Continuing the working program of the Tenth Session, this morning, October 23, the National Assembly Delegation of Lam Dong province and the National Assembly Delegation of Nghe An province discussed in groups the draft Bankruptcy Law (amended) and the draft Deposit Insurance (amended).

Clarifying the recovery process before or during bankruptcy proceedings

Speaking at the discussion session on the draft Bankruptcy Law (amended), the majority of opinions agreed with the expansion of the draft Law's scope of regulation in the direction of building and perfecting the rehabilitation procedure as an independent procedure carried out before the bankruptcy procedure. However, delegate Nguyen Truong Giang (Lam Dong) said that it is necessary to review more carefully to ensure logic, consistency and feasibility in practice, especially the contents related to the scope of regulation, the relationship between rehabilitation procedures and bankruptcy procedures, as well as the authority and responsibility of related entities.

The delegate stated that the current law has stipulated the rehabilitation procedure as a stage in the bankruptcy resolution process. Therefore, it is necessary to inherit and perfect this mechanism in the direction of clarifying the rehabilitation procedure before or during the bankruptcy proceedings, instead of separating it into an independent law.

.jpg)

According to the delegate, the name "Bankruptcy Law" should be kept to ensure the stability of the legal system; in which, the rehabilitation procedure can be regulated in a separate chapter, with specific conditions, processes and applicable subjects.

Regarding bankruptcy costs, the delegate said that if the state budget advances the bankruptcy process, it should only be applied in truly special cases, such as when the person requesting bankruptcy is the tax authority or the social insurance agency. Even in these two cases, the impact on the budget should be carefully assessed to avoid creating a precedent or burdening the state budget.

Regarding the provision of “priority in applying rehabilitation procedures” (Article 3), delegates commented that this is a content that needs to be carefully considered. In fact, when entities have different requests, for example, the tax authority requests to open bankruptcy proceedings because the enterprise is insolvent, while another creditor requests rehabilitation – mechanically applying “priority in rehabilitation” can prolong the processing time, affecting the interests of creditors and the budget… Therefore, it is necessary to clearly stipulate specific application conditions, determine which cases are considered for rehabilitation, which cases are required to apply bankruptcy procedures, helping the court to apply them consistently, objectively and effectively.

The delegate also proposed to amend the regulations on bankruptcy petitions. Accordingly, instead of only stipulating that "the court may request amendments or supplements to the petition", it should be expressed more fully as "the court has the right to request amendments or supplements to the dossier and accompanying documents", because the bankruptcy petition includes the recovery plan, list of creditors, financial reports, and debt documents, to ensure legal accuracy and suitability with trial practice.

Regarding the implementation period of the recovery plan, the delegate said that the provision of “not exceeding a certain period of time” is not specific, which could lead to an indefinite extension, making monitoring difficult. It is necessary to set a specific maximum period, for example, not exceeding 3 years from the date the recovery plan is approved, to ensure transparency and feasibility.

Regarding the authority to request the opening of bankruptcy proceedings, delegates agreed with the delegation of authority to the tax authority, because this is the agency with the function of managing budget collection and has enough information to monitor the tax obligations of enterprises... However, regarding Vietnam Social Security, there were opinions suggesting careful consideration, because this is a public service organization with the function of specialized inspection, not a direct subject of litigation. The delegation of additional authority to request the opening of bankruptcy proceedings needs to have a solid legal basis, avoiding exceeding the scope of functions.

In addition, there are also suggestions to study the role of trade unions or agencies protecting workers' rights in cases where businesses are slow or evade paying social insurance, so that the handling is appropriate, reasonable and protects workers' rights.

.jpg)

Based on the analysis, delegates emphasized that the amendment of the Bankruptcy Law needs to focus on transparency, clarity and rationality in the process; clearly distinguish between the stages of recovery and bankruptcy; and clarify the authority of the participating entities... To ensure feasibility, the draft law needs to continue to carefully review the regulations on recovery conditions, time limits, bankruptcy procedures and financial handling mechanisms, ensuring clarity, transparency and ease of application, helping businesses have the opportunity to recover operations, while better protecting the rights of creditors, employees and the state budget.

The limit adjustment process requires full consultation with relevant stakeholders.

Commenting on the draft of the Deposit Insurance (amended), National Assembly Deputy Tran Hong Nguyen (Lam Dong) said that the current regulation applying a uniform deposit insurance premium of VND 125 million as prescribed by the Government is appropriate in the current period. However, international experience shows that there are two fee calculation mechanisms: a flat fee and a differentiated fee.

