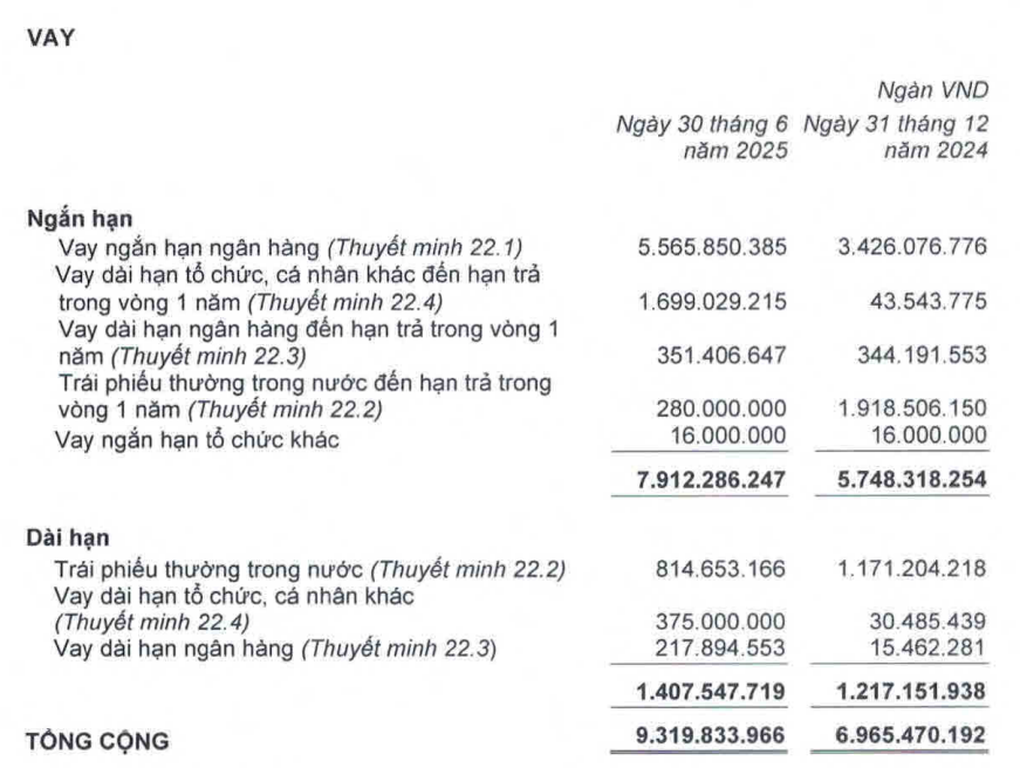

Hoang Anh Gia Lai Joint Stock Company (stock code: HAG) has just announced its consolidated financial report for the second quarter of 2025. The report shows that in the first half of the year, the company, chaired by Mr. Doan Nguyen Duc (Bau Duc), increased its short-term debt by VND2,164 billion.

The loan is mainly with the creditor being Orient Commercial Joint Stock Bank (OCB), amounting to 1,976 billion VND. Another part of the short-term debt is from Ho Chi Minh City Development Joint Stock Commercial Bank ( HDBank ), equivalent to 150 billion VND.

In the long-term debt section,OCB also lent Hoang Anh Gia Lai nearly 218 billion VND.

Financial loans of Hoang Anh Gia Lai (Source: Financial statements).

