Today's coffee price in the domestic market on October 15, 2025 returns to the starting line

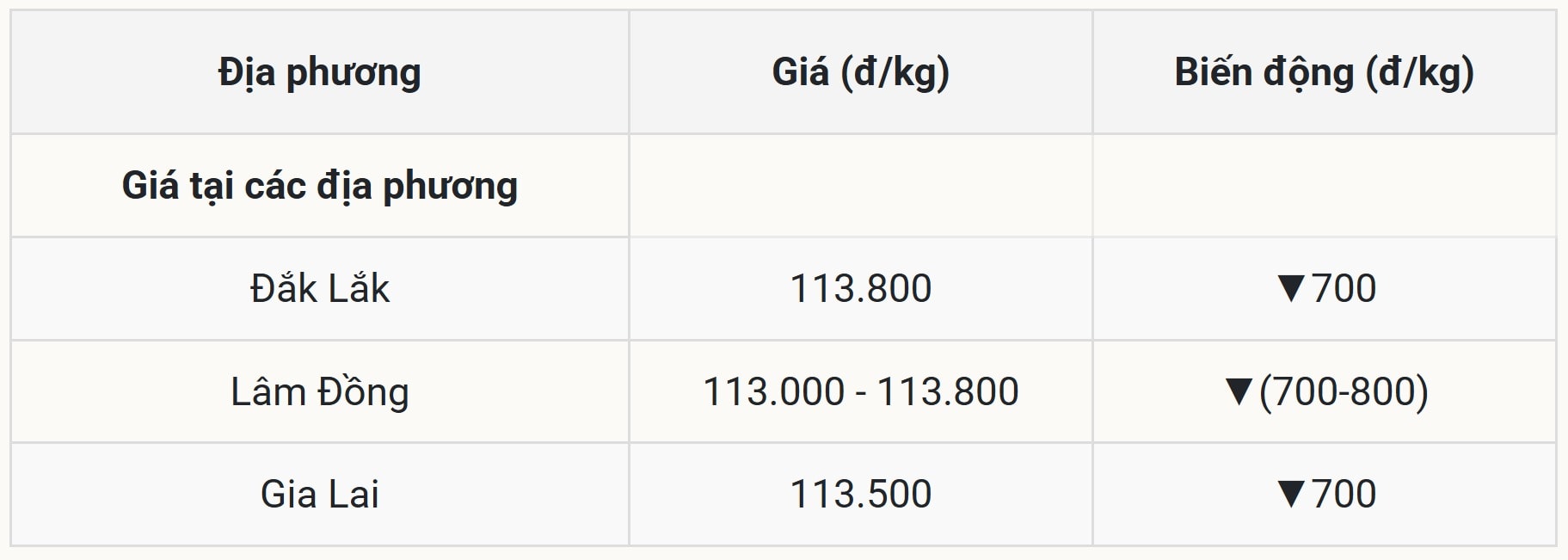

On October 15, the coffee market in the Central Highlands recorded a slight downward trend in prices in key provinces. The market is fluctuating around 113,000 - 113,800 VND/kg, showing a negative adjustment compared to the previous session.

Specifically, in Lam Dong , coffee prices were traded at 113,000 - 113,800 VND/kg, down 700 - 800 VND/kg compared to the previous session. The floor price reached 113,000 VND/kg, the lowest in the region.

Next, Dak Lak , a land famous for high-quality coffee, recorded a price of VND 113,800/kg, down VND 700/kg compared to the previous session. This decrease reflects pressure from fluctuations in supply and demand, but still maintains Dak Lak's position in providing quality coffee, meeting the needs of roasters and exporters.

Gia Lai is also not out of the downward trend, with the price reaching 113,500 VND/kg, down 700 VND/kg compared to the previous session. As one of the main coffee supplying provinces, Gia Lai continues to maintain a stable supply, making an important contribution to the domestic and international markets.

