Coffee prices today in the domestic market on October 12, 2025

The coffee market in the Central Highlands closed the week with stable purchasing prices in key provinces. Prices are fluctuating around 113,000-114,000 VND/kg. (Data are calculated based on the most recent purchasing prices).

In the price race, Dak Lak is currently trading at 113,800 VND/kg. This province maintains the highest price in the region, showing stability in purchasing prices.

Following closely behind is Gia Lai , a land famous for its coffee, which is currently trading at 113,500 VND/kg. This province also maintained stable prices, demonstrating the uniformity in the price level of the region.

Meanwhile, Lam Dong - a large-production area, maintained a common price of 113,000-114,000 VND/kg. This province continues to play an important role in supplying coffee to the market with the widest price range.

The coffee market is dominated by a conflict between future supply risks and current supply realities.

Factors that are putting downward pressure on prices include: Faster harvest progress in Brazil, forecasted 6% increase in Vietnam Robusta production, and a drop in demand after prices were too high. However, price support factors remain very strong. Record low Arabica inventories (up to 8.5 million bags deficit according to Volcafe) and record short positions could cause a spike in prices if positive news comes.

Online coffee prices on October 12, 2025 in the world market

On the London exchange, the online Robusta coffee price closed the week at 4,489 USD/ton for the November 2025 term and the January 2006 term stopped at the lowest level of 4,245 USD/ton. Specifically:

The November 25 contract closed at a high of $4,480/ton. This was the leading contract.

Immediately after that, January 26 Futures closed at 4,391 USD/ton, maintaining the second highest price on the floor.

The remaining maturities all show a gradual decrease over time:

The March 26 contract has a matching price of 4,333 USD/ton.

May 26 futures closed at $4,286/ton.

The July 26 contract closed at $4,245/mt, the lowest price among the traded contracts. However, this inverted market structure shows consistent support for early contracts.

