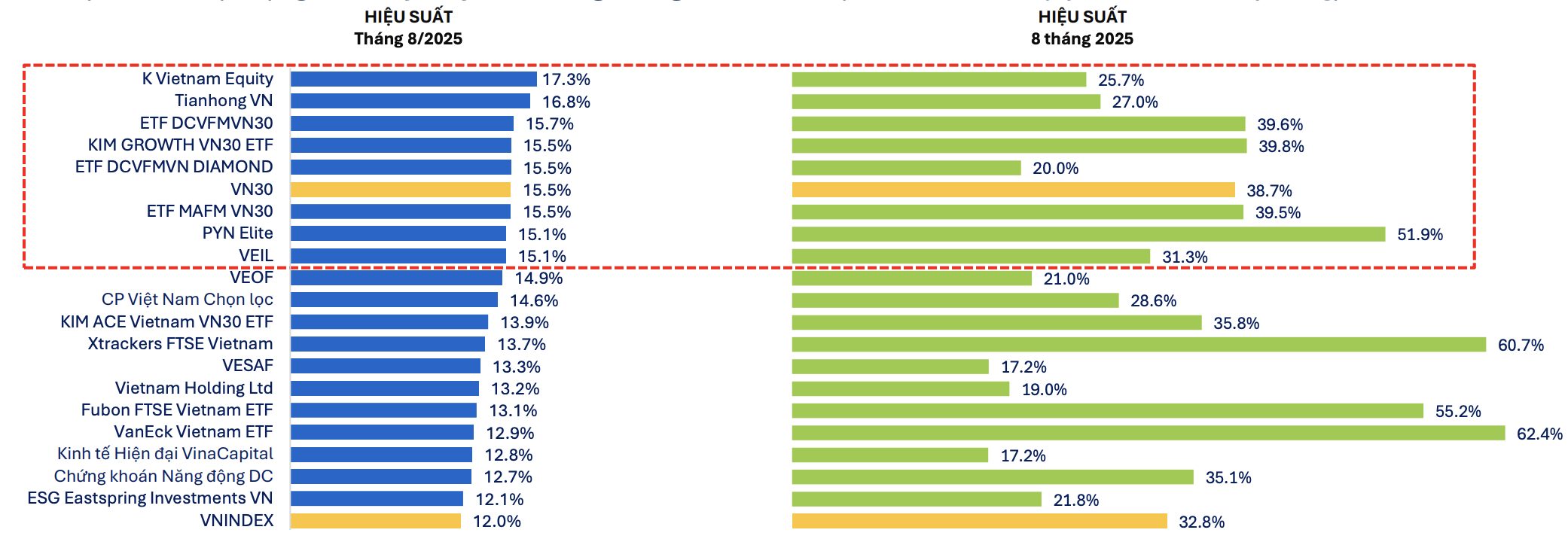

FiinGroup's statistics on the performance of investment funds in Vietnam show that in August 2025, the group of equity funds achieved an average return of about 12.9%, of which 44/74 funds recorded outstanding performance compared to the VN-Index (+12%).

Leading the way is the foreign fund K Vietnam Equity with a performance of 17.3% thanks to its portfolio focusing on large-cap stocks, especially banks, the second-highest-growing sector after the securities sector in August 2025. However, this fund from Thailand recorded a net withdrawal of nearly VND 1,600 billion in the same month, the highest in the past 2 years.

In addition, ETF funds simulating VN30 and VNDiamond also achieved high performance (15%-16%).

|

| Performance of Equity Funds in August and 8 months of 2025 (only shows funds with NAV > VND 900 billion). Source: FiinPro-X Platform |

In line with the VN-Index trend, August 2025 marked the fourth consecutive month that the equity fund group recorded positive performance, raising the cumulative growth rate for the first 8 months of 2025 to an average of 23.8%, far exceeding the same period in 2024 (15.7%).