Online coffee prices on October 15, 2025 in the world market

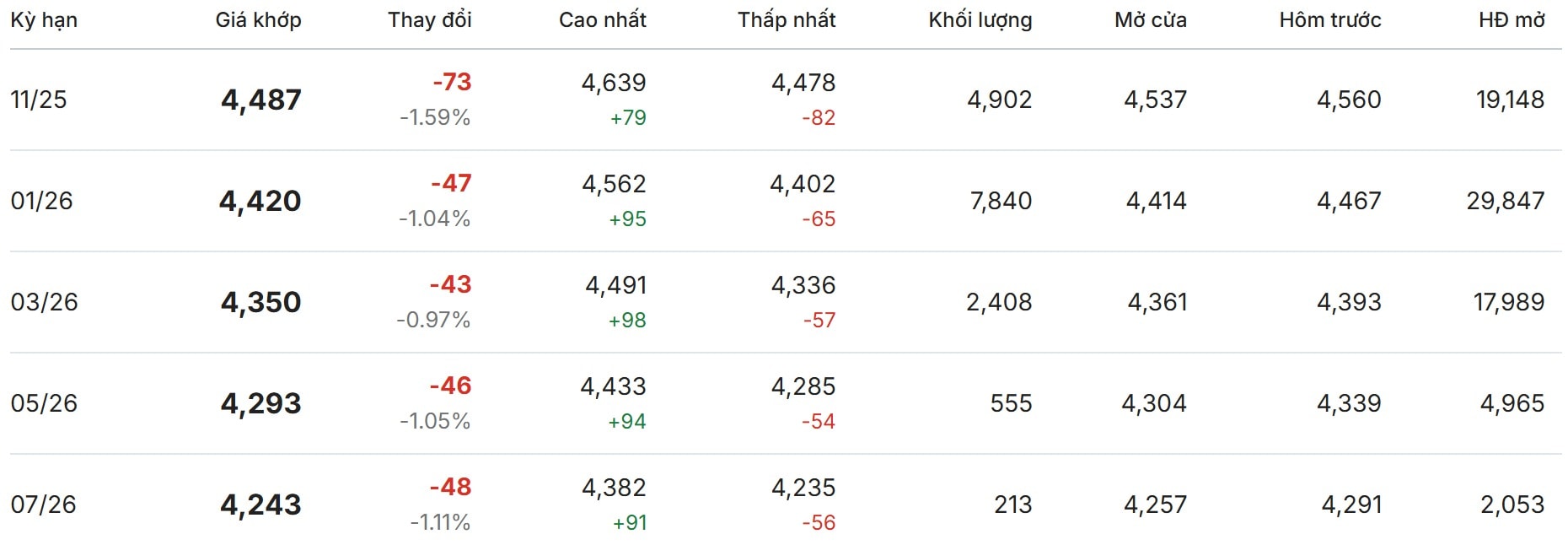

On the London exchange today, October 15, Robusta online coffee prices recorded a slight downward trend in terms. All terms showed a decrease in price compared to the previous session. Specifically:

The November 25 contract closed at $4,487/ton, down $73/ton (-1.59%) from the previous session. This was the contract with the highest price but also under the strongest downward pressure.

Immediately after that, the January 26 contract closed at 4,420 USD/ton, down 47 USD/ton (equivalent to -1.04%).

The remaining terms all maintained a downward trend in price:

The March 26 contract had a matching price of 4,350 USD/ton, down 43 USD/ton (equivalent to -0.97%).

May 26 futures closed at $4,293/ton, down $46/ton (-1.05%).

The July 26 contract closed at $4,243/mt, the lowest price among the traded contracts, down $48/mt (-1.11%). Despite the lowest price, this downward trend reflects the overall pressure in the market.

