"Blackmailing" Tesla shareholders

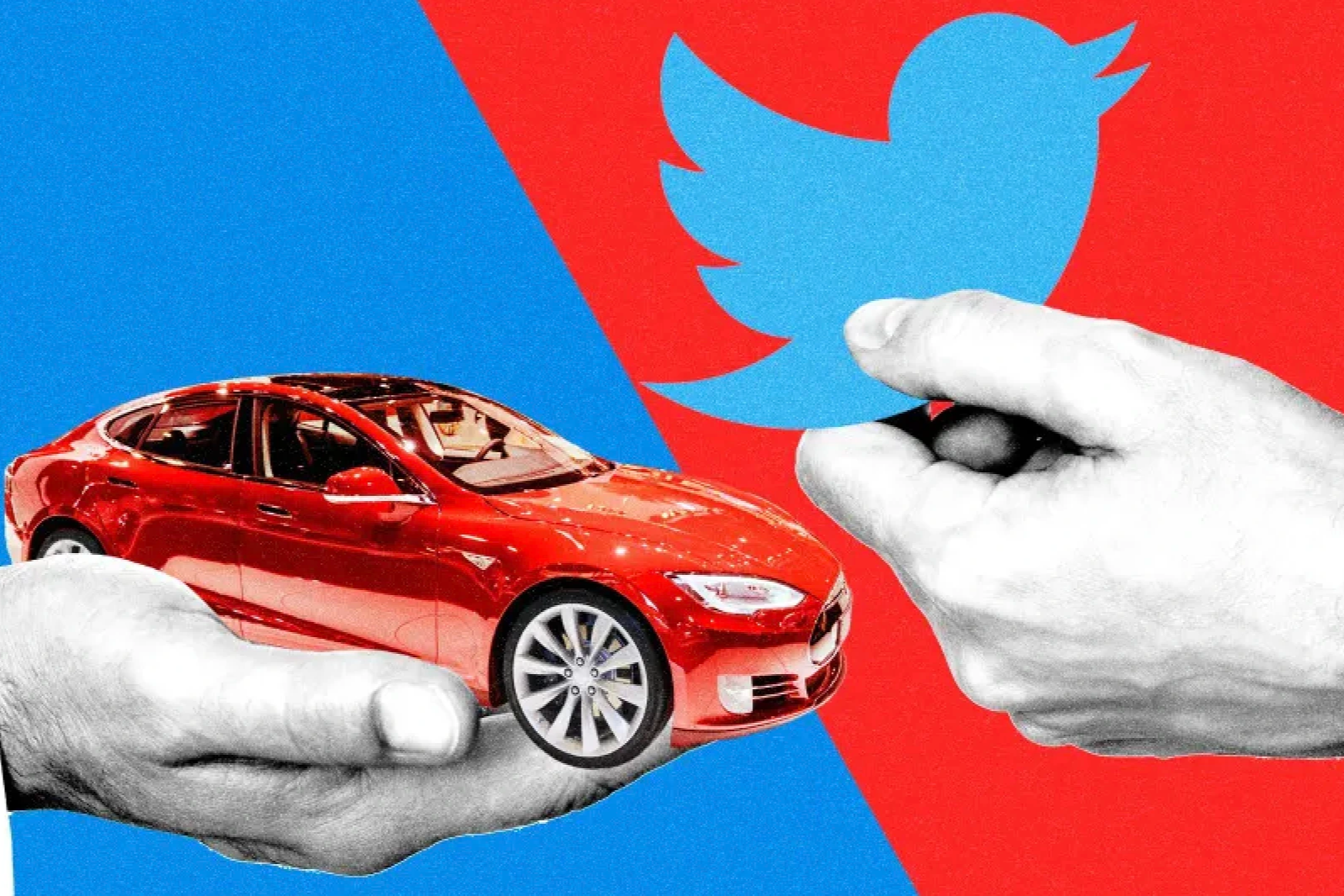

According to Fortune , Elon Musk's control of Tesla has significantly decreased when this billionaire pledged shares to the bank to get money to buy Twitter. This $43 billion deal is considered a misstep of the Tesla boss when the total value of this social network is now estimated to be only $22 billion.

