In previous Financial Street programs, we have reported on the reform efforts, as well as the prospects for upgrading the Vietnamese stock market. And in the latest assessment period, the market rating organization FTSE Russell has officially upgraded the Vietnamese stock market from Frontier market to Secondary Emerging market. The upgrade is one of the important milestones in the development journey of the Vietnamese stock market over the past 25 years, creating great opportunities for Vietnam to attract foreign capital resources and increasingly integrate deeply into the international financial system. And this is considered just a new beginning, in the long term it will promote the construction of a transparent, modern and developed capital market, becoming a medium and effective capital mobilization channel for the economy , helping to achieve national financial autonomy and enhance its position in international integration.

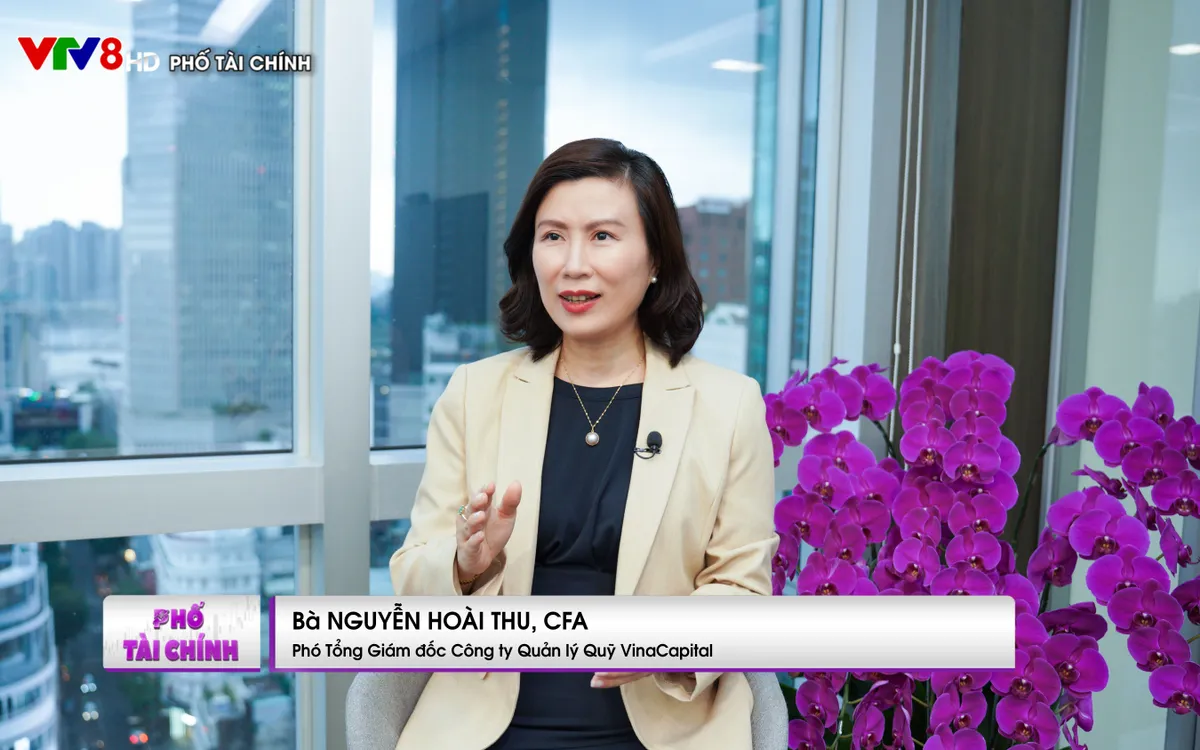

Discussing this issue in the Talk show The Finance Street on VTV8, Ms. Nguyen Hoai Thu, CFA, Deputy General Director of VinaCapital Fund Management Company , one of the leading prestigious investment groups in Vietnam, as well as having made many contributions to the capital market and stock market of Vietnam in the past two decades, Evaluate, Upgrading Vietnam's stock market is of great significance to the country's economic development. Upgrading helps attract foreign indirect investment from active funds and index funds, providing resources for businesses to expand production, improve competitiveness and international position.

