The most recent report of the Ministry of Construction said that in the first 9 months of the year, apartment selling price In Hanoi and Ho Chi Minh City, prices remained high and tended to increase compared to the same period last year.

Specifically, the average primary selling price of apartments in Hanoi in the third quarter of 2025 is from 70-80 million VND/m², an increase of 5.6% compared to the first quarter of 2025 and an increase of 33% compared to the same period in 2024. In particular, some luxury apartment projects in Hanoi recorded selling prices of 150-300 million VND/m².

In Ho Chi Minh City, the average primary selling price of apartments in the past 9 months was about 75 million VND/m², unchanged from the first quarter of this year but up 36% compared to the same period in 2024. Some high-end projects have selling prices from 150 million VND/m² or more.

Savills’ latest report also shows that each square meter of newly launched apartments in the second quarter in Hanoi reached an average of VND91 million/square meter. This price is not expected to decrease, at least this year, because most of the projects that are ready to be launched in the rest of the year have an expected price of over VND90 million/square meter.

The report of the Ministry of Construction also emphasized that real estate prices increase steadily every year but do not reflect their true value, and are still high compared to the average income of most people.

In particular, according to the Ministry of Construction, there are still phenomena of hoarding, price hikes, and speculation. This increases the real estate price level, causing an imbalance between supply and demand and exceeding the affordability of most people.

Meanwhile, according to real estate experts, the majority of buyers in the high-priced segment of the market today are investors hoping for high profit potential. On the contrary, despite high demand, the ability to access housing for the majority of people, especially young people, is very low due to expensive housing prices.

Mr. Nguyen Van Dinh, Chairman of the Real Estate Brokerage Association, analyzed: Regarding home buyers, reality shows that only a small group are first-time buyers and buy with real housing needs. The majority are investors, some buy for short-term "surfing" purposes, some buy to keep assets in the context of strong fluctuations in other investment channels.

According to a survey by market research company DKRA Vietnam, in fact, investment buyers account for a larger proportion than buyers with real housing needs, accounting for 70-80% of sales. Most of these customers already own at least 2 properties, using idle money instead of borrowing. They focus on profitability, clear legal status, rental capacity and liquidity.

A survey by Property Guru Vietnam Company shows that up to 60% of the recent apartment market transactions are concentrated in the investment customer group. Investors with inherent risk tolerance are all willing to use financial leverage to buy in with the belief that apartment prices will continue to increase in the near future.

In addition to the group of investors who buy for profit, Ms. Pham Thi Mien, Deputy Director of the Vietnam Real Estate Market Research and Evaluation Institute (VARS IRE) pointed out another group of people who are willing to buy apartments at the price of 100 million VND/m², which are people with good financial potential.

Ms. Mien cited that despite the high selling price, investors still sold their products. Specifically, the absorption rate on new supply still reached 62%. In particular, most of the "closed" apartments were in the high-end and luxury segment.

“ Newly opened projects have high price but still well absorbed because the housing demand of the group of people with good financial capacity - including Vietnamese people and foreigners - remains high. In addition, investment demand has also increased as customers take advantage of the 'preferential' cash flow with the expectation that prices will continue to increase, " Ms. Mien said.

The expert also said that most of the transactions in the primary market come from the demand of people who own many properties.

A representative of a real estate company in Hanoi revealed that with projects in prime locations, priced at hundreds of millions of VND/m², the majority of buyers are wealthy people with real housing needs. These could be customers in the 8X and 9X age groups looking for a living space with full amenities and a civilized community.

" Projects with the price range of 100 - 150 million VND/m² are the easiest to sell, while apartments over 200 million VND/m² will be more selective ," he said.

Investing at the peak is risky.

Mr. Nguyen Quoc Hung, Vice Chairman and General Secretary of the Vietnam Banking Association, once warned that investors who are "holding" many high-priced apartments, waiting for prices to go up and then selling will face many risks, starting from 2025. According to Mr. Hung, banks themselves keep lending, investors keep buying houses, and later buyers have a price difference with other buyers with the expectation of price increases. But when prices go down or can no longer be sold, the final buyers will suffer the consequences.

Mr. Hung believes that in the coming time, when the Government implements the "1 million social housing apartments" project, the real estate market will return to its true nature.

Along with that, the capital of more than 145,000 billion VND waiting for social housing investors will also suggest a good direction for the real estate market.

Mr. Nguyen Quang Huy, CEO of the Faculty of Finance and Banking (Nguyen Trai University), also said that investing in apartments worth hundreds of millions of dong will pose high risks.

Specifically, this is a segment with limited liquidity, when the customer base is small, it will be difficult to resell quickly. The rental yield of these hundred million/m² apartments is also quite modest, with a yield of only about 3-5%/year, much lower than other channels.

Meanwhile, investing in these apartments has a high risk of price adjustment or flat growth. If the price is far beyond the affordability and actual exploitation value, the market may witness a slowdown.

Finally, according to Mr. Huy, putting all the capital into a luxury apartment means missing the opportunity to diversify investments in other areas.

Mr. Pham Duc Toan, General Director of EZ Real Estate Investment and Development Joint Stock Company, also said that investors should only spend money to buy cheap apartments at this time.

According to Mr. Toan, about 2-3 years ago, apartments were rarely in the attractive investment portfolio because of the mentality that they were consumables, losing value over time. But when the new supply in Hanoi gradually became limited, this product was again interested by many investors with a safe taste. Because of the monthly rental cash flow combined with the price increase rate, investing in apartments brings better profits than current savings.

However, the current apartment prices are so high that buyers will easily "buy at the top", leading to great risks. For example, an apartment costs 4 - 5 billion VND but the rental rate is only about 10 million VND/month, while an apartment costs 2 - 3 billion VND, the rental price is also equivalent. Therefore, according to Mr. Toan, investors should only invest in products with reasonable prices.

Mr. Nguyen Quoc Anh - Deputy General Director of PropertyGuru Vietnam - also believes that you should only buy or invest in cheap, reasonable products. He also noted that the time of purchase is not as important as preparing a solid financial situation. Buyers should have at least 30-40% of the house value in their own money. It is necessary to ensure a stable cash flow in the next 3-5 years to avoid financial pressure when borrowing to buy a house.

Source: https://baolangson.vn/chung-cu-100-trieu-dong-m-cuoc-choi-danh-cho-ai-5060380.html

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

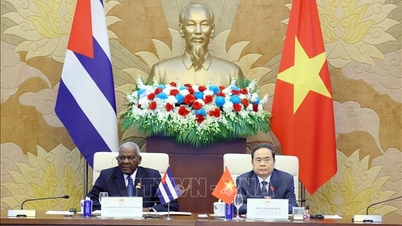

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)