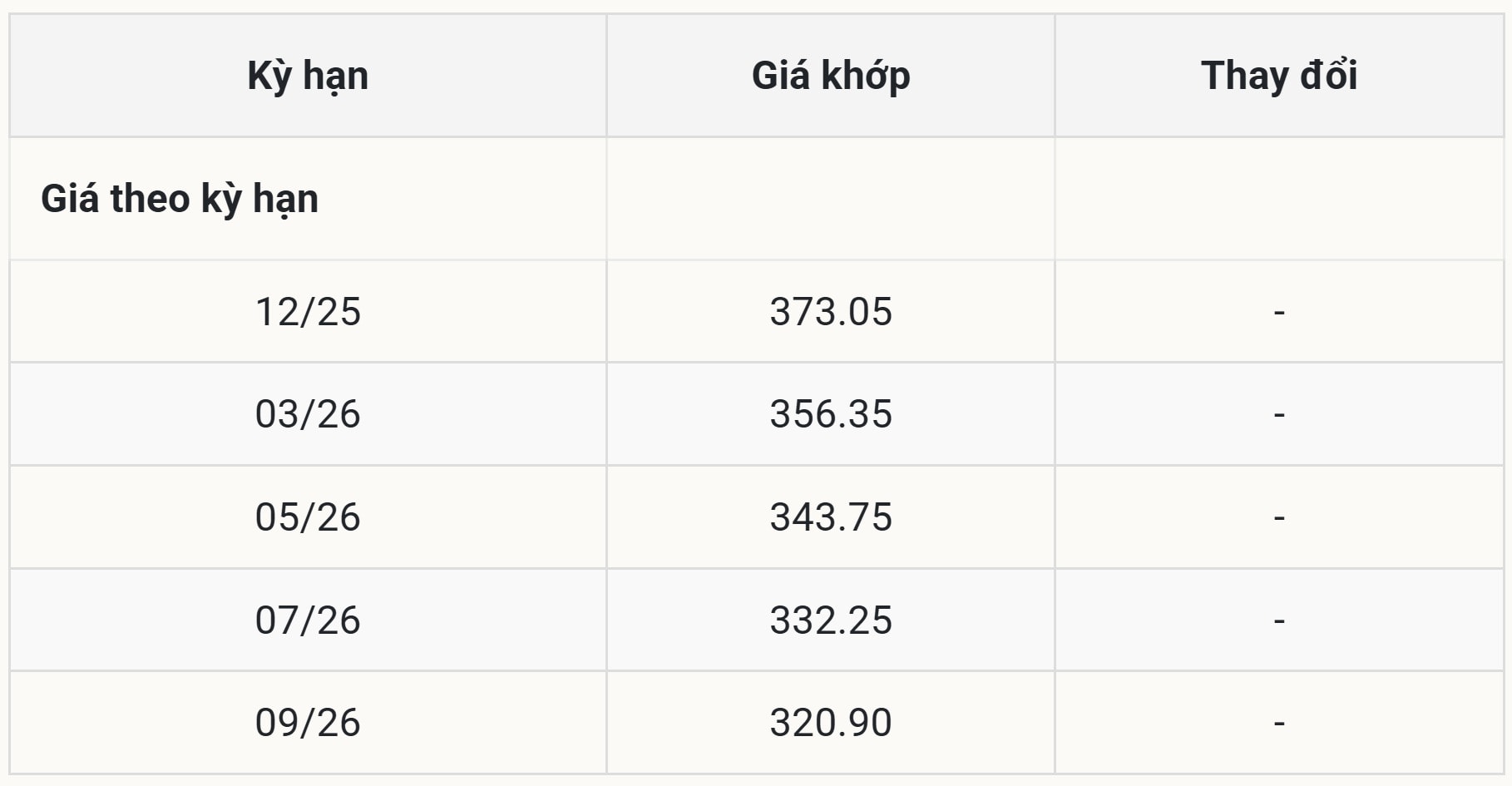

On the New York Stock Exchange, Arabica coffee prices closed the week at a high of 373.05 US cents/pound and a low of 320.90 US cents/pound. Specifically:

The December 25 contract closed at a session high of 373.05 US cents/pound, a leading price, reflecting strong interest for spot and fourth-quarter cargoes.

The March 26 futures contract also remained high at 356.35 US cents/pound.

The remaining maturities all show a gradual decrease in price over time, indicating a cooling of the market in the future:

The May 26 contract had a closing price of 343.75 US cents/pound.

July 26 futures settled at 332.25 US cents/pound.

The September 26 contract closed at 320.90 US cents/pound, the lowest price of any contract traded. The large price difference between the 12/25 and 09/26 contracts is a clear demonstration of the current strong inverted market structure.

Coffee prices fell further in late trading after Brazil's real fell to a two-month low against the dollar.

However, coffee prices are still supported by depleting ICE inventories. According to the latest data, ICE-monitored Arabica stocks fell to a 1.5-year low of 509,383 bags as of October 10, while Robusta stocks fell to a 2.5-month low of 6,237 lots as of October 8.

Brazilian coffee exporters association Cecafe said the country's coffee bean exports in September 2025 fell about 18% compared to the same period last year, to 3.45 million bags (60 kg/bag), due to the impact of US tariff measures.

Brazil, the world’s top coffee producer and exporter, shipped 2.97 million bags of Arabica last month, down about 10% from a year earlier, while Robusta exports fell sharply by about 47% to nearly 489,700 bags, according to data.

In a statement, Cecafe President Marcio Ferreira said the decline was expected due to a comparison with last year's high base, when Brazil exported a record amount of coffee in 2024.

The decline was exacerbated by the 50% tariff imposed by US President Donald Trump on Brazilian coffee, Mr. Ferreira added. He also noted that the US used to be the main importer of Brazilian coffee.

However, according to Cecafe data, the US not only lost its top spot to Germany in August – when Trump’s 50% tariffs on most Brazilian goods came into effect – but was also overtaken by Italy in September.

Also according to Cecafe data, Brazil's coffee exports to the US in September fell nearly 53% compared to a year earlier, to about 333,000 bags, including green and processed coffee.

However, from the beginning of the year to the end of September, the US still maintained its position as Brazil's largest coffee buyer.

Forecast for next week: Strong selling pressure, but recovery chance?

The market is expected to open the new week with selling pressure from abundant Brazilian supply, but low inventories and weather risks (little rain in Minas Gerais) could reverse the trend. Domestic prices in Vietnam could fluctuate between VND113,500 and VND114,500 per kg if London Robusta exceeds USD4,500 per ton. Farmers in the Central Highlands should closely monitor the trading floor to decide whether to harvest - "keep the price" or "sell immediately" will be a difficult problem.

Vietnam, with 213,000 hectares of Dak Lak coffee and an output of 526,000 tons/year, continues to be the "dark horse" in the global game. Follow updates at Giacaphe.com or Reuters to capture real-time fluctuations.

Source: https://baodanang.vn/gia-ca-phe-hom-nay-12-10-2025-chot-tuan-voi-dak-lak-van-dinh-lam-dong-sat-nut-trong-cuoc-dua-gia-3306066.html

![[Photo] National Assembly Chairman Tran Thanh Man attends the 725th anniversary of the death of National Hero Tran Hung Dao](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/12/1760285740475_ndo_br_bnd-8978-jpg.webp)

![[Photo] Delegation attending the Government Party Congress visited President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/12/1760240068221_dsc-3526-jpg.webp)

![[Photo] The 1st Government Party Congress held a preparatory session.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/12/1760257471531_dsc-4089-jpg.webp)

Comment (0)