Differential fee mechanisms are applied by many countries, according to which credit institutions with high risk levels must pay higher fees, while institutions with good credit are applied lower fees... Delegates believe that this mechanism reflects market principles, encourages credit institutions to improve their management capacity, and ensures operational safety. However, in the current context of Vietnam, immediately applying a differential fee mechanism can cause risks of shifting cash flows, affecting system stability.

Therefore, delegates agreed with the Government's approach of allowing the parallel application of two forms of fees - equal or differentiated - depending on the practical conditions of each stage; at the same time, giving the Governor of the State Bank the right to flexibly regulate and adjust.

Regarding inspection authority, delegates said that assigning the Deposit Insurance of Vietnam to participate in the inspection is appropriate, provided that the activities are carried out according to the plan and content assigned by the State Bank.

Citing the reality of the 2019-2025 period, the State Bank has piloted the assignment of the Deposit Insurance of Vietnam to inspect 354 people's credit funds, achieving positive results..., delegates proposed to supplement the authority to recommend and warn when violations are detected, to help credit institutions self-correct before being handled, and at the same time clearly stipulate the legal value of inspection results and coordination mechanisms to avoid overlap.

Delegate Trinh Thi Tu Anh (Lam Dong) emphasized that the deposit insurance payment limit is a key issue, directly affecting the rights and trust of depositors... Currently, according to Decision No. 32/2021/QD-TTg, the deposit insurance payment limit is 125 million VND per person at a credit institution, an increase from the previous level of 75 million VND. This level protects about 92% of depositors, within the recommended range of 90-95% of the International Association of Deposit Insurers (IADI). However, according to the delegate, with increasing income and living costs, especially in large urban areas, this limit has clearly revealed its limitations.

.jpg)

The delegate analyzed that with the current limit, the rate of fully insured deposit balances only reached 8.38% of the total insured deposit balance, much lower than the global average of about 47%. Meanwhile, the average income per capita in Vietnam is about 5,000 USD/year, according to international practice, the insurance limit is usually equivalent to 2-5 times the GDP per capita... Thus, the current level of 125 million VND only protects a small part of the total value of deposits, especially of individuals and small businesses, leading to the risk of losing confidence in the banking system.

Compared to international standards, Vietnam's limit (about 5,000 USD) is much lower than that of the United States (250,000 USD) or the European Union (100,000 EUR). Therefore, delegates believe that it is necessary to adjust the payment limit to better suit reality and approach international practices, thereby maximally protecting the interests of depositors and strengthening confidence in the financial system.

Highly agreeing with the regulation that gives the Governor of the State Bank the authority to adjust the periodic payment limit, based on criteria such as inflation rate, per capita income, average deposit size and international standards, delegate Trinh Thi Tu Anh said: the limit should be reviewed and adjusted periodically every 3-5 years, to ensure that the real value of the insurance is not reduced due to economic fluctuations.

Delegates suggested that the limit adjustment process should have full consultation with relevant parties, including: Vietnam Deposit Insurance, credit institutions, depositor representatives and independent experts, and be publicly announced to collect opinions at least 30 days before promulgation.

In addition, delegates proposed a flexible insurance mechanism for different subjects - individuals, small businesses, non-profit organizations to ensure fairness and suitability for actual risks... At the same time, it is necessary to strengthen communication and education of the community about the benefits, limits and procedures of deposit insurance, helping people understand the policy, contributing to strengthening trust in the banking system.

According to delegate Trinh Thi Tu Anh, the adjustment of payment limits must be accompanied by an assessment of the financial capacity of the Vietnam Deposit Insurance Fund, ensuring that the fund is capable of paying in all situations, even when credit institutions go bankrupt or lose their ability to pay... "This is a key factor to ensure the sustainability of the deposit insurance system, thereby best protecting the legitimate rights of depositors and contributing to maintaining national financial stability," delegate Trinh Thi Tu Anh emphasized.

Source: https://daibieunhandan.vn/nen-giu-ten-luat-pha-san-nhu-luat-hien-hanh-10392609.html

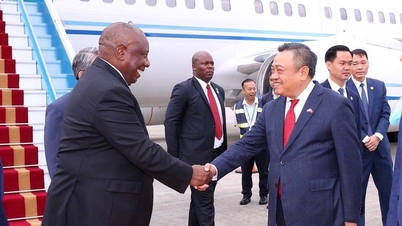

![[Photo] President Luong Cuong holds talks with South African President Matamela Cyril Ramaphosa](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761221878741_ndo_br_1-8416-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on railway projects](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761206277171_dsc-9703-jpg.webp)

Comment (0)