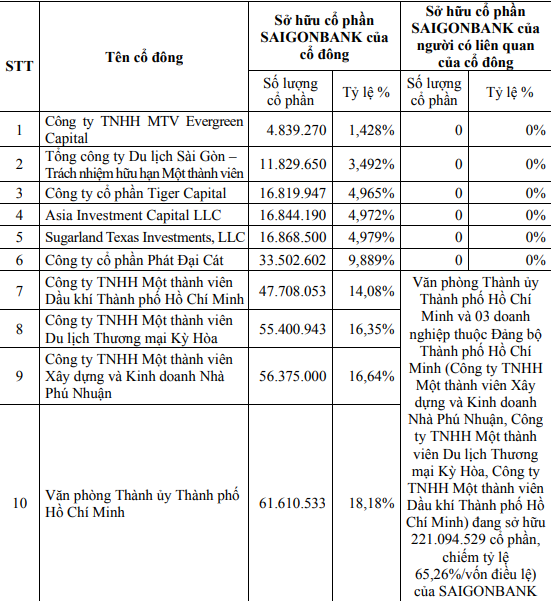

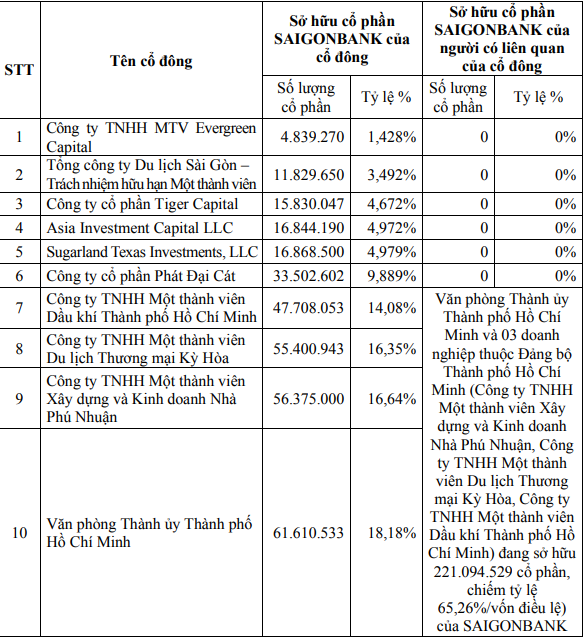

Accordingly, Tiger Capital JSC has reduced its ownership of 1 million SGB shares. After the transaction, this organization still holds 15.8 million shares, equivalent to 4.672% of charter capital, down 0.3% compared to the announcement in March 2025.

Tiger Capital is one of three legal entities related to the ecosystem of Nguyen Kim Investment and Development JSC, which is a major shareholder at Saigonbank. The remaining two organizations still maintain their ownership ratio, including: Phat Dai Cat JSC: Holding more than 33.5 million shares, equivalent to 9.889% of capital; Evergreen Capital LLC: Holding 4.8 million shares, equivalent to 1.428% of capital.

Thus, after Tiger Capital reduced its ownership, the total holding ratio of the group of shareholders related to Nguyen Kim at Saigonbank is now 15.98% of the charter capital, equivalent to more than 54.1 million shares. All three legal entities have close ties with Nguyen Kim Investment and Development JSC through ownership structure or senior personnel.

According to financial experts, the above move shows an adjustment in investment strategy or cash flow restructuring of the Owner. The slight reduction in ownership ratio may be an exploratory step or part of capital diversion, but Nguyen Kim group still holds the role of major shareholder with a ratio of nearly 16%.

Nguyen Kim Group, with its core legal entity being Nguyen Kim Investment and Development Company, is associated with the name of its founder Nguyen Van Kim, who built the Nguyen Kim electronics supermarket chain before selling it to Thailand's Central Group.

Apart from the Nguyen Kim group, Saigonbank’s shareholder structure is quite concentrated with the dominant ownership ratio belonging to State entities. Four State shareholders are holding a total of 65.25% of the bank’s charter capital, equivalent to more than 221 million shares.

In addition, the bank also has other major shareholders such as two foreign investment funds, Asia Investment Capital LLC (4.972%) and Sugarland Texas Investments LLC (4.979%), and Saigon Tourist Corporation - LLC (3.492%).

In another development, Saigonbank announced that October 6, 2025, will be the closing date for the shareholder list to collect written opinions. The main content of the collection of opinions is to approve the plan to increase charter capital from undistributed accumulated profits. The expected bonus share issuance rate is 6.5%.

Source: https://daibieunhandan.vn/tiger-capital-thoat-bot-von-tai-sgb-tien-se-chay-ve-dau-trong-he-sinh-thai-nguyen-kim-10388341.html

![[Photo] Prime Minister Pham Minh Chinh launched a peak emulation campaign to achieve achievements in celebration of the 14th National Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/8869ec5cdbc740f58fbf2ae73f065076)

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's online conference with localities](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/264793cfb4404c63a701d235ff43e1bd)

![[VIDEO] Summary of Petrovietnam's 50th Anniversary Ceremony](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/4/abe133bdb8114793a16d4fe3e5bd0f12)

![[VIDEO] GENERAL SECRETARY TO LAM AWARDS PETROVIETNAM 8 GOLDEN WORDS: "PIONEER - EXCELLENT - SUSTAINABLE - GLOBAL"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/23/c2fdb48863e846cfa9fb8e6ea9cf44e7)

Comment (0)