Worse, neglecting Tesla and waging a price war has eroded the company's profits and allowed its Chinese rival BYD to overtake it.

In addition, the slowing demand of the electric vehicle market has made many shareholders worried, leading to the story of information leaked to the Wall Street Journal about Elon Musk's drug use as well as doubts about the founder's leadership ability.

Not only that, Elon Musk recently "blackmailed" Tesla shareholders by threatening to switch to making electric cars at another company if he is not given more voting rights.

Elon Musk, CEO of Tesla, said he was not comfortable running the electric car company without at least 25% of the voting rights, double the current level.

Elon Musk's control of Tesla has significantly decreased when the billionaire pledged shares to the bank to get money to buy Twitter (Photo: Forbes).

According to Tesla's financial report, in the third quarter of last year, Musk owned 13% of the electric car company's shares. This amount of shares is considered relatively large, after he sold tens of billions of dollars of Tesla shares in 2022 to buy Twitter (now X).

However, Musk still wants more power at Tesla. "I cannot comfortably lead Tesla to become the leader in artificial intelligence (AI) and robotics without 25% of the voting rights. I am currently only influential, not invincible," billionaire Elon Musk posted on social network X.

Musk has said that if he can’t do that, he’d rather create those products outside Tesla. Musk has long touted Tesla’s fully autonomous software and humanoid robots, predicting that the humanoid robot Optimus will be more valuable than self-driving cars and software.

The throne is gradually shaking

Now, when this social network X is still a black hole sucking money without generating any profit, and is even getting worse because companies are withdrawing advertising, Elon Musk is also having trouble with his influence at Tesla.

Many Tesla shareholders have filed a lawsuit in court because the company's board of directors did not intervene in time to allow Elon Musk to freely use his shares for other projects, thereby negatively affecting Tesla's reputation and stock price.

It was Elon Musk's fear of being usurped that caused the billionaire to put pressure on Tesla's board of directors.

Ironically, the world’s richest man’s consolidation of power is not auspicious. According to Fortune, Tesla is off to its worst start to 2024 in the company’s history, losing $94 billion in market value and shrinking profit margins.

Elon Musk has been in trouble lately (Photo: Daily Mail).

Tesla has seen its market capitalization fall this much since going public in 2010. The company’s stock price has fallen nearly 15% year-to-date, its worst performance since 2016.

With a total market capitalization of 675.42 billion USD, Tesla is far behind its peak of 1,200 billion USD before Elon Musk bought Twitter.

Meanwhile, the price war is eating away at Tesla’s profits. The gross profit margin of Elon Musk’s empire, excluding government tax subsidies, was just 16.3% in the third quarter of last year, down from 27.9% in the same period in 2022. Not only that, but workers in the US auto industry are on strike to demand higher wages.

“We are going through a cyclical downturn with electric vehicles, and the current price war and competition in the market is only exacerbating these cyclical pressures,” Ivana Delevska, director of investment firm Spear Invest, told Fortune .

Partners lose confidence

Experts also believe that 2024 is a rather dark start for Tesla as the company's strategy of lowering prices to gain market share in 2023 fails to stimulate consumer demand as expected.

Although electric vehicle sales in the US are still growing, they have slowed significantly and are lower than expected compared to government support.

Car rental company Hertz announced that it would sell 20,000 electric cars to switch to gasoline cars, and at the same time, it left open a contract to buy 100,000 electric cars from Tesla, making the situation worse.

"Investors are worried about Tesla's growth slowing down," warned analyst Jeffrey Osborne of investment bank Cowen.