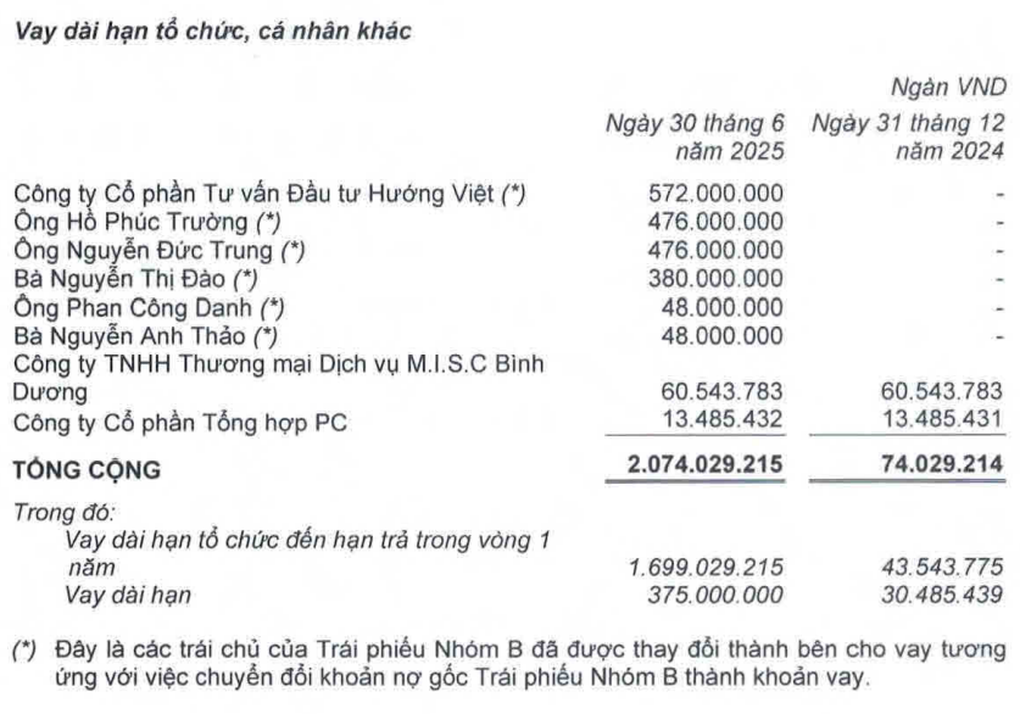

Notably, during the period, Mr. Duc's company paid and transferred the bond debt from BIDV to new bondholders. As of June 30, the bond debt at BIDV was only 1,099 billion VND.

Specifically, during the period, a part of the bond with an original value of VND2,000 billion (Group B bond) and accumulated bond interest up to May 20 with a value of more than VND2,022 billion was transferred to new bondholders.

This group of bondholders includes Huong Viet Investment Consulting Joint Stock Company and individuals including Ms. Nguyen Thi Dao, Mr. Phan Cong Danh, Ms. Nguyen Anh Thao, Mr. Ho Phuc Truong, and Mr. Nguyen Duc Trung.

New bondholder group of Hoang Anh Gia Lai (Source: Financial Statements).

Regarding this group, Hoang Anh Gia Lai recently consulted shareholders about converting debt by issuing 210 million shares at a price of VND12,000/unit.

It is expected that after the exchange issuance, Huong Viet will hold 4.74% of the company's capital. Some other individuals will hold more than 3% of the capital.

If this more than 2,000 billion VND is converted, Hoang Anh Gia Lai's debt will be greatly reduced. Mr. Duc once hoped to be able to resolve all debts and the group's financial report at the end of this year would be "extremely beautiful".

Regarding business results, Hoang Anh Gia Lai recorded a second quarter after-tax profit of nearly VND510 billion, nearly double the same period last year. The company explained during the period that gross profit increased thanks to banana trading activities.

Accumulated for 6 months, the group achieved profit of 870 billion VND, up 74% over the same period last year.

Thanks to good business results, Hoang Anh Gia Lai has officially erased accumulated losses that have lasted for many years. As of June 30, the group's accumulated profit reached nearly 400 billion VND.

Source: https://dantri.com.vn/kinh-doanh/cong-ty-bau-duc-co-lai-gia-tang-vay-no-tu-mot-ngan-hang-quen-ten-20250731131426487.htm

![[Photo] "Exposing letters" in the flood center of Lang Son](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/10/1760080117518_ndo_br_z7101324112737-07cd4d1c01801a8ccf4ae0cbaf31c4a3-507-jpg.webp)

![[Photo] Ho Chi Minh City is brilliant with flags and flowers on the eve of the 1st Party Congress, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/10/1760102923219_ndo_br_thiet-ke-chua-co-ten-43-png.webp)

![[Photo] Unique Phu Gia horse hat weaving craft](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/10/1760084018320_ndo_br_01-jpg.webp)

Comment (0)