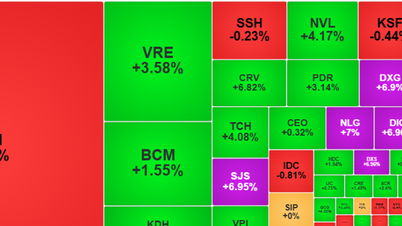

At the end of the morning session, VN-Index temporarily stopped at 1,753.32 points, down 0.77%; HNX-Index maintained a slight green color, up 0.23% to 277.71 points.

The entire market recorded 318 stocks increasing (21 stocks hitting the ceiling) and 376 stocks decreasing (23 stocks hitting the floor). In the group with the most negative impact on the VN-Index, " Vingroup " (VIC, VHM, VRE, VPL) created a huge downward pressure on the general market. Large bank stocks such as VPB, CTG, VCB and BID also decreased in price, making the downward pressure even greater. On the contrary, bright spots such as MSN, VJC, MBB, HPG narrowed their increase compared to the beginning of the session.

The differentiation is clear, most industry groups only fluctuated within a narrow range, except for real estate which decreased sharply, weighed down by VIC (down 3.57%), VHM (down 3.52%), VRE (down 3.57%), PDR (down 1.52%), TCH (down 1.18%) and KBC (down 1.08%).

Foreign capital returned to the net selling trend after yesterday's reversal. Foreign investors still net sold nearly 800 billion VND on all 3 exchanges this morning. Notably, VSH shares were net sold up to 878 billion VND, mainly through negotiated transactions at the price of 40,000 VND/share. In addition to VSH, VRE and VIC were also net sold for more than 80 billion VND, while DXG was a bright spot with a net purchase of about 70 billion VND.

Profit-taking pressure on large-cap stocks is slowing down the market's growth, while cash flow is showing signs of shrinking and becoming more cautious. This development shows that the accumulation trend may continue to dominate in the short term, before the market finds a new equilibrium.

Source: https://baotintuc.vn/thi-truong-tien-te/chung-khoan-sang-1710-vnindex-giam-hon-13-diem-20251017124604148.htm

![[Photo] Closing ceremony of the 18th Congress of Hanoi Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/17/1760704850107_ndo_br_1-jpg.webp)

![[Photo] Nhan Dan Newspaper launches “Fatherland in the Heart: The Concert Film”](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/16/1760622132545_thiet-ke-chua-co-ten-36-png.webp)

Comment (0)