Expanding into the securities sector will help the bank increase revenue from service fees and exploit its customer network to develop the ecosystem - Photo: QUANG DINH

With the backing of banks, securities companies are creating an increasingly heated capital race.

Banking wave enters the stock market

The ambition of private banks to expand into the securities sector is becoming increasingly clear. In July 2025, at the Annual General Meeting of Shareholders, PG Bank's board of directors publicly expressed their desire to own a securities company.

In fact, the Vietnamese stock market in the past 3 years has witnessed an expansion of securities companies linked to banks, not only in terms of capital size but also in terms of outstanding margin loans.

VIS Ratings - a credit rating company with capital from Moody's - once emphasized that these companies are the driving force behind the growth of securities industry profits, thanks to making the most of their customer network and capital from their parent banks.

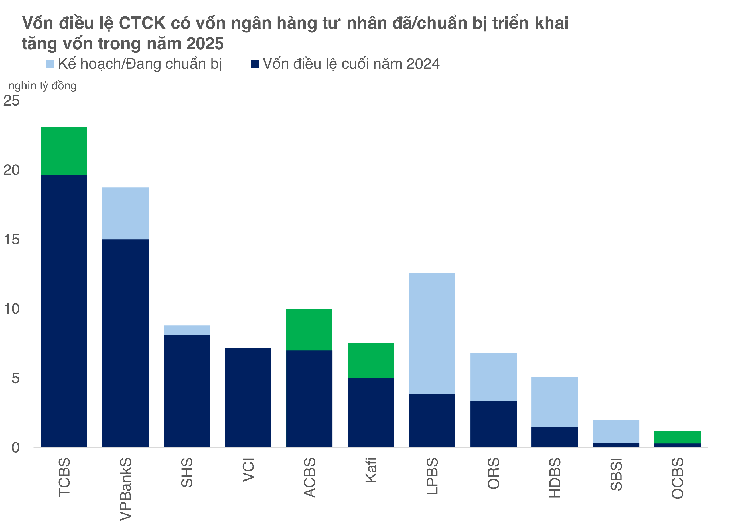

According to statistics from Tuoi Tre Online, more than 11 securities companies affiliated with private banks have plans to increase capital by a total of more than VND31,720 billion in 2025, equivalent to about USD1.2 billion.

In addition to the completed TCBS and ACBS deals, KAFI, with many ofVIB 's imprints, has also just completed increasing its charter capital to VND7,500 billion. KAFI has increased its capital 5 times in just 4 years and is preparing to register for trading on UPCoM.

Meanwhile, OCBS Securities has increased its charter capital 4 times from VND 300 billion to VND 1,200 billion by the end of the second quarter of 2025.

Regarding the unimplemented deals, VPBankS plans to IPO 375 million shares by the end of 2025, LPBS (LienVietPostBank Securities) plans to increase its capital 3.3 times to VND 12,668 billion. Meanwhile, HD Securities will offer 365 million shares, thereby increasing its charter capital from VND 1,460 billion to more than VND 5,100 billion.

Capital scale is still an "inevitable race" for securities companies in general as well as groups with interests linked to banks. Because only when they have enough capital can they deploy margin lending on a large scale, invest in technology infrastructure and expand into digital asset services - a field considered the next step of the market.

Lessons from MSI: Missing and Coming Back

The wave of banks owning securities companies was vibrant in the 2010s, but quickly cooled down in the 2012-2015 period when the financial system encountered difficulties.

Many banks were forced to withdraw, including Maritime Bank (MSB) selling Maritime Securities (MSI) in 2017 to focus on core credit. It was estimated that at that time, MSB earned about 33 million USD from this deal.

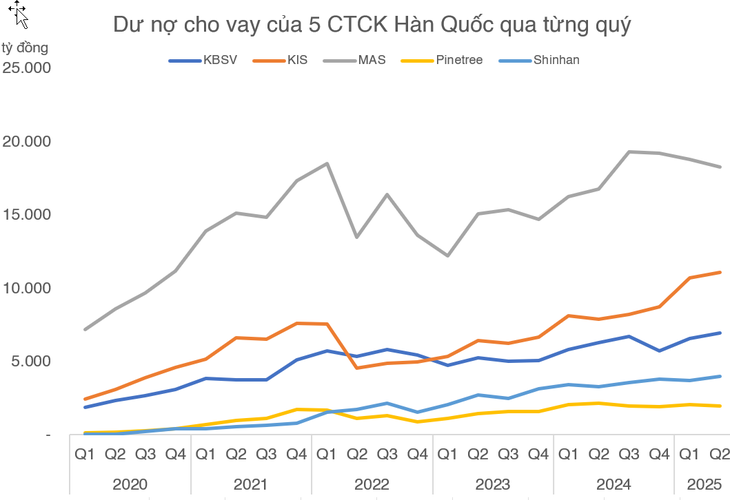

But this "breakup" left many regrets. After being acquired by KB, MSI was quickly "transformed" into KBSV - one of the Korean-invested securities companies that has built a reputation. Charter capital reached over VND 3,000 billion, outstanding loans reached nearly VND 7,000 billion by the end of the second quarter of 2025.

MSB’s return through SBSI is still modest. Despite the target of increasing capital to VND2,000 billion, this scale is still behind KBSV - the "child" that MSB once sold. This is what makes MSB’s return seem belated, both regretful and challenging.

In contrast to MSB's reticence, VPBank chose to make a decisive comeback.

After selling VPS, this bank quickly acquired ASC, changed its name to VPBankS, then implemented a huge capital increase strategy and prepared for IPO. If MSB is cautious, VPBank shows a strong acceleration.

A market analyst commented that securities companies with large bank potential would also need 2-3 years if rebuilt from scratch.

However, the barrier to entry is now higher as the brokerage market is more concentrated, transaction fees are approaching zero, and margin interest rates are forced to compete fiercely.

If SBSI does not invest heavily like its competitors or does not dare to follow new directions such as technology or digital assets, the opportunity to get in will be extremely limited.

In general, investing in securities companies gives banks significant advantages from the existing customer ecosystem and solid financial potential.

However, this advantage can only be truly realized if accompanied by a decisive strategy and large resources to invest in infrastructure, technology and new products.

Source: https://tuoitre.vn/ngan-hang-do-bo-chung-khoan-thay-gi-tu-cuoc-dua-tang-von-dong-loat-hang-ti-usd-2025092609550876.htm

![[Photo] High-ranking delegation of the Russian State Duma visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/c6dfd505d79b460a93752e48882e8f7e)

![[Photo] The 4th meeting of the Inter-Parliamentary Cooperation Committee between the National Assembly of Vietnam and the State Duma of Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/9f9e84a38675449aa9c08b391e153183)

![[Photo] Joy on the new Phong Chau bridge](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/b00322b29c8043fbb8b6844fdd6c78ea)

Comment (0)