Behind this result is the process of applying a tax management model that focuses on taxpayers as the center of service, combined with promoting digital transformation and tightening discipline in management and budget collection.

Tax management in 5 wards: Quy Nhon, Quy Nhon Nam, Quy Nhon Tay, Quy Nhon Bac, Quy Nhon Dong and Nhon Chau island commune with more than 5,300 enterprises and nearly 10,000 business households, Tax Base 1 faces the biggest budget collection pressure in the province - estimated at more than 1,695 billion VND.

Support taxpayers, create sustainable revenue

Demonstrating the determination to successfully complete the assigned tasks, in early 2025, the Base Tax 1 reviewed and grasped the list of enterprises, business households and revenues; analyzed and evaluated revenue sources and collection capabilities, thereby developing and implementing appropriate tax management and collection measures. Instead of focusing only on collection, the Base Tax 1 also actively supports taxpayers to develop production and business and avoid unnecessary violations, thereby creating a stable and long-term source of revenue.

Mr. Phan Cong Hoa, Deputy Head of Tax Department 1, shared: “We do not wait for taxpayers to ask before answering, but as soon as we have draft tax support policies, we proactively review and classify subjects to provide timely information. We fully exploit information technology applications to serve propaganda work, bringing the State's support policies into life. In addition to sending open letters, we also organize conferences to advise and guide taxpayers to carry out procedures quickly, ensuring their maximum benefits.”

The proactive approach to supporting SMEs has brought about clear results and has been highly appreciated by the business community. Thanks to the enthusiastic advice and guidance from the tax authorities, after a short time, Suntoue Furniture Co., Ltd. (Area 8, Quy Nhon Tay Ward - specializing in the production of exported wooden products) completed the VAT refund dossier for exported goods with an amount of more than 6 billion VND. "This amount of money is like a valuable booster, helping us maintain orders and create stable jobs for workers" - said the company representative.

Not only that, when the 2-level local government model officially operated, Base Tax 1 established 3 working groups to go to new wards and communes to support people and businesses. At the same time, the "one-stop" mechanism was well operated at the headquarters, receiving and handling tax-related procedures, helping to minimize time and travel costs for taxpayers, quickly resolving issues related to the tax sector.

Good management, effective tax collection

Along with supporting taxpayers, Tax Department 1 proactively reviews revenue sources, taxes, calculates potential revenue sources associated with each tax management and collection measure.

In particular, the Basic Tax 1 takes the electronic invoice platform as the center, thereby promoting applications to effectively serve the work of monitoring tax declaration records and promoting the model of "open management - full disclosure", in order to create a civilized and modern tax management environment to ensure correct and full collection. Cases that have been warned, reminded, and advised many times but still violate the Law on Tax Administration will be strictly handled.

Tax Department 1 has also announced a hotline number to receive and handle taxpayers' feedback related to the implementation of documents, procedures, management, tax collection, and service attitude of tax officials. All information is public and transparent for all levels, sectors, and taxpayers to monitor. This has increased taxpayers' trust in tax authorities and the State's support, thereby making efforts to invest in developing production and business, contributing more to the budget.

The ward and commune authorities highly appreciate the tax sector's approach, so they should strengthen the direction and coordination of tax management, tax collection, and prevention of tax losses in the locality. This is also a prominent new feature of the Base Tax 1 compared to many other units in the sector, after the province operated the 2-level local government model.

With these comprehensive efforts, Base Tax 1 has collected more than VND 1,553 billion in the first 8 months of 2025, reaching 91.7% of the estimate, up 11% over the same period last year. This result not only affirms the correctness and effectiveness of taking taxpayers as the center of service, but also shows the possibility that Base Tax 1 will soon reach the budget revenue estimate for 2025.

Mr. Nguyen Quoc Tuan, Head of Tax Department 1, said: With the goal of creating favorable conditions for people and businesses to develop production and business, while ensuring correct and sufficient collection for the state budget, we continue to implement the State's support policies well, ensuring maximum benefits for taxpayers. Along with that, we encourage, remind, warn, and help taxpayers avoid mistakes and voluntarily fulfill their tax obligations well.

The entire industry continues to promote digital transformation, taking the electronic invoice platform as the center to develop applications to effectively serve management, collect correct and full taxes, and prevent tax fraud and evasion.

Source: https://baogialai.com.vn/thue-co-so-1-quan-ly-thu-thue-va-chong-that-thu-hieu-qua-post566271.html

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

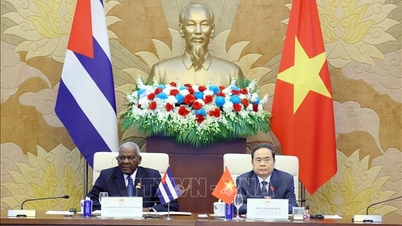

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)