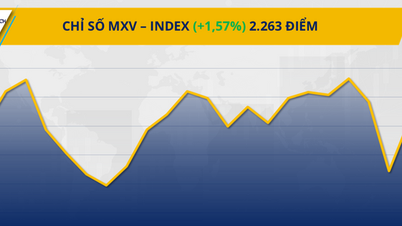

The Vietnam Commodity Exchange (MXV) said that selling pressure dominated the commodity market, pushing the MXV-Index down nearly 0.6% to 2,250 points.

The energy market is "red" with all 5 commodities falling in price. Source: MXV

According to MXV, all five energy commodities have weakened. Of which, the prices of two crude oil commodities have returned to their lowest price levels since the beginning of May.

Specifically, Brent oil price fell to 62.39 USD/barrel, equivalent to a decrease of about 1.47%; while WTI oil price also decreased by 1.33%, stopping at 58.7 USD/barrel.

Oil prices fell again as the market continued to receive warnings about the risk of global oversupply in the coming time.

The International Energy Agency (IEA) October Oil Market Report forecasts global output to rise by 3 million barrels per day to 106.1 million barrels per day this year and continue to rise by 2.4 million barrels per day in 2026.

Meanwhile, the IEA's global oil demand growth forecast is only 700,000 barrels per day for both 2025 and 2026, thereby reinforcing the prospect of oversupply in the market.

Besides, investors continued to express concerns about the prospect of global energy demand amid escalating global trade tensions.

Selling pressure dominates the metal commodity market. Source: MXV

The metal group continued to face strong selling pressure when 9/10 items simultaneously decreased in price, in which iron ore price suddenly reversed and decreased by 2.4% to 105.17 USD/ton, ending a series of 4 consecutive increasing sessions.

While hopes of a recovery in Chinese demand have helped iron ore prices hit new highs, reactions to political and trade risks have also caused strong selling pressure.

Source: https://hanoimoi.vn/gia-quang-sat-giam-dau-tho-ve-day-5-thang-719668.html

![[Photo] Ready for the 2025 Fall Fair](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/14/1760456672454_ndo_br_chi-9796-jpg.webp)

![[Photo] General Secretary To Lam chairs the meeting of the Central Steering Committee on science, technology development, innovation and digital transformation](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/15/1760500443782_anh-man-hinh-2025-10-15-luc-10-52-47.png)

Comment (0)