Editor Khanh Ly: As you have seen, the Vietnamese stock market is experiencing an unprecedented growth period in both points and liquidity in the context of a strong economic growth. What is your assessment of this?

Ms. Nguyen Hoai Thu, CFA, Deputy General Director of VinaCapital Fund Management Company: This is a positive result, reflecting the efforts and drastic actions of the Government, the Ministry of Finance , the State Securities Commission and relevant agencies in developing the Vietnamese capital market to be increasingly sustainable and transparent. The upgrading of technology infrastructure to KRX, the issuance of Decree 245/2025/ND-CP (amending and supplementing Decree 115 guiding the Securities Law) and Decision 2014/QD-TTg approving the Project to Upgrade the Vietnamese Stock Market are evidence that Vietnam has been focusing on synchronously implementing many solutions to develop the stock market, creating more favorable conditions for domestic and foreign investors to participate in the market.

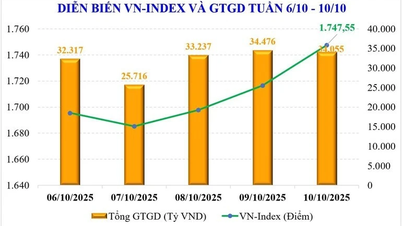

In fact, the Vietnamese stock market has been growing steadily over the past 25 years. Vietnam's performance has also been better than many other Asian stock markets in recent decades. In addition, the liquidity of the Vietnamese stock market is currently leading ASEAN with an average daily trading value of over 1 billion USD and the FTSE's upgrade of Vietnam to a secondary emerging market is an important historical milestone in this development process.

Editor Khanh Ly: After many efforts, the Vietnamese stock market has been upgraded to a secondary emerging market by FTSE. As a long-time expert in the industry who has also followed many upgrading events of other countries, how important do you think the upgrading event is to a market?

Ms. Nguyen Hoai Thu, CFA, Deputy General Director of VinaCapital Fund Management Company: Upgrading the Vietnamese stock market is of great significance to the country's economic development. Upgrading helps attract foreign indirect investment from active funds and index funds, providing resources for businesses to expand production, improve competitiveness and international position. Institutional investors not only provide capital but also act as strategic partners, promote transparent governance, improve operational efficiency, and maintain shareholder confidence.

In addition, upgrading helps increase the depth of the stock market, overcoming the current situation where individual investors account for 90% of transactions. The participation of institutional investors, with stable capital flows, will contribute to reducing market fluctuations, improving sustainability and transaction quality. Their methodical investment approach and long-term analysis spreads fundamental investment thinking, which is very necessary for the current Vietnamese market. This helps the stock market develop stably, supports businesses in realizing their long-term goals, and at the same time enhances Vietnam's international financial reputation.

Ms. Nguyen Hoai Thu talks with Editor Khanh Ly at Financial Street.

Editor Khanh Ly: So, in order for the capital market to develop sustainably and attract more domestic and foreign investors, what does Vietnam need to do to continue improving the market in the future, after being upgraded?

Ms. Nguyen Hoai Thu, CFA, Deputy General Director of VinaCapital Fund Management Company: In my opinion, for the Vietnamese stock market to develop strongly and sustainably, four main issues need to be solved.

First, improve the quality of “goods” in the market. Currently, the capitalization structure is unbalanced, with 60% concentrated in banking and real estate. The rate of freely circulating shares in many large enterprises, especially state-owned enterprises, is still low. It is necessary to promote the equitization of state-owned enterprises and encourage IPOs of private enterprises in the technology, consumer, healthcare , and industrial sectors to diversify investment opportunities. Listed enterprises must apply international standards on governance, information transparency, and switch to financial reporting according to IFRS to approach global standards.

