USD exchange rate today 7/30/2025

At the time of survey at 4:30 a.m. on July 30, the central exchange rate at the State Bank was currently 25,206 VND/USD, an increase of 24 VND compared to yesterday's trading session.

Specifically, at Vietcombank , the USD exchange rate is 26,010 - 26,400 VND/USD, an increase of 30 VND in both directions, compared to yesterday's trading session.

NCB Bank is buying USD cash at the lowest price: 1 USD = 25,760 VND

VietinBank is buying USD transfers at the lowest price: 1 USD = 25,795 VND

VPBank is buying USD cash at the highest price: 1 USD = 26,333 VND

OCB Bank is buying USD transfers at the highest price: 1 USD = 26,032 VND

HSBC Bank is selling USD cash at the lowest price: 1 USD = 26,266 VND

HSBC Bank is selling USD transfers at the lowest price: 1 USD = 26,266 VND

SCB Bank is selling USD cash at the highest price: 1 USD = 26,410 VND

SCB Bank is selling USD transfers at the highest price: 1 USD = 26,410 VND

USD exchange rate at some banks today. Source Webgia.com

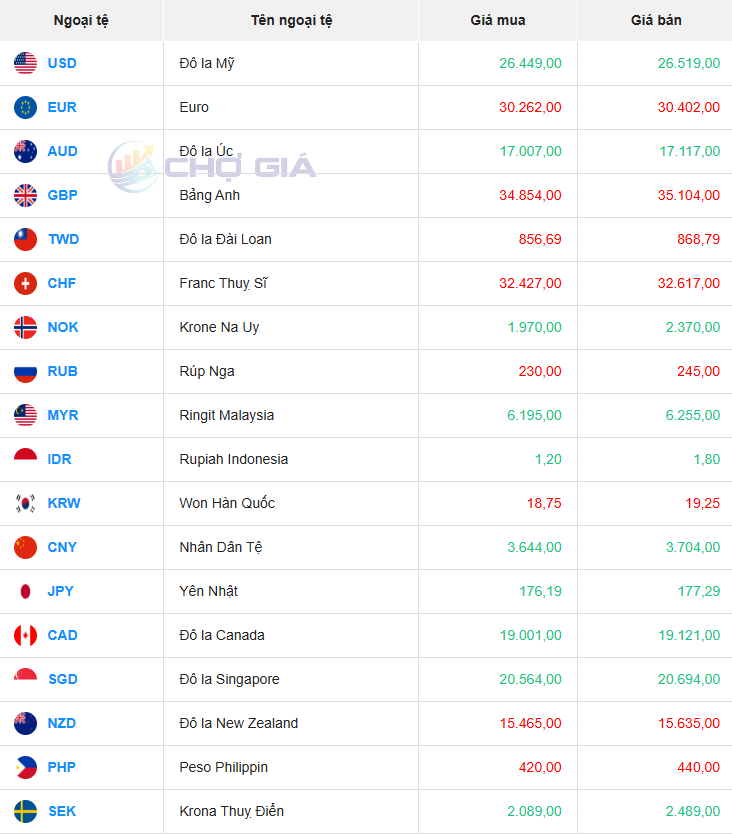

In the "black market", the black market USD exchange rate as of 4:30 a.m. on July 30, 2025 increased by 63 VND in both directions, compared to yesterday's trading session, trading around 26,449 - 26,519 VND/USD.

Black market on July 30, 2025. Photo: Chogia.vn

USD exchange rate today July 30, 2025 on the world market

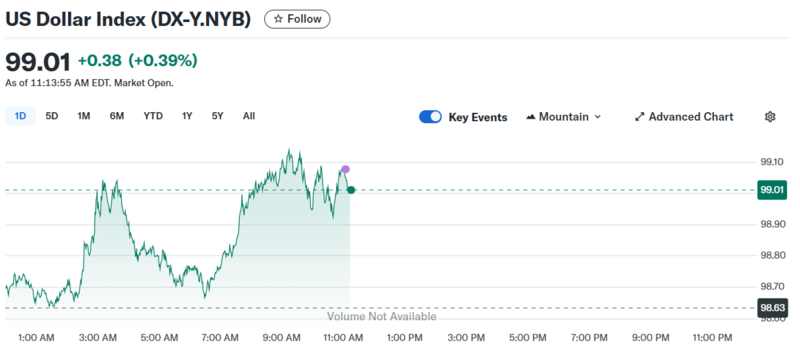

The Dollar Index (DXY), which measures the USD against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), stopped at 99.01 - up 0.62 points compared to July 29, 2025.

DXY index performance over time.

The dollar’s recovery comes as the US Federal Reserve begins its two-day policy meeting, Reuters reported. While no interest rate changes are expected this week, markets are looking ahead to the September meeting. At the same time, important data on the US labor market will be released, starting with June employment figures and the goods trade balance.

Amid a busy earnings season, Wall Street hit new records early in the week. Futures continued to rise, as European and Chinese stocks also rallied. Only Japan bucked the trend. In the bond market, yields held steady after big debt issuances earlier in the week, with the $1.007 trillion borrowing plan for the third quarter coming in just under expectations.

In addition, investors are also watching crude oil prices rise again, especially after Mr. Trump suddenly shortened the deadline for Russia to end the conflict in Ukraine to "10 or 12 days" or else face new sanctions against both Moscow and countries that buy Russian oil.

In Stockholm, US-China trade negotiators entered a second day of talks, hoping to reach an agreement to extend the tariff truce signed in mid-May by 90 days. Meanwhile, South Korean Finance Minister Koo Yun-cheol vowed to push for a mutually beneficial bilateral trade agreement when he meets his US counterpart Scott Bessent this week.

Notably, the USD Index (DXY) rose more than 1%, its strongest daily gain in more than two months, and continued its upward momentum. With only two trading sessions left, the USD is on track for its best week of the year.

USD exchange rate today, July 30, 2025. Illustration photo

Source: https://baohatinh.vn/ty-gia-usd-hom-nay-307-dong-usd-hoi-sinh-manh-me-post292737.html

![[Photo] Ho Chi Minh City is brilliant with flags and flowers on the eve of the 1st Party Congress, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/10/1760102923219_ndo_br_thiet-ke-chua-co-ten-43-png.webp)

![[Photo] Unique Phu Gia horse hat weaving craft](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/10/1760084018320_ndo_br_01-jpg.webp)

![[Photo] Opening of the World Cultural Festival in Hanoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/10/1760113426728_ndo_br_lehoi-khaimac-jpg.webp)

Comment (0)