The group of foreign funds continues to lead, including VanEck Vietnam ETF (62.4%), xtrackers FTSE Vietnam (60.7%), PYN Elite (51.9%), and Fubon FTSE Vietnam ETF (55.2%). Particularly for the VEIL fund, the performance in the first 8 months of 2025 reached 31.3%, double that of the same period in 2024 thanks to the portfolio focusing on the sectors leading the market growth such as banking, real estate, steel and retail.

However, despite positive performance, the net withdrawal trend still exists and shows signs of increasing in most of these foreign funds last August.

In the domestic fund group, it is noteworthy that DC Dynamic Securities Fund (DCDS) and ETF DCVFMVN30 (E1VFVN30), both managed by Dragon Capital, are among the few funds (8/74 stock funds) that maintained higher performance than VN-Index and VN30 for 4 consecutive months (from May to August 2025).

Meanwhile, in the bond fund group, FiinGroup said that although most bond funds still maintained higher performance than savings interest rates, up to 16/23 funds recorded lower returns in August 2025 than in July, including many funds with NAV larger than VND 1 trillion such as ABBF, DCIP, DCBF and Bao Thinh Vinawealth.

In contrast, Techcom TP Fund (TCBF) has improved significantly with August performance reaching 0.54%, the highest level in the past three months, but still lower than the average monthly performance in 2024 (1.1%). Some smaller-scale bond funds also showed positive signals, including SSI TP Fund (SSIBF), VCBF TP Fund (VCBF-FIF) and Mirae Asset Vietnam Flexible TP Fund (MAFF).

In August 2025, the bond fund group achieved an average return of 3.9%, lower than the same period in 2024 (4.1%). Meanwhile, 14/23 funds recorded lower performance than the same period and only 8/23 funds had improved performance.

However, the cumulative return for the first 8 months of 2025 of the bond fund group is still higher than the average savings interest rate (3.05%). Notably, there are 8 funds that have maintained monthly returns exceeding the savings interest rate for 8 consecutive months. Typical examples are ABBF, DCIP, and DCBF. All three bond funds recorded positive net cash inflows in August as well as the first 8 months of 2025.

Regarding cash flow developments, net withdrawal value increased sharply in August 2025, mainly coming from the stock fund group with a value of nearly VND 7.6 trillion, marking the strongest net withdrawal month in more than 2 years (from August 2023).

On the contrary, the bond fund group continued to maintain a net inflow status (+0.8 trillion VND), but it was not enough to offset the large net withdrawal scale in the stock fund, causing the total fund cash flow to be negative by nearly 6,900 billion VND in August.

FiinGroup said that in the last two years, the stock fund group had a net withdrawal of nearly VND65,000 billion, equivalent to 45% of the total net selling value through order matching by foreign investors in the same period, showing increasing capital withdrawal pressure despite the recent positive developments of the domestic stock market.

In contrast, the bond fund group has been steadily netting in, with a total cumulative value of more than VND13,000 billion, and more than 95% of it is domestic money. Although the net inflow scale of the bond fund group is still modest, this move shows investors' preference for more stable and less risky products.

Source: https://baodautu.vn/danh-muc-dau-tu-manh-cac-quy-co-phieu-tiep-tuc-thang-hoa-d389732.html

![[Photo] Prime Minister Pham Minh Chinh launched a peak emulation campaign to achieve achievements in celebration of the 14th National Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/8869ec5cdbc740f58fbf2ae73f065076)

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's online conference with localities](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/264793cfb4404c63a701d235ff43e1bd)

![[VIDEO] Summary of Petrovietnam's 50th Anniversary Ceremony](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/4/abe133bdb8114793a16d4fe3e5bd0f12)

![[VIDEO] GENERAL SECRETARY TO LAM AWARDS PETROVIETNAM 8 GOLDEN WORDS: "PIONEER - EXCELLENT - SUSTAINABLE - GLOBAL"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/23/c2fdb48863e846cfa9fb8e6ea9cf44e7)

Comment (0)