Second, strengthen supervision of law compliance and strictly handle acts of stock price manipulation to strengthen the confidence of domestic and foreign investors.

Third, after the FTSE Russell upgrade, Vietnam’s stock market needs to aim for an upgrade by MSCI. This requires loosening foreign ownership limits in sectors that do not require restrictions, and implementing a central counterparty (CCP) mechanism, replacing the temporary 100% margin solution, to attract long-term institutional capital flows.

Fourth, maintaining macroeconomic stability – a factor that Vietnam has done well and is highly appreciated by international investors. Continuing to maintain this foundation is necessary to ensure sustainable development of the stock market, support businesses to realize long-term goals, and improve international financial position.

Editor Khanh Ly: As you just shared, the capital market is not only a tool to support growth, but also a pillar in realizing long-term and sustainable goals, requiring capital and the support of investment funds. So how do you assess the current development stage of investors in Vietnam?

Ms. Nguyen Hoai Thu, CFA, Deputy General Director of VinaCapital Fund Management Company: Vietnam's capital market plays an important role in supporting economic growth and realizing the goal of long-term, sustainable development for businesses. However, the scale of investors in Vietnam is currently in the early stages of development, especially when considering the participation of institutional investors and professionalism.

Currently, individual investors account for up to 90% of daily trading value, with an average account of only a few hundred million VND, and lack of resources to allocate capital effectively (knowledge, experience, time, etc.). Compared to stock markets like Thailand (individual investors account for ~40%), Vietnam still depends heavily on small, unprofessional investors. This shows that the market has not yet reached the mature stage, where institutional investors play a leading role.

The investment fund industry, an important pillar, has total assets under management of only about 6% of GDP, much lower than other countries in the region. The number of people investing in fund certificates is less than 0.5% of the population, compared to 20-50% in other Asian markets. Although some open-end funds (such as equity funds managed by VinaCapital) have achieved impressive growth (20-22%/year), the scale of the fund industry is still too small, showing great growth potential but also reflecting the difficult initial development stage.

To reach maturity, Vietnam needs to increase the scale and proportion of institutional investors, improve professionalism, and encourage the participation of investment funds to allocate capital more effectively, in line with the long-term capital goals of enterprises, thereby reducing dependence on the banking system, helping the economy develop sustainably.

Editor Khanh Ly: With the context of the world economic developments and the strong economic growth of Vietnam along with breakthrough policies in the current era of development, how will Vietnam's capital market develop in the coming time, in your opinion?

Ms. Nguyen Hoai Thu, CFA, Deputy General Director of VinaCapital Fund Management Company: We believe that with the Government's active economic management, we can achieve GDP growth at 7% - 8% in the long term ahead, which is also a solid foundation for the stock market to develop strongly in the future.

Along with growing in scale, we must aim to build a foundation for national financial autonomy, including developing the internal strength of Vietnamese enterprises to become strong, transparent in management, and reach international standards.

We believe that in the coming time, the capital market will develop positively in several directions, firstly, through breakthroughs in the legal framework and development of new products, helping the market catch up with global trends, contributing to diversifying investment opportunities for investors.

Second, the fund industry will grow stronger when supported by many synchronous solutions, including mass financial education to improve knowledge and skills for investors, encourage the formation of long-term investment habits, and accumulate assets through open-ended funds instead of short-term speculation. The development of open-ended funds, ETFs, and voluntary pension funds will also help create long-term institutional capital in the country, thereby reducing dependence on short-term capital flows from abroad.

Besides, more and more international financial institutions such as index funds, pension funds, and foreign sovereign wealth funds are interested in Vietnam thanks to the strong growth prospects of the economy.

Editor Khanh Ly: Thank you for the above information!

Source: https://vtv.vn/nang-hang-thi-truong-buoc-dem-vung-chac-cho-von-ngoai-vao-viet-nam-100251014100434705.htm

Comment (0)