Car rental company Hertz, which has invested heavily in electric vehicles in recent years, has decided to downsize its fleet. Teslas account for about 80% of Hertz’s electric fleet . The company said it would sell a third of its electric vehicles, or about 20,000, and use the money to buy more gas-powered vehicles instead.

Tesla's partners also lost confidence in Elon Musk (Photo: Reddit).

According to Hertz's management, electric vehicles are harmful to the company's financial situation because they often have high repair costs and large depreciation.

"Collision and damage repair costs on an electric vehicle are typically double that of a comparable internal combustion engine vehicle," said Hertz CEO Stephen Scherr.

At the same time, the recent sharp decline in electric car prices in the new car market has also somewhat affected the value of the company's used electric rental cars, leading to a decrease in the amount of money earned when reselling them.

"The wave of retail price cuts in 2023 led by Tesla has caused our EV values to be lower than last year, so vehicle disposals create a larger loss and a greater burden," Hertz CEO shared with CNBC .

Tesla has recently started a price war, leading other automakers to follow suit. When automakers cut prices on new cars, it causes the value of those models on the used car market to drop, leading to rapid depreciation.

In addition, Teslas do not have as many spare parts and trained mechanics as other automakers, making repairs more expensive and time-consuming. In addition to being more expensive to repair when damaged, the company also revealed that electric cars are more likely to be involved in accidents.

The legend of the past gradually collapsed

Recently, Elon Musk was also suspected of using drugs, causing confusion among investors and the boards of directors of the companies he runs.

Billionaire Elon Musk has used LSD, cocaine, ecstasy and hallucinogenic mushrooms, often at private parties around the world where attendees sign non-disclosure agreements or must leave their phones outside, according to WSJ sources.

Musk has previously smoked marijuana in public and said he has a prescription for the hallucinogen ketamine. In 2018, he used the drug at a party he hosted in Los Angeles. The following year, Musk partied with magic mushrooms at an event in Mexico.

In 2021, he used ketamine recreationally with his brother, Kimbal Musk, in Miami at a house party during Art Basel. Musk also used illegal drugs with former Tesla board member Steve Jurvetson.

Meanwhile, billionaire Musk has denied drug use, claiming that not even traces of drugs or alcohol were found in his body after three years of random drug testing, according to Forbes .

Rumors of Musk using banned substances were the last straw that made many shareholders lose confidence in this billionaire (Photo: Los Angeles Times).

According to Fortune , billionaire Elon Musk often boasts that Tesla is leading in the field of AI and robotics with its self-driving electric car products. However, the safety of this self-driving mode is being questioned by US officials due to its involvement in too many accidents.

Even Tesla's promised Cybertruck electric pickup truck, although it has begun deliveries, is considered difficult to increase production due to technological problems.

Meanwhile, Tesla itself had to admit the possibility of a decline in demand for electric vehicles in its third-quarter financial report last year. Since then, a series of global automakers have changed their previously optimistic forecasts about the market, while many have canceled their plans to expand their electric vehicle production.

By the fourth quarter of last year, although Tesla's business results were better than previously forecast, their sales were lower than BYD, their main competitor from China.

Tesla is sold in China, but BYD is not sold in the US. Therefore, the growth potential of the Asian electric car company is much larger than that of Elon Musk's empire.

Fortune believes that investors are gradually losing faith in Elon Musk by early 2024 when they realize that Tesla is just a young electric car company that can fail compared to many other long-standing automakers.

In 2023, Tesla's stock was the 8th best performing stock on the S&P 500. But earlier this year, Tesla's stock was one of the biggest losers.

Source

![[Photo] Collecting waste, sowing green seeds](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/18/1760786475497_ndo_br_1-jpg.webp)

![[Photo] Closing ceremony of the 18th Congress of Hanoi Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/17/1760704850107_ndo_br_1-jpg.webp)

![[Photo] General Secretary To Lam attends the 95th Anniversary of the Party Central Office's Traditional Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/18/1760784671836_a1-bnd-4476-1940-jpg.webp)

Comment (0)