On the afternoon of September 30, Hoang Anh Gia Lai Joint Stock Company (HAGL, code HAG), chaired by Mr. Doan Nguyen Duc (Bau Duc), announced unusual information related to the State Securities Commission's (SSC) official dispatch on the document reporting the results of HAGL's debt swap stock issuance.

Accordingly, the State Securities Commission requested Hoang Anh Gia Lai Joint Stock Company to contact the Vietnam Securities Depository and Clearing Corporation and the Ho Chi Minh City Stock Exchange (HoSE) to carry out procedures for registration, depository and additional listing of shares according to regulations.

Previously, on June 26, immediately after receiving the approval letter from the State Securities Commission and the resolution of the Board of Directors, HAGL announced the completion of the private share issuance for the purpose of debt conversion.

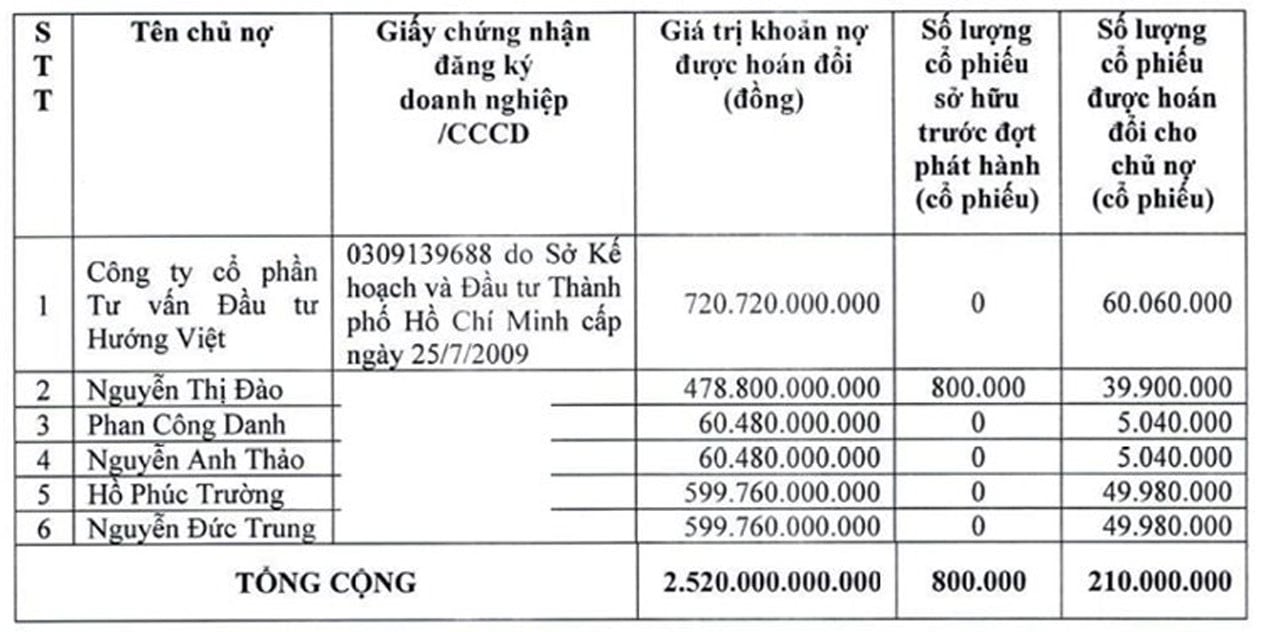

Specifically, HAGL has successfully distributed 210 million common shares to a group of creditors, corresponding to the debt swap with a total value of VND2,520 billion. The swap value is set at VND12,000 per share.

The list of creditors participating in this debt swap includes 1 organization, Huong Viet Investment Consulting JSC (60.06 million HAG shares) and 5 individual investors, including Ms. Nguyen Thi Dao (39.9 million HAG shares), Mr. Phan Cong Danh (5.04 million HAG shares), Mr. Nguyen Anh Thao (5.04 million HAG shares), Mr. Ho Phuc Truong (49.98 million HAG shares) and Mr. Nguyen Duc Trung (49.98 million HAG shares).

Thus, the above shares will be listed on HoSE.

After the transaction is completed, this group of investors holds a total of 16.65% of Hoang Anh Gia Lai's charter capital.

However, according to the issuance regulations, all 210 million HAG shares will be restricted from transfer within one year, starting from September 25, 2025.

HAG shares are at a historical peak, closing on September 30 at VND16,300/share, a sharp increase compared to VND11,800/share in early 2025 and about VND7,000/share in 2023.

HAG shares have recently increased sharply after Mr. Doan Nguyen Duc (Bau Duc) pushed for restructuring, ending a decade of debt for the famous mountain town enterprise on the stock market.

Recently, Bau Duc's son became a shareholder of Hoang Anh Gia Lai after Mr. Duc sold a large amount of HAG shares.

Currently, Mr. Duc still holds nearly 305 million HAG shares, equivalent to 28.84%.

In the second quarter of 2025, HAG reported a net profit of VND483 billion, up 86% year-on-year thanks to the breakthrough in the banana business segment. In the first 6 months of the year, HAG reported a 34% increase in revenue to over VND3,700 billion, and a 72% increase in profit to VND824 billion, reaching 78% of the year's profit target.

Thus, by the end of June, HAG had no more accumulated losses. The company plans to record durian revenue and aim to achieve the target of after-tax profit of VND1,500 billion for the whole year 2025.

Over the past few years, HAG has continuously recorded positive business results and made significant efforts to reduce debt. However, the debt is still quite large and the company has an imbalance between short-term assets and debt, and financial costs are still a burden.

By mid-2025, HAG will have total liabilities of VND15,630 billion, 1.5 times higher than equity. Of which, financial debt accounts for VND9,320 billion. HAGL's interest expense in the first 6 months of 2025 is VND360 billion.

The debt swap between Huong Viet Investment Consulting JSC and 5 individual investors helps HAGL reduce the financial burden and improve its balance sheet. Of course, in return, the shareholders' ownership ratio decreases.

After the deal, Huong Viet Investment Consulting JSC and its related parties became major shareholders, holding nearly 75.6 million HAG shares (5.96%). Huong Viet alone purchased 60.06 million shares with a total value of more than VND720 billion. This is a core member of the Huong Viet Holdings ecosystem, investing in real estate and renewable energy, including the Metropole Thu Thiem project.

Source: https://vietnamnet.vn/sau-hoan-doi-no-hoang-anh-gia-lai-niem-yet-bo-sung-210-trieu-co-phieu-hag-2447808.html

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

Comment (0)