Domestic revenue completed 3 months in advance

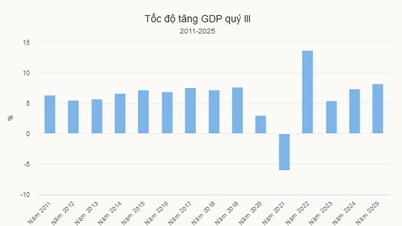

According to information from the provincial Tax Department, the province's domestic revenue in the first 9 months is estimated at 27,300 billion VND, exceeding 7.7% of the ordinance estimate, exceeding 1.3% of the estimate assigned by the Provincial People's Council, reaching 87.3% of the target estimate assigned by the Tax Department and increasing by 59.9% (equivalent to an increase of 10,274 billion VND) over the same period. In particular, in the third quarter alone, the province is estimated to achieve 12,732 billion VND, exceeding 21.5% of the estimate and increasing by 89.5% over the same period.

|

| Production activities at Khatoco Garment Factory. Photo: D.LAM |

Many revenue items exceeded the average estimated collection schedule, including a number of revenue items and taxes that have exceeded the legal estimate and increased compared to the same period last year. Notably, revenue from land is estimated at VND 10,100 billion, reaching 139.6% of the estimate, accounting for about 37.5% of total revenue, equal to 218.2% over the same period; revenue from the production and business sector is estimated at VND 11,957 billion, reaching 85.9% of the estimate, up 116.6% over the same period; fees, charges and other revenues are estimated at more than VND 387.4 billion, equal to 88.5% of the estimate, equal to 118.7% over the same period.

|

| State budget revenue is invested in cultural institutions serving the community. (In photo: April 16 Square, Phan Rang Ward). Photo: VAN NY |

In addition, the revenue increase is also due to the emergence of extraordinary revenues (about 10,654 billion VND). Specifically: Non-state enterprises pay tax arrears according to Decree No. 64 on extension of tax and land rent payment in 2024 about 1,168 billion VND; enterprises temporarily pay in the fourth quarter of 2024 and submit final settlement in 2024 about 933 billion VND; Cam Ranh Investment Joint Stock Company pays one-time land rent and land use fees arising from the Cam Ranh Bay Urban Area Project 6,173 billion VND; ACT Holdings Joint Stock Company pays land use fees for the Dam Ca Na New Urban Area Project 427.8 billion VND; Vega City Joint Stock Company pays one-time land rent for the Champarama Tourism Area Project 769.5 billion VND...

|

| Activities of a business household in Nha Trang ward. |

According to Mr. Nguyen Ngoc Tu - Head of Khanh Hoa Provincial Tax, to achieve the above results, the Provincial Tax has been proactive in allocating, assigning budget estimates and closely monitoring the implementation status and tax collection progress of each basic tax unit according to each tax target and specific collection field to have timely direction and management solutions. At the same time, close coordination between departments within the tax sector with departments, branches, sectors and local authorities at all levels to remove difficulties, synchronously implement solutions, especially after the period of merging provinces and changing the 2-level local government organization model.

The provincial Tax Department also implemented many solutions to effectively manage key revenue sources, especially revenue from land, real estate transfer, e-commerce, and online business; tax inspection and examination work was strengthened, contributing to preventing revenue loss and ensuring correct and sufficient collection for the State budget. Along with that, propaganda and support for taxpayers continued to be focused on. Many business dialogue conferences were organized; online support channels via Zalo, phone, and public service portal were maintained regularly. The provincial Tax Department also promptly implemented policies to exempt, reduce, and extend taxes, fees, and charges according to Government regulations to support businesses to overcome difficult times.

Synchronize solutions to create sustainable revenue

In 2025, the Prime Minister's decree estimates assigned to the provincial Tax sector are 25,269 billion VND; the state budget revenue estimate assigned by the Provincial People's Council is 26,880 billion VND; the state budget revenue estimate assigned by the Tax Department to the Provincial Tax is 31,166 billion VND. Thus, to implement the state budget revenue estimate for 2025 assigned by the Tax Department, in the last 3 months of the year, Khanh Hoa Provincial Tax must collect 3,866 billion VND.

|

| Chinese partners visit the production line of Khanh Hoa Salanganes Nest Beverage Joint Stock Company. Photo: D.LAM |

To complete the State budget revenue estimate, Khanh Hoa Provincial Tax Department has proposed many solutions to increase revenue sources such as: Proactively following the State budget revenue target, fully covering all revenue sources, promoting the implementation of revenue management solutions, preventing budget revenue loss; focusing on exploiting revenue sources with room and potential to compensate for revenue sources and fields forecast to decrease; identifying key tasks, fields and industries to exploit revenue sources in 2025; strengthening tax management for fields with high risk of revenue loss and great potential such as: Mineral exploitation, real estate business, cross-border e-commerce and transportation...

At the same time, promote administrative reform and digital transformation in all aspects of work, stages and processes of tax management; focus on perfecting the database system, data management, applying artificial intelligence (AI) to support the implementation of tasks at tax authority departments, minimizing risk factors in tax management; focus on and focus on tax inspection and audit work at enterprises, especially in areas with signs of transfer pricing and fraud; strengthen the control of risks of electronic invoices and electronic invoices generated from cash registers, proactively review business households that pay taxes by the lump-sum method with annual revenue of 1 billion VND or more to use electronic invoices generated from cash registers in accordance with regulations. At the same time, resolutely urge and collect outstanding tax and fee debts, especially land revenues; Implement coercive measures in accordance with the law in a resolute and timely manner to completely handle bad debts; effectively implement policies to support businesses and people in accordance with regulations; continue to simplify tax administrative procedures, creating the most favorable conditions for taxpayers in fulfilling their obligations to the State budget... The provincial Tax Department also strengthens coordination with departments, branches and localities to effectively exploit sustainable revenue sources, contributing to consolidating the budget and developing the province's socio-economy in the new period.

C. VAN

Source: https://baokhanhhoa.vn/kinh-te/202510/nganh-thue-tinh-khanh-hoa-thu-noi-dia-da-vuot-du-toan-nam-e261b3b/

![[Photo] Prime Minister Pham Minh Chinh launched a peak emulation campaign to achieve achievements in celebration of the 14th National Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/8869ec5cdbc740f58fbf2ae73f065076)

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's online conference with localities](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/264793cfb4404c63a701d235ff43e1bd)

![[Photo] Opening of the 13th Conference of the 13th Party Central Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/6/d4b269e6c4b64696af775925cb608560)

Comment (0)