Vietnam’s stock market is considered by experts to be entering its most vibrant period in many years. Domestic investors are making a strong comeback. Many private enterprises are preparing for their initial public offerings (IPOs).

Profile of 2 securities companies with "VP"

On the afternoon of October 13, the Board of Directors of VPS Securities Joint Stock Company (expected code: VCK) approved a resolution to adjust the IPO plan with the announced price of 60,000 VND/share - nearly 3 times higher than the book value. With this price, the company's valuation could reach nearly 89,000 billion VND, equivalent to about 3.4 billion USD.

VPS Securities was established in 2006 with the majority of capital held by Vietnam Prosperity Joint Stock Commercial Bank ( VPBank ). In December 2015, VPBank divested 89% of its capital at VPBS, the transfer price and the partner of the deal were not disclosed.

Since VPBank divested, VPS has continuously increased its capital. It is recorded that VPS Securities' charter capital increased from VND 970 billion to VND 3,500 billion at the end of 2018, before the company was renamed to its current name. In 2021, VPS Securities' capital reached VND 5,700 billion.

At the same time, VPBank also IPO'd its new "favorite" VPBank Securities (VPBankS). VPBank's subsidiary plans to raise more than VND12,700 billion through the offering of 375 million VPX shares at VND33,900. At this price, VPBankS is valued at about VND63,600 billion, equivalent to nearly USD2.4 billion.

The "once-acquainted strangers" duo have been and are the center of attention of the stock market, heating up the IPO wave.

Previously, Techcom Securities Company (TCBS) also completed its IPO. With an offering price of VND46,800/share, TCBS raised VND10,818 billion, net income (after expenses) reached VND10,729 billion.

The current offering prices are much higher than the current average of the "seniors", such as SSI Securities (market price 41,450 VND/share), Ho Chi Minh City Securities (market price 26,700 VND/share), VNDirect (market price 23,500 VND/share), VIX Securities (market price 39,600 VND/share), MB Securities (market price 34,000 VND/share)...

2025 is the "golden" time for IPO (Photo: DT).

The "golden" time for IPO?

New movements as well as expectations of the stock market after the upgrade are the catalysts for good prices of recent IPOs.

Mirae Asset Securities assessed that the combination of favorable policies, abundant liquidity and investor confidence are two main factors creating a golden IPO cycle in the 2025-2027 period.

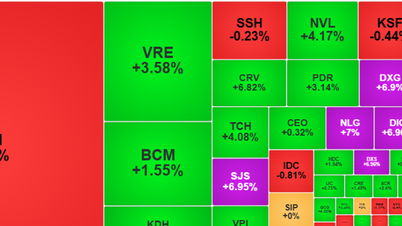

Regarding liquidity, according to the report of this securities company, the decision to impose reciprocal taxes from the US in early April triggered a wave of active trading by domestic investors. The VN-Index recorded many sessions with an average matched value of VND50,000-70,000 billion, much higher than the level of VND20-30,000 billion when it peaked in 2022.

Liquidity in July and August reached VND32,800 billion and VND46,000 billion per session, respectively, reflecting abundant cash flow and excitement returning to the market.

Regarding policy, on September 11, the Government issued Decree 245/2025 amending Decree 155/2020. A notable change is that the time to list shares on the stock exchange is shortened from 90 days to 30 days. Offering documents and listing documents are reviewed simultaneously, helping to reduce waiting time and administrative costs.

In the banking sector, the Prime Minister 's Decision 2070 continues to loosen listing conditions, allowing banks to be listed without having to make profits for two consecutive years, without having to maintain a bad debt ratio below 3% for two consecutive quarters, and without having to ensure a full board of directors or supervisory board structure as before.

This policy paves the way for small and medium-sized banks to move to new floors or list on new exchanges, contributing to increasing the diversity and depth of the capital market. The above unit believes that this is a favorable opportunity for private enterprises, especially in the fields of finance, consumption and securities.

IPOs and capital raising are the main drivers for the securities industry.

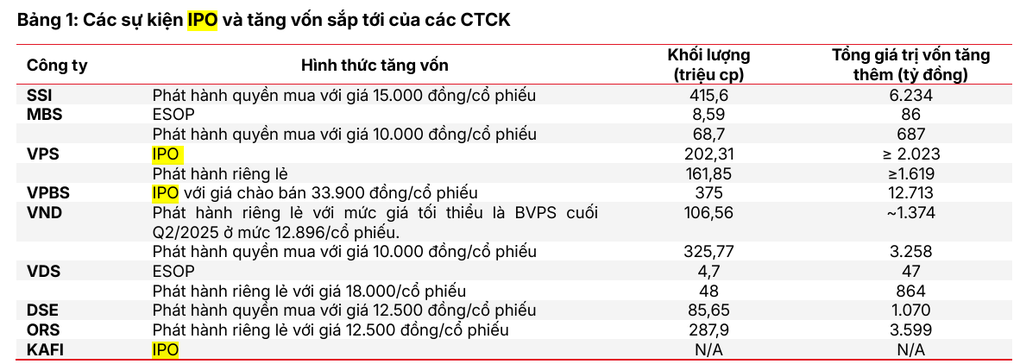

IPOs and capital raising are the main driving forces for the securities industry (Photo: SSI Research).

According to SSI Research, IPOs and capital raising activities will continue to be the main driving forces of the securities industry in 2025. Companies are expanding their scale and increasing capital mobilization to improve their margin lending, investment and proprietary trading capacity in the context of a vibrant market again.

Besides the three major deals, many other securities companies such as SSI, MBS, VNDirect, KAFI... are also implementing large-scale capital increase plans to strengthen financial capacity and expand operations.

The above research unit stated that the upcoming capital mobilization scale of the securities company block is very large, with the total added capital value of the whole industry estimated at more than 35,000 billion VND, showing the heat of the new capital mobilization cycle.

Source: https://dantri.com.vn/kinh-doanh/bo-doi-nguoi-la-tung-quen-va-dong-thai-khi-thi-truong-chung-khoan-nong-20251014094146367.htm

![[Photo] Many dykes in Bac Ninh were eroded after the circulation of storm No. 11](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/15/1760537802647_1-7384-jpg.webp)

![[Photo] Conference of the Government Party Committee Standing Committee and the National Assembly Party Committee Standing Committee on the 10th Session, 15th National Assembly](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/15/1760543205375_dsc-7128-jpg.webp)

![[Photo] General Secretary To Lam attends the 18th Hanoi Party Congress, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/16/1760581023342_cover-0367-jpg.webp)

![[Video] TripAdvisor honors many famous attractions of Ninh Binh](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/16/1760574721908_vinh-danh-ninh-binh-7368-jpg.webp)

Comment (0)