| US dollar and rising inventories push export coffee prices down Robusta coffee prices rose for three consecutive sessions amid a slight decline in the US dollar and a surge in gold. |

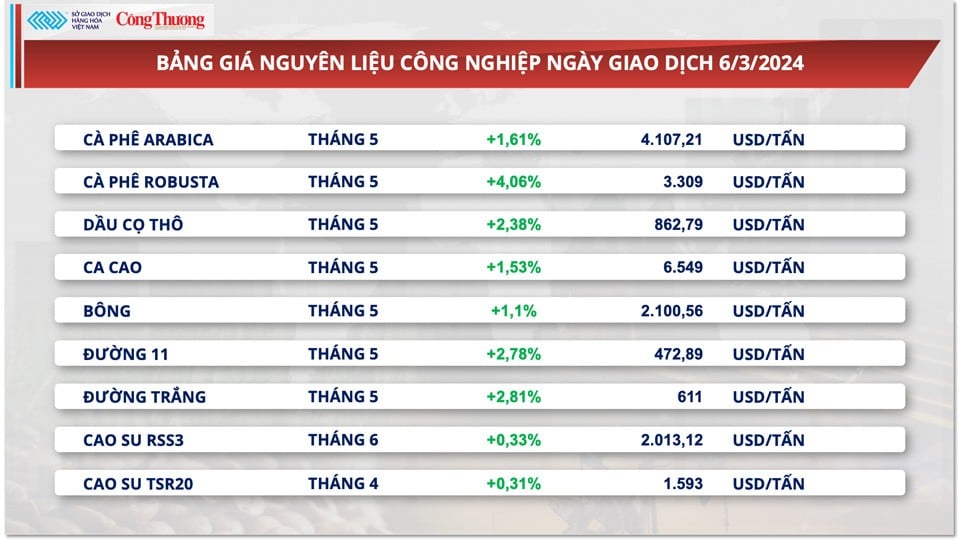

According to the Vietnam Commodity Exchange (MXV), at the end of the trading session on March 6, the prices of two coffee products simultaneously improved. Of which, the price of Robusta increased by 4.6%, reaching the highest level in a month, the price of Arabica recovered by 1.61% compared to the reference price. The weakening USD/BRL exchange rate overshadowed the improvement in inventory on the ICE-US Exchange, from which buying power prevailed.

|

| Robusta prices rose 4.6% to a one-month high, while Arabica prices recovered 1.61% from the reference price. |

Specifically, the Dollar Index fell sharply by 0.41% in yesterday's session while the Brazilian Real increased, causing the USD/BRL exchange rate to lose 0.27%. The narrowing exchange rate difference limited the demand for coffee from Brazilian farmers, thereby supporting prices.

At the same time, the weakening USD also pushed money flow from safe-haven assets to other markets such as stocks or commodities. This made the buying force of coffee become overwhelming.

Robusta prices rose sharply as the risk of supply shortages remained. In the closing report on March 5, Robusta inventories on the ICE-EU continued to decrease by 120 tons, bringing the total amount of coffee stored to 23,350 bags. Moreover, prolonged heat in Vietnam's key coffee growing areas has increased concerns about the prospects of new crop coffee supply.

The shortage has pushed up domestic coffee prices. In the first two months of 2024, Vietnam exported about 438,000 tons of coffee, earning 1.38 billion USD, up 27.9% in volume and 85% in value compared to the same period in 2023. Coffee export turnover set a record when it surpassed the 1 billion USD mark after only 2 months. This has caused a shortage of domestic goods, especially in the context of a decrease in output last year.

The Vietnam Coffee and Cocoa Association estimates that coffee output in the 2023/24 crop year will continue to decrease by another 10% compared to the previous crop year. The US Department of Agriculture (USDA) forecasts that output in two other major supplying countries, Brazil and Indonesia, will also decrease by 6.2% and 8%, respectively, compared to the 2022/23 crop year.

|

| Coffee prices tend to increase again due to the increase in world market prices. |

Coffee prices are on the rise again due to rising prices on the world market. However, this coffee crop has been forecasted by the Vietnam Coffee and Cocoa Association to see a further decrease in output of about 10% due to the impact of climate change; the area of intercropping has increased.

Assessing the global coffee supply and demand situation, experts believe that the world will not lack or face difficulties with Arabica supply but will have difficulties with Robusta. Vietnam has been the world's number 1 producer and supplier of Robusta for many years. The whole world is used to buying Robusta coffee from Vietnam. Roasters around the world have changed their roasting formula with a large component of Vietnamese Robusta.

The Department of Crop Production said that the country currently has more than 710,000 hectares of coffee. Vietnam currently ranks 6th in the world in terms of coffee area, but thanks to the highest productivity in the world, Vietnam has the second largest annual coffee harvest in the world, from 1.75-1.85 million tons. Of the total of more than 710,000 hectares, Vietnam only has more than 185,000 hectares of coffee area certified for sustainable production, with certifications: Utz Certified, Rainforest, 4C, VietGAP...

Therefore, according to experts, localities need to plan key coffee growing areas, promote replanting, and apply sustainable coffee production processes with VietGAP, 4C, Rainforest, and organic certifications to meet the strict export standards of international markets.

The Import-Export Department ( Ministry of Industry and Trade ) said that at the end of February 2024, the price increase of Robusta coffee slowed down, while the price of Arabica coffee decreased due to concerns about increased risks due to the possibility of the US economy falling back into recession, causing funds and speculators to shift capital flows to look for markets with more attractive profit margins. In addition, reports of a sharp increase in inventories have caused a sell-off by funds and speculators, affecting coffee prices.

World coffee prices will be under downward pressure in the coming time due to the sell-off activities of funds and speculators, despite concerns about tightening supply due to international shipping problems and increasing global demand for coffee.

Estimated figures for Vietnam’s coffee exports increased sharply in the first two months of 2024 and Brazil’s coffee output in the 2024/2025 crop year is expected to be higher than previous forecasts, as dry weather has eased. Meanwhile, fluctuations in the USD/BRL exchange rate have encouraged Brazilians to boost coffee exports.

Source

![[Photo] Ho Chi Minh City is brilliant with flags and flowers on the eve of the 1st Party Congress, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/10/1760102923219_ndo_br_thiet-ke-chua-co-ten-43-png.webp)

![[Photo] Unique Phu Gia horse hat weaving craft](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/10/1760084018320_ndo_br_01-jpg.webp)

![[Photo] Opening of the World Cultural Festival in Hanoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/10/1760113426728_ndo_br_lehoi-khaimac-jpg.webp)

Comment (0)