VN-Index trades sideways, electricity and gas stocks "light up" the market

Electricity stocks were the brightest in the session as two large-cap stocks, PGV and POW, both increased by a significant margin. At the same time, GAS also increased sharply, not only contributing to the overall increase of the VN-Index but also rising to the third position in terms of capitalization.

In the first trading session of the week, May 27, investors remained cautious after a decline with high liquidity. This caused the market to fall into a tug-of-war with alternating increases and decreases in the indices, along with a sharp decrease in liquidity.

The ups and downs in a narrow range continued throughout today's trading session. However, all indices closed in the green thanks to the buying pressure concentrated at the end of the session.

The focus of attention is on energy, rubber, tire and insurance stocks. In the energy group, PGV and POW were suddenly pulled up to the ceiling price. POW shares traded with high liquidity, more than 41 million shares were matched. Previously, information at the annual shareholders' meeting revealed many positive factors. This enterprise estimated its business results in May and could receive 1,000 billion VND from compensation for the Vung Ang 1 factory. In addition, other energy stocks such as TV2, TV1, PPC, NT2... also broke out simultaneously.

Not only electricity stocks, the shares of utility giant PV GAS also increased by 2.53%, contributing the most to the overall increase of VN-Index. Currently, this Corporation has risen to the 3rd position in the ranking of market capitalization of listed organizations on the stock exchange, only behind VCB and BIDV .

In the insurance group, codes such as BMI, BVH, PVI, MIG... competed to increase prices well. Of which, BMI increased by 4.2%, BVH increased by 4%, PVI increased by 2.6%... The recent increase in prices of the insurance group is due to many investors' expectations that interest rates could increase and have a positive impact on businesses in this industry group.

The rubber and tire group also traded positively. DRI increased by 5.8%, DPR increased by 4.6%, GVR increased by 2.9%... This industry group is also benefiting from the continuous increase in rubber prices and staying at high levels recently. Tire and tube stocks such as CSM, DRC, BRC all closed in green.

|

| The top 5 stocks with the most positive impact on the VN-Index are all state-owned enterprises. |

Some industry groups such as oil and gas, industrial zones... also recorded positive developments. The stocks with the most positive impact on VN-Index are GAS, GVR, HVN, POW, PGV... Of which, GAS had the largest contribution with 1.12 points when increasing 2.5%. Notably, the top 5 stocks contributing the most points to the general market today are all groups of enterprises with more than 50% of capital owned by the State.

On the other hand, the group of banking and financial stocks had a bad trading session and put significant pressure on the general market. In which codes such as HDB, SSB, BID, SSI, TPB or CTG were all in red. BID decreased by 0.6% and took away 0.41 points from VN-Index.

At the end of the trading session, VN-Index increased by 5.75 points (0.46%) to 1,267.68 points. The entire floor had 233 stocks increasing, 198 stocks decreasing and 67 stocks remaining unchanged. HNX-Index increased by 1.11 points (0.46%) to 242.83 points. The entire floor had 98 stocks increasing, 70 stocks decreasing and 56 stocks remaining unchanged. UPCoM-Index increased by 0.47 points (0.5%) to 94.87 points.

Total trading volume on HoSE reached nearly 727 million shares worth VND17,584 billion, down 50% compared to the session at the end of last week, of which the negotiated trading value contributed VND2,738.89 billion. Trading value on HNX and UPCoM reached VND1,397 billion and VND1,084 billion, respectively.

In terms of trading volume, POW was the strongest matched code in the market with 41.2 million units. Following that, EIB and EVF matched orders with 23.3 million units and 17 million units respectively. In terms of trading value,FPT returned to strongly attract cash flow with 682 billion VND traded in the session. Next were SSI (591 billion VND), POW (492 billion VND).

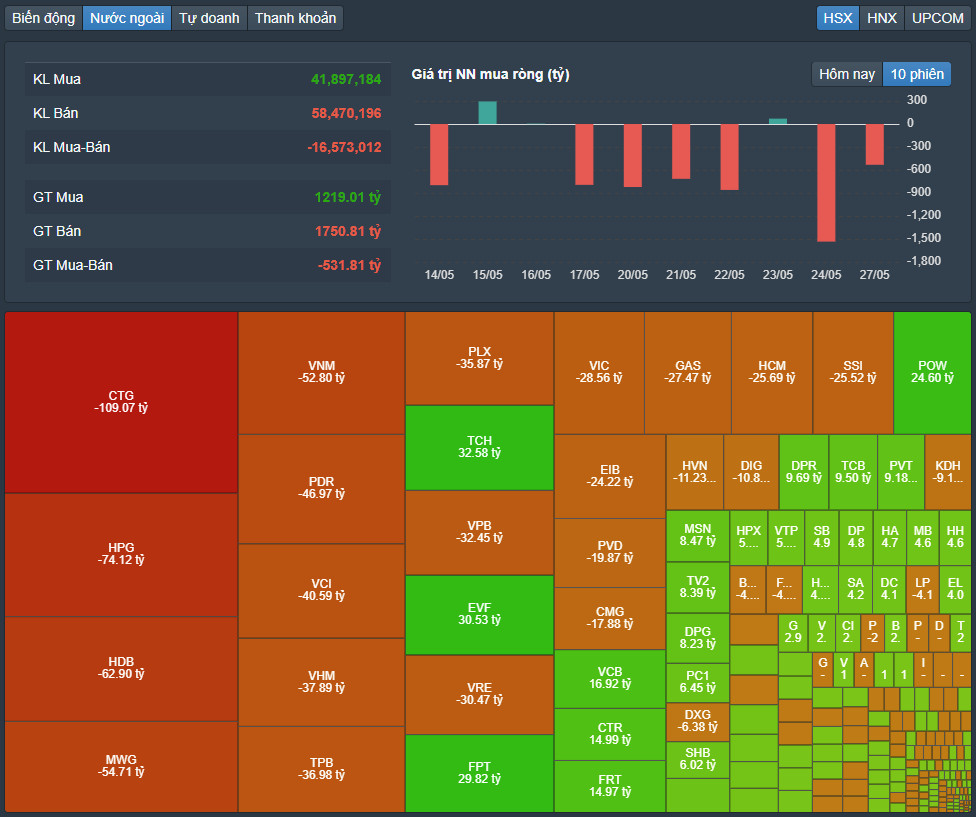

|

| Foreign investors continued to net sell after the previous week of strong selling. |

Foreign investors continued to net sell VND531 billion on HoSE, in which, this capital flow net sold the most CTG code with VND109 billion. HPG and HDB were net sold VND74 billion and VND63 billion respectively. Meanwhile, TCH was net bought the most but the value was only VND33 billion. EVF was also net bought VND31 billion.

Source: https://baodautu.vn/vn-index-giao-dich-giang-co-co-phieu-dien---khi-thap-sang-thi-truong-d216164.html

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's online conference with localities](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/264793cfb4404c63a701d235ff43e1bd)

![[Photo] Prime Minister Pham Minh Chinh launched a peak emulation campaign to achieve achievements in celebration of the 14th National Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/8869ec5cdbc740f58fbf2ae73f065076)

![[VIDEO] Summary of Petrovietnam's 50th Anniversary Ceremony](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/4/abe133bdb8114793a16d4fe3e5bd0f12)

![[VIDEO] GENERAL SECRETARY TO LAM AWARDS PETROVIETNAM 8 GOLDEN WORDS: "PIONEER - EXCELLENT - SUSTAINABLE - GLOBAL"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/23/c2fdb48863e846cfa9fb8e6ea9cf44e7)

Comment (0)