According to data from the State Bank of Vietnam (SBV), the average interbank interest rate in VND for overnight term on December 25, 2023 increased from 0.25%/year to 0.74%/year compared to the end of last week.

Other interest rates also showed signs of increasing. Specifically, the short term of 1 week increased by 1.2% compared to the end of last week, to 1.76%; the 2-week term increased by 0.57% to 1.74%; the 1-month term increased by 0.1% to 1.57%.

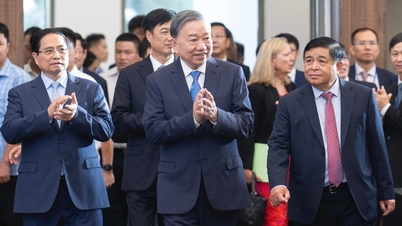

Overnight interbank interest rates suddenly increased (Photo TL)

In contrast, the 3-month and 9-month interest rates decreased to 3.29% and 6.04%, respectively. The 6-month interest rate increased slightly from 4.86% to 5.08%.

Interbank interest rates have been continuously increasing in recent trading sessions. There was a time when interbank interest rates remained at a level lower than 0.2% when the State Bank stopped issuing treasury bills.

The fluctuations of overnight interbank interest rates are relatively consistent with the predictions of many experts for the banking industry. Interest rates may increase slightly because it is the end of the year, but a liquidity shortage is unlikely to occur. This is clearly shown when many commercial banks continue to tend to reduce deposit interest rates.

Since the beginning of 2023, the average deposit interest rate has decreased by 2.5% - 3.0%. The excess liquidity in the system is assessed by many experts as the economy 's credit absorption capacity is still low. Accordingly, by the end of November, the credit growth of the entire system only reached 9.15%, much lower than the expectation of 14% set by the State Bank.

Source

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Megastory] A term of creation: An Giang rises from historical imprints](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/1/2660ab96e53f4270bcc37f8d39c36c78)

Comment (0)