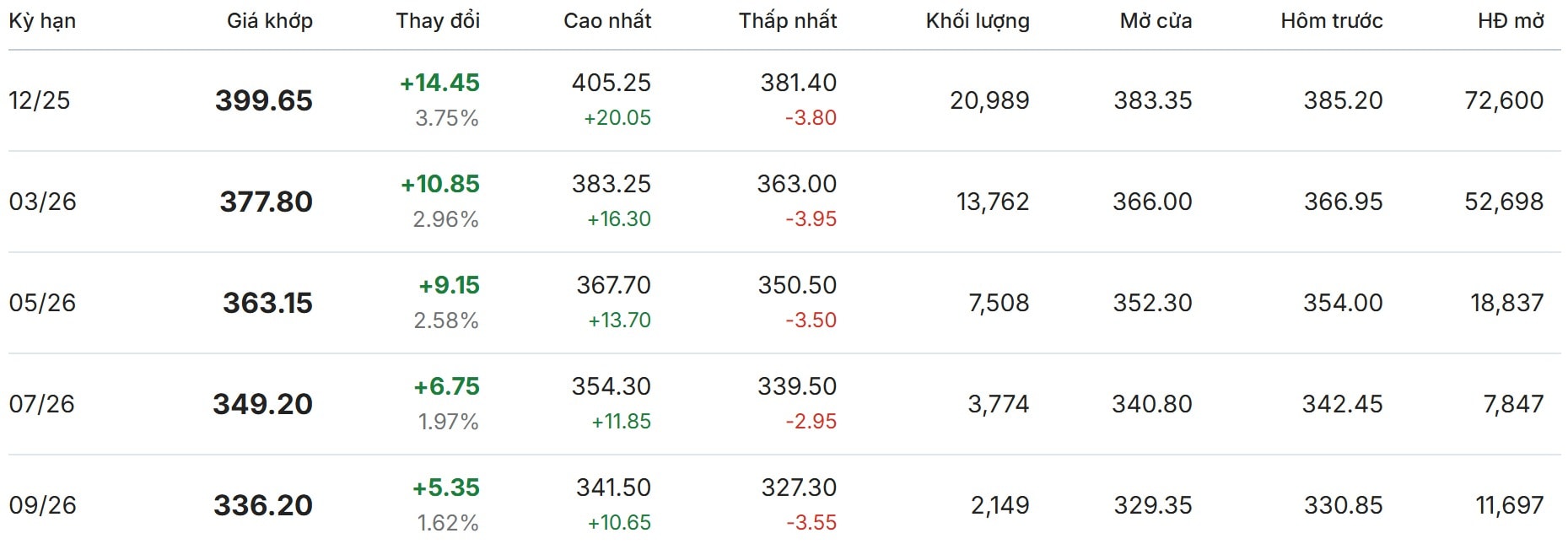

On the New York Stock Exchange this morning, October 15, the price of Arabica coffee closed at the highest level of 399.65 US cents/pound (12/25 term) and the lowest level of 336.20 US cents/pound (09/26 term). All terms recorded positive price increases. Specifically:

The December 25 contract closed at a session high of 399.65 US cents/pound, up 14.45 US cents/pound (or 3.75%), a leading price, reflecting strong interest in spot and fourth-quarter cargoes.

The March 26 futures contract also remained at a high of 377.80 US cents/pound, up 10.85 US cents/pound (or 2.96%).

The remaining maturities all show a gradual decrease in price over time, but still maintain a steady increase:

The May 26 contract had a matching price of 363.15 US cents/pound, up 9.15 US cents/pound (equivalent to 2.58%).

The July 26 contract reached 349.20 US cents/pound, up 6.75 US cents/pound (equivalent to 1.97%).

The September 26 contract closed at 336.20 US cents/pound, up 5.35 US cents/pound (or 1.62%), the lowest price among the traded contracts.

Coffee price assessment and forecast

Amid warming bilateral relations thanks to signs of reconciliation, the Brazilian coffee industry still faces a big worry: the flow of exports to the US is at risk of drying up if tariff barriers are not removed soon, warned Marcio Ferreira, President of the Brazilian Coffee Exporters Association (Cecafé), in a recent interview.

The imposition of a 50% tariff on coffee and other Brazilian goods in early August marked a turning point in tensions stemming from the conflict between the Trump administration and President Luiz Inácio Lula da Silva. The result? The US – once Brazil’s “golden customer” – has been overtaken as the largest market. According to Cecafé data, coffee exports to the US in August plunged 46% compared to the same month last year, a stellar export record. By September 19, that figure had fallen another 20%, prompting exporters to quickly turn to new horizons.

“If tariffs remain in place, the flow of goods will continue to bleed,” Ferreira stressed. As CEO of Tristao Trading – one of Brazil’s biggest coffee exporters – he did not hesitate to point out that only a policy shift from Washington could “revive” this market. In fact, as the US closes its doors, other partners are opening their arms: exports to Colombia jumped 578% in August alone, while China – with its booming coffee demand from young people – is becoming an attractive destination thanks to new agreements that allow 183 more Brazilian businesses to enter.

Nevertheless, optimism still permeates the industry. The meeting on the sidelines of the UN meeting between the two leaders resulted in friendly gestures, from brief hugs to polite phone calls, that left Mr. Ferreira and his colleagues “very excited.” This could be the trigger for deeper negotiations, helping Brazil regain its growth momentum – not only to save revenue but also to stabilize global coffee prices, avoiding “bitter” inflation for American consumers. The Brazilian coffee industry, with its resilient vitality from lush green plantations, is waiting for a real “cup of peace coffee.”

Source: https://baodanang.vn/gia-ca-phe-hom-nay-15-10-2025-gia-ca-phe-noi-dia-ve-lai-vach-xuat-phat-dau-tuan-the-gioi-tang-giam-trai-chieu-3306340.html

![[Photo] General Secretary To Lam attends the 18th Hanoi Party Congress, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/16/1760581023342_cover-0367-jpg.webp)

![[Photo] Conference of the Government Party Committee Standing Committee and the National Assembly Party Committee Standing Committee on the 10th Session, 15th National Assembly](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/15/1760543205375_dsc-7128-jpg.webp)

![[Photo] Many dykes in Bac Ninh were eroded after the circulation of storm No. 11](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/15/1760537802647_1-7384-jpg.webp)

![[Video] TripAdvisor honors many famous attractions of Ninh Binh](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/16/1760574721908_vinh-danh-ninh-binh-7368-jpg.webp)

Comment (0)