Supply pressure causes oil prices to plummet

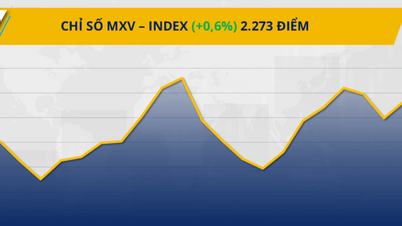

According to the Vietnam Commodity Exchange (MXV), the global commodity market slowed down after a series of 5 positive sessions, in which energy led the decline.

Energy markets were in the red as most major commodities fell sharply. WTI crude oil prices fell nearly 3.5% to $63.4 a barrel, while Brent crude also fell more than 3% to $67.9 a barrel. Positive signs about supply emerged last weekend, halting a four-session winning streak.

On September 30, the energy group witnessed overwhelming selling pressure on most of the key commodities in the group. The prices of both crude oil products fell to their lowest levels in the past 3 weeks. Specifically, Brent oil price stopped at 67.02 USD/barrel, corresponding to a decrease of about 1.4%; meanwhile, WTI oil price also recorded a decrease of about 1.7%, falling to 62.37 USD/barrel.

According to MXV, behind the weakening oil price momentum is a combination of many resistances, which are expectations of OPEC+ production expansion, the return of Iraqi supply, US crude oil production setting a new record and more signals of prolonged oversupply.

The market’s focus is on OPEC+’s November production decision. Although the group has dismissed rumors of a 500,000 bpd increase, the possibility of raising the quota in the range of 137,000-400,000 bpd remains. With pressure from the US growing and the group keen to maintain global market share, a move to “open the valve” is almost inevitable.

At the same time, Iraq has just resumed oil exports from the northern region, adding 150,000-160,000 barrels/day to the market, with the potential to reach a maximum of 230,000 barrels/day.

The ominous coincidence is that non-OPEC supplies are also expanding. Data from the US Energy Information Administration (EIA) shows that US crude oil production in July reached 13.64 million barrels per day, setting a new record and surpassing June's level. Reports from the IEA and TotalEnergies have both forecast that the supply surplus could last through 2025-2026. The overall message is that supply is growing faster than any signs of recovering demand.

Oil prices continue to decline

On October 1, world crude oil prices continued to decline for the third consecutive session. Specifically, Brent oil prices fell to the lowest level since early June, 65.35 USD/barrel, equivalent to a decrease of about 1.03%; while WTI oil prices also closed the session with a decrease of 0.95%, stopping at 61.78 USD/barrel - the lowest level since late May.

Not stopping there, on October 2, crude oil prices continued to extend the series of 4 consecutive sessions of decline. Of which, Brent crude oil prices lost nearly 1.9%, down to 64.11 USD/barrel, the lowest level since the end of May; WTI crude oil fell more sharply, up to 2.1%, closing at 60.48 USD/barrel, the lowest level in 5 months.

According to analysis by the largest investment bank in the US - JPMorgan Chase, the combination of increased supply, global refining slowdown due to maintenance, and consumption entering a low period, will increase inventories and continue to weigh on prices.

The latest weekly report from the US Energy Information Administration (EIA) has further reinforced the downward momentum in oil prices as the market is facing the prospect of a global supply glut.

Specifically, US commercial crude oil reserves in the week ending September 26 increased by nearly 1.8 million barrels, exceeding forecasts (an increase of about 1-1.5 million barrels), and completely opposite to the forecast of a decrease of 3.67 million barrels by the American Petroleum Institute (API).

The decline in oil prices also stemmed from demand factors when the US Institute for Supply Management (ISM) announced the PMI indexes for September were not optimistic. Many indexes recorded a decrease compared to the previous month, in which the manufacturing PMI index continued to remain below the threshold of 50 points, signaling a contraction in this sector.

Along with that, the ADP employment report said that the US lost about 32,000 non-farm jobs in September, increasing investors' concerns about the health of the world's largest economy and accompanying energy demand.

This morning (October 4), oil prices turned slightly up, with Brent oil prices increasing by 0.7% to 64.53 USD/barrel and WTI oil prices increasing by 0.7% to 60.88 USD/barrel. However, for the whole week, the prices of the two oil products still decreased by 7% to 8%.

Source: https://hanoimoi.vn/tuan-lao-doc-manh-cua-gia-dau-tho-718424.html

![[Photo] Solemn opening of the 8th Congress of the Central Public Security Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/f3b00fb779f44979809441a4dac5c7df)

![[Photo] General Secretary To Lam attends the 8th Congress of the Central Public Security Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/79fadf490f674dc483794f2d955f6045)

![[Photo] Bustling Mid-Autumn Festival at the Museum of Ethnology](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/da8d5927734d4ca58e3eced14bc435a3)

![[VIDEO] Summary of Petrovietnam's 50th Anniversary Ceremony](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/4/abe133bdb8114793a16d4fe3e5bd0f12)

![[VIDEO] GENERAL SECRETARY TO LAM AWARDS PETROVIETNAM 8 GOLDEN WORDS: "PIONEER - EXCELLENT - SUSTAINABLE - GLOBAL"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/23/c2fdb48863e846cfa9fb8e6ea9cf44e7)

Comment (0)