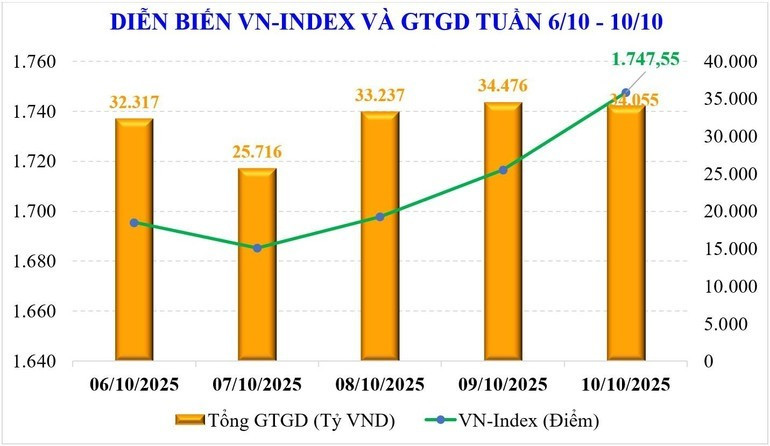

At the end of the week, VN-Index reached 1,747.55 points, up 101.75 points (equivalent to 6.18%) compared to the previous week, marking a record high since the market was born. The VN30 index increased by 6.51%, the Midcap group increased by 4.95%, while Smallcap increased slightly by 1.89%. Average liquidity of the whole market reached about 34,849 billion VND/session (up 24%), with matching orders alone reaching 32,065 billion VND/session (up 26%).

Investor sentiment was buoyed by the upgrade news and positive macro factors such as GDP growth in the third quarter reaching over 8%, along with positive profit prospects of listed companies. Strong cash flow focused on Bluechips and Midcaps, helping the market break out of the sideways range of 1,600-1,700 points that has lasted for more than a month.

Among the stocks that increased sharply, Vingroup (+14.7%), retail (+6.9%), securities (+6.8%), real estate (+6.4%), construction and building materials (+6.4%) stood out. However, foreign investors still sold a net VND5,543 billion, marking the 12th consecutive week of net selling; the cumulative amount since the beginning of the year reached VND115,697 billion.

New week outlook: Excitement continues to spread

According to securities companies, the uptrend may continue next week, although there may be a short correction due to the impact of US-China trade tensions or the VN30 futures contract expiration session.

Saigon - Hanoi Securities Company (SHS) commented that the short-term trend is still positive, VN-Index may head towards 1,750 points, and VN30 may reach 2,000 points.

Tien Phong Securities Company (TPS) forecasts that the index may increase to at least 1,776 points, with domestic cash flow being the main support in the context of foreign investors not stopping net selling.

Yuanta Vietnam Securities Company (YSVN) predicts that the market may correct at the beginning of the week but will soon recover, considering this an opportunity to increase stock proportion during slight declines.

Experts recommend that investors should select stocks with strong liquidity and large price fluctuations, prioritizing banking, public investment, construction and retail sectors, which have not grown strongly in the previous period.

Year-end outlook: VN-Index could reach 1,800–2,000 points

According to Mirae Asset Securities Vietnam (MASVN), Vietnam's stock market is benefiting from the loose monetary policy, promoting consumption and large-scale public investment. The upgrade by FTSE Russell is expected to attract more foreign capital into pillar stocks, supporting the market to conquer higher peaks.

MASVN maintains a positive scenario with the consensus recovery momentum of banking, securities, raw materials and retail groups, forecasting that the VN-Index could reach 1,800 - 2,000 points by the end of 2025.

Source: https://baogialai.com.vn/vn-index-lap-dinh-moi-sau-nang-hang-du-bao-co-the-tien-sat-moc-1800-diem-post569159.html

Comment (0)