , Ms. Tran Thi Khanh Hien, Research Director of MB Securities (MBS), said that the Fed slightly reduced interest rates by 0.25 percentage points as predicted by the market, so the USD Index remained almost unchanged.

Currently, the USD interest rate is 4 - 4.25%, still significantly different from the VND interbank interest rate (the reference overnight interest rate on September 15 was 4.54%, according to the State Bank). To control the devaluation of VND, the VND interest rate needs to be raised, for example from 4.5% or more.

However, according to Ms. Hien, increasing interbank interest rates immediately creates reverse pressure on interest rates in the deposit market, while we want to maintain a low level to support the economy.

Therefore, the current concern is the Fed's next roadmap, with the possibility of two more interest rate cuts this year. If the Fed cuts another 0.5 percentage points in the fourth quarter of 2025, bringing the total reduction for the year to 0.75 percentage points, the VND - USD interest rate gap will narrow, creating conditions for the State Bank to maintain low interest rates, according to Ms. Hien.

Mr. Nguyen Hoang Tuan Minh - senior economist of Vietcombank Securities (VCBS) - said that with the Fed's interest rate cut, investment cash flow can gradually shift to countries with positive growth potential and ensuring macroeconomic stability. In particular, Vietnam will be an ideal destination for investment capital and production and business activities in the future.

Meanwhile, according to Mr. Le Van Thanh - financial consultant at Wigroup Data Company, the main reason for VND devaluation from 2022 to now, especially during the periods when the Fed continuously raised interest rates, is not simply the interest rate difference in the interbank market (market 2), but mainly comes from market 1 (residential and corporate deposits).

"While USD deposit interest rates in Vietnam are almost 0%, in the US, short-term deposit interest rates are closely following the operating interest rate. This huge difference is the main factor putting pressure on the exchange rate," Mr. Thanh analyzed.

Mr. Thanh added that in addition to interest rate factors, exchange rate fluctuations are also strongly influenced by foreign currency supply and demand. For example, since the beginning of the year, foreign investors have net sold about 3.5 billion USD on the Vietnamese stock market, contributing to increasing the pressure on VND depreciation.

Regarding the outlook for the coming months, Mr. Thanh said that if the Fed continues to lower interest rates two more times from now until the end of the year, while Vietnam keeps it the same, the impact on cash flow will still be limited.

"The difference in USD deposit interest rates between Vietnam and the US is still very high. Therefore, whether foreign currency comes from exports or FDI, part of the cash flow will still flow out. This is a structural pressure that cannot be resolved by just a few interest rate cuts by the Fed," he said.

Source: https://tuoitre.vn/fed-cat-giam-lai-suat-lan-dau-sau-gan-mot-nam-ai-huong-loi-ai-chiu-thiet-20250920075